Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

BUY – Venture Minerals (VMS)

The company recently announced the second stage of its resource definition drilling program had started at the Jupiter Rare Earths prospect in the mid-west region of Western Australia. This 300-drill hole program will provide the necessary data for a maiden resource estimate at Jupiter. The outlook is encouraging for a company with a prospect in a tier one jurisdiction. The shares were priced at 1.9 cents on March 21.

BUY – Aurumin (AUN)

The company focuses on exploring and developing advanced gold projects. The company recently announced it was debt free following the redemption of the outstanding balance of the convertible note and placement commitments. The company is fully funded for all planned exploration in calendar year 2024. Drilling on existing mining leases is planned at the company’s flagship Sandstone Gold Project in April. AUN is leveraged to an increasingly strong gold spot price. The shares were trading at 3.5 cents on March 21.

HOLD RECOMMENDATIONS

HOLD – ClearVue Technologies (CPV)

The solar technology company recently completed a placement of $4 million. The share purchase plan aims to raise up to $2 million. ClearVue is funded to execute its plans of completing and finalising testing and certification of its generation 2 products, leading to anticipated early sales during the second half of the year.

HOLD – AdAlta (1AD)

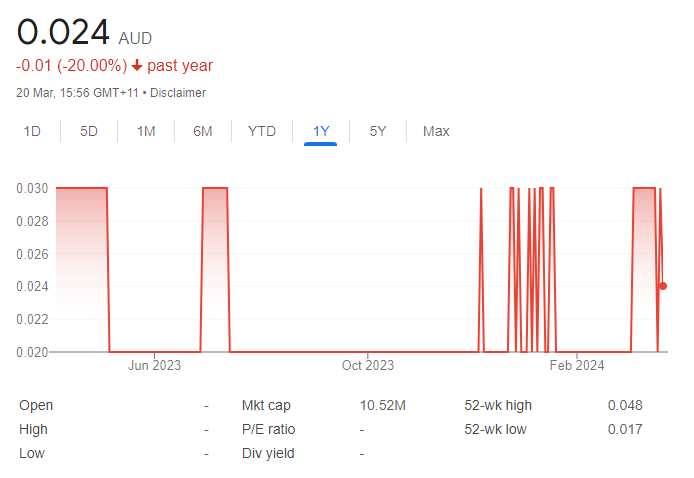

This clinical stage drug company recently announced encouraging results from its phase 1 extension study of lead asset AD-214. The study established the safety and tolerance for the planned phase 2 dose. AD-214 is a molecule designed to treat idiopathic pulmonary fibrosis. Results are being shared with potential partners, with a view to progressing a licensing or asset financing transaction in the near term. The shares were trading at 2.4 cents on March 21.

SELL RECOMMENDATIONS

SELL – Premier Investments (PMV)

Premier owns retail conglomerate Just Group. Brands include Smiggle, Peter Alexander and Portmans, among others. Premier Retail sales of $1.64 billion in full year 2023 were up 9.7 per cent on the prior corresponding period. PMV’s adjusted net profit after tax of $278.6 million was up 6.4 per cent. The company is exposed to increasing pressure on retail spending. We see downside risk, as high interest rates and increasing cost of living expenses may impact consumer spending.

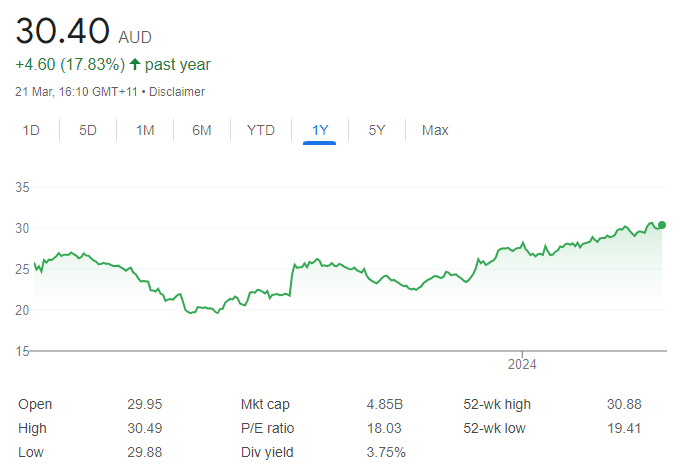

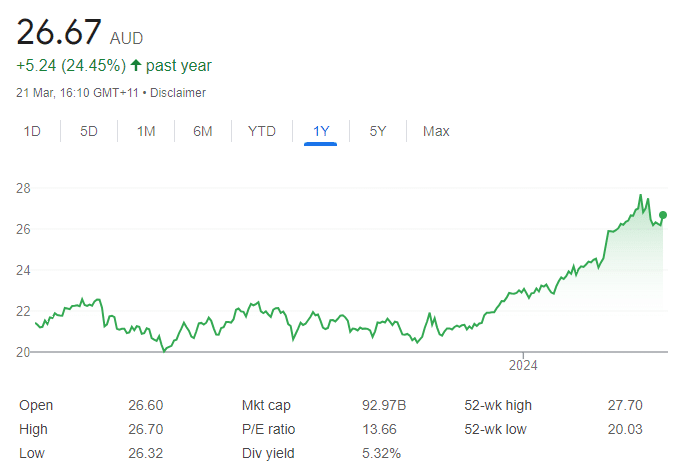

SELL – Commonwealth Bank of Australia (CBA)

The bank posted cash net profit after tax of $5.019 billion in the first half of fiscal year 2024, a fall of 3 per cent on the prior corresponding period. The net interest margin was down 11 basis points. The CBA trades at a premium compared to other banks. The shares have risen from $96.87 on November 1, 2023, to trade at $116.56 on March 21, 2024. Investors may want to consider cashing in some gains.

Top Australian Brokers

- IG - Extensive product array and user-friendly platforms - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

- Quadcode Markets - multi-asset CFD broker - Read our review

Dylan Evans, Catapult Wealth

BUY RECOMMENDATIONS

BUY – Seek (SEK)

Seek operates online employment marketplaces in Australia and internationally. Seek has invested in technology improvements during the past few years, so the benefits should flow through in the next two to three years. We’re attracted by potentially strong growth and an appealing valuation compared to peers.

BUY – Cleanaway Waste Management (CWY)

Cleanaway is a leader in the waste and recycling industry, which offers defensive cash flows and reasonable growth. We see an opportunity for Cleanaway to improve profitability on the back of industry consolidation. It should generate growth as it expands into resource recovery, supported by a national goal to increase recycling rates from 60 per cent to 80 per cent by 2030.

HOLD RECOMMENDATIONS

HOLD – CSL (CSL)

CSL is a high quality company. The core blood plasma business is improving after disruptions from COVID-19. The immunisation and kidney divisions need to improve for the stock to outperform, in our view. A stagnant share price combined with underlying growth have resulted in CSL’s multiples returning to more reasonable levels, so the company is more attractive on a valuation basis.

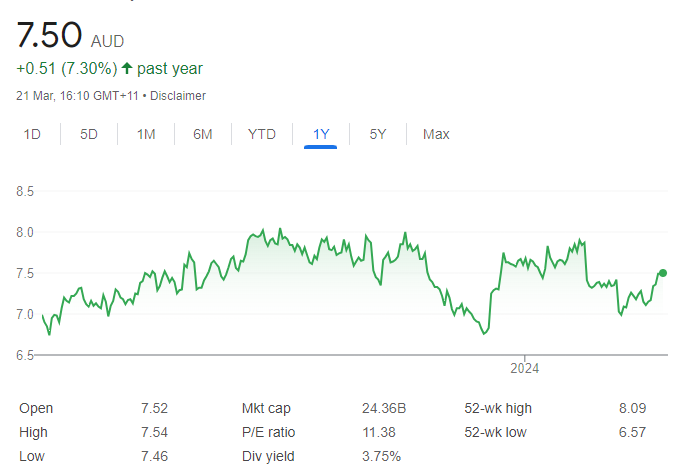

HOLD – Telstra Group (TLS)

The telecommunication giant’s mobile division has been a strong performer, although partially offset by weakness in the fixed network business. The 5G network and careful cost control should drive growth. The separation of infrastructure assets should also realise additional value. Telstra is an appropriately priced business for those seeking a solid defensive income play.

SELL RECOMMENDATIONS

SELL – Xero (XRO)

This cloud-based accounting software provider operates a quality business with attractive recurring and growing revenues. However, the stock trades on demanding multiples, so market expectations are high compared to recent history. The stock is priced to perfection, so there is little room for error. We suggest avoiding the stock for now, with an eye to buying it if the valuation becomes more appealing.

SELL – Seven Group Holdings (SVW)

Seven Group has diverse operations across industrial services, energy and media. The underlying businesses are performing, but the share price is trading at a premium, in our view. The shares have risen from $33.69 on January 18 to trade at $41.49 on March 21. Investors may want to consider taking a profit. We’re concerned about a cyclical downturn in an uncertain Australian economy.

Jed Richards, Shaw and Partners

BUY RECOMMENDATIONS

BUY – Santos (STO)

The future growth prospects pipeline is far stronger for Santos than Woodside Energy, in my view. STO has positioned itself well over the past few years to be an attractive addition for Woodside. Although the last round of negotiations hasn’t resulted in a merger, I expect this strategy will be addressed again in the future.

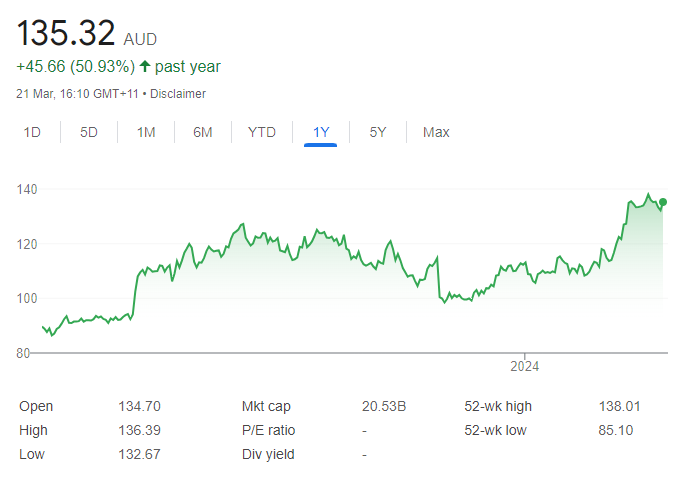

BUY – Paladin Energy (PDN)

Australia is closer to accepting nuclear power than ever before. China’s demand for uranium is enough to drive profitability. Paladin is the premium and most liquid stock in the uranium sector. It remains our preferred exposure to an improving uranium market. The shares have performed strongly in the past year, and we expect this favourable momentum to continue.

HOLD RECOMMENDATIONS

HOLD – BHP Group (BHP)

Shares in this quality miner have retreated from $50.54 on January 2 to trade at $44.09 on March 21. The iron ore price has retreated on the back of uncertain Chinese demand. The share price has rapidly followed the iron ore graph. China has the necessary means to grow the economy, and I’m confident iron ore will play a big role in the future.

HOLD – Westpac Banking Corporation (WBC)

Although the banks have rallied significantly in the past five months, Westpac’s dividend is sufficient to justify a hold recommendation. I see little or no earnings growth from Westpac and the other major banks at this point, but WBC’s recent fully franked dividend yield above 5 per cent is appealing in this current economic environment.

SELL RECOMMENDATIONS

SELL – Wesfarmers (WES)

The company’s performance has been rewarded with strong buying. The share price has risen from $56.41 on January 8 to trade at $67 on March 21, which, in my view, seems excessive. The dividend yield was recently below 3 per cent, so I wouldn’t be surprised to see the stock trading in the $50 range in coming months. I believe the growth rate is insufficient to justify the current price/earnings ratio.

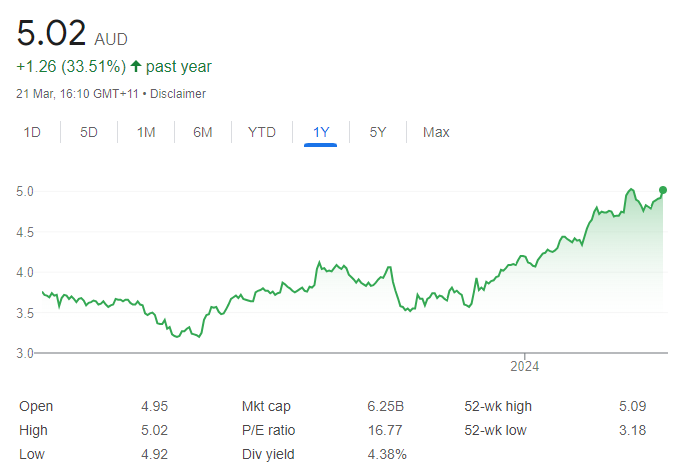

SELL – Harvey Norman Holdings (HVN)

Shares in the retail giant have risen from $3.57 on November 27, 2023, to trade at $4.98 on March 21, 2024. We believe it’s a good time to pocket some profits. The retail sector still faces challenges in times of high interest rates and soaring cost of living expenses. Competition in the discretionary retail sector is fierce and Amazon continues to gain market share.

Related Articles:

- The Best ASX Stocks for Day Trading

- The Best CFD Trading Platform in Australia

- Australian Automated Trading Software

- How to Trade Commodities in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.