- Venture Minerals has six projects in various stages of development.

- With the exception of iron ore, the other five all target critical minerals for the green energy transition.

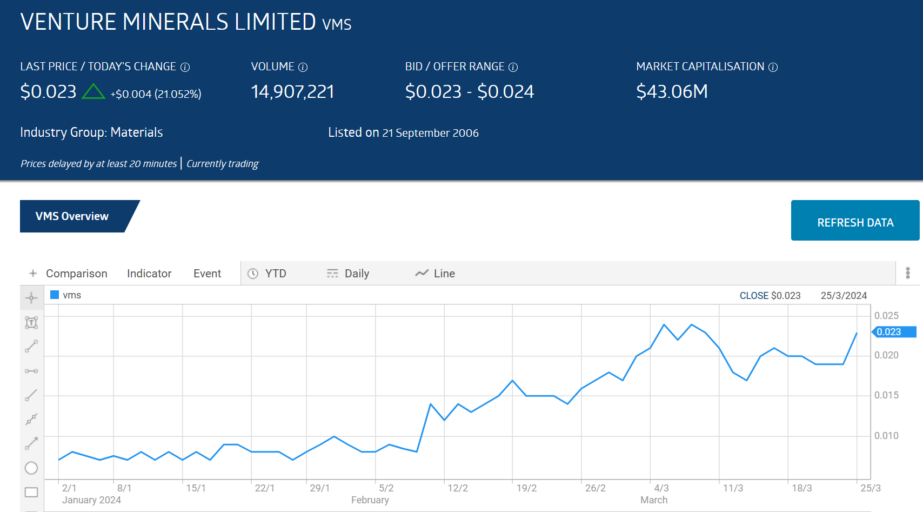

- The company’s share price year to date is up 228.5%.

Venture has many irons in the fire, with the Jupiter Rare Earth Element (REE) Prospect, part of the broader Brothers REE project in a top tier Western Australian mining region, driving the share price year to date. On 8 February Venture released positive findings from the initial assay results from Stage One drilling at the project.

Venture’s managing director stated the “record-breaking ultra high-grade REE clay results place Venture ahead of competitive miners in the region.”

Source: ASX

The share price skyrocketed, driven by the continuing positive announcements from the Jupiter Prospect.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

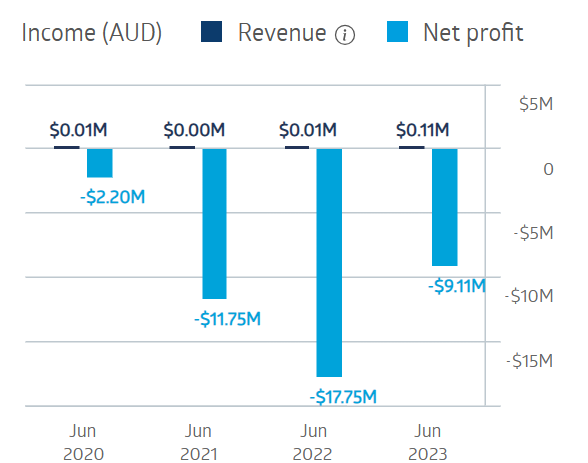

Venture is a penny stock, spread thin over multiple projects and in a race to generate revenue to stem the cash bleeding out to pay for development. The company did manage to cut its loss in FY 2023.

Venture Minerals Financial Performance

Source: ASX

As of the most recent quarter (MRQ) the company has a strong balance sheet, with total cash of $2 million dollars against total debt of $162 thousand; debt to equity at 6.85% and a current ratio of 2.23.

An analyst at Peak Asset Management has a BUY recommendation on Venture Minerals, citing the company’s recent announcement of additional drilling at Jupiter Rare Earths, which will lead to a maiden resource estimate. The analyst’s conclusion is “the outlook is encouraging for a company with a prospect in a tier one jurisdiction.”

There is scant analyst coverage on VMS shares, with only the Wall Street Journal reporting a single analyst at BUY.

Investors appear more enthusiastic as tipranks.com lists investor blog sentiment at BULLISH.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 25th March 2024

- Property and Energy Sectors Lead as ASX 200 Edges Towards a Record Breaking Finish

- Xero (ASX:XRO) Shareholders Continue Celebrations : Up 181.83% Over 5 Years

- Netwealth Group Ltd (ASX-NWL) Insider Confidence Cannot be Knocked

- Down 3% Over 3 Months, Is Seek Limited (ASX: SEK) a BUY?