Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

BUY – Saturn Metals (STN)

High grade gold intersections have been reported at Apollo Hill in Western Australia, highlighting potential for the project to host areas of high-grade mineralisation. The current published mineral resource is 105 million tonnes at 0.54 grams a tonne of gold for 1.839 million ounces reported above a cut-off grade of 0.20 grams a tonne of gold. We expect further upgrades following additional drilling. We see medium to longer-term potential as a gold growth opportunity, with studies progressing towards targeted production scenarios.

BUY – Pacgold (PGO)

PGO owns the Alice River gold project in North Queensland. Exploration continues to deliver extensions to zones that may host high-grade gold mineralisation. A 4000-metre reverse circulation and aircore drilling program is investigating six priority IP geophysical and high-grade gold targets on 8 kilometres of strike within the 30-kilometre Alice River fault zone. PGO is a high risk and high reward emerging gold explorer, with the potential to define economic gold resources at the central and southern zones.

HOLD RECOMMENDATIONS

HOLD – Eagle Mountain Mining (EM2)

The mineral resource estimate (MRE) for the Oracle Ridge copper resource in Arizona has increased substantially to 28.2 million tonnes at 1.35 per cent copper, 11.06 grams a tonne of silver and 0.16 grams a tonne of gold for 380,000 tonnes of contained copper. The expanded MRE will underpin technical studies, including metallurgical, processing and mining evaluations to meet the objective of EM2 becoming a higher tonnage producer. Growth potential remains, but the stock is highly speculative.

HOLD – Copper Search (CUS)

The company is targeting copper-gold deposits within the Gawler Craton of South Australia. Company tenements cover more than 5000 square kilometres. The Peake project is prospective for iron-oxide-copper-gold mineralisation in the north-east corner of the Gawler Craton. A six-hole reverse circulation drilling program at the Peake project – testing the Paradise Dam prospect – has been completed. Assay results, expected to be released in January 2024, will provide a clearer picture about the outlook. This stock only suits investors with a high tolerance for exploration risk. The shares closed at 11 cents on November 30.

SELL RECOMMENDATIONS

SELL – Super Retail Group (SUL)

The group delivered sales growth of 4 per cent in the first 16 weeks of fiscal year 2024 when compared to the prior corresponding period. Like-for-like sales grew by 2 per cent. Supercheap Auto, rebel and BCF performed well. However, SUL expects the cost of doing business as a percentage of sales to increase in fiscal year 2024 due to continuing inflationary pressures on wages, rents and electricity. The shares have been performing well, so investors may want to consider cashing in some gains.

SELL – Lovisa Holdings (LOV)

The fast fashion jewellery retailer operates 836 stores across 40 markets. LOV recently reported global comparable store sales for the first 20 weeks of fiscal year 2024 were down 6.2 per cent on fiscal year 2023 for the year to date. Total sales for this period were up 17 per cent on fiscal year 2023. It might be time to consider trimming holdings in a challenging retail environment.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Findi (FND)

Findi is a digital payments and financial services provider. It has exposure to the fast-growing Indian economy. The company’s Indian subsidiary, TSI India, successfully raised $37.6 million via a placement of compulsory convertible debentures, which converts to equity at the intended TSI India IPO (initial public offering). The capital raise effectively values FND at $190.6 million, significantly higher than FND’s current market capitalisation. We believe FND offers plenty of upside from here.

BUY – Domain Holdings Australia (DHG)

Domain is a digital real estate listings company. Property prices have recovered from their post COVID-19 dip. In our view, we’re likely to see stable interest rates, which we expect will support consumer confidence. Consequently, we anticipate increasing property listings moving forward, which paints a brighter outlook for DHG.

HOLD RECOMMENDATIONS

HOLD – Fortescue Metals Group (FMG)

The iron ore giant is trading at attractive multiples and benefiting from Chinese stimulus, which has contributed to iron ore prices recently trading at nine-month highs. Despite these positive attributes, there’s no need to rush into FMG as the price of the underlying commodity can pull back from these higher levels. Keep an eye on the news flow.

HOLD – Paladin Energy (PDN)

This uranium company’s Langer Heinrich mine will resume production in the first quarter of calendar year 2024. We’re positive about PDN, as governments around the world consider adding uranium into their energy mix in a bid to reduce emission targets with a proven reliable source. Despite our bullish outlook on uranium, PDN’s share price has risen significantly in 2023, so we believe it’s best to hold at this point.

SELL RECOMMENDATIONS

SELL – Nick Scali (NCK)

This furniture retailer’s chief executive Anthony Scali recently sold 4.6 million NCK shares worth about $50 million via a fully underwritten block trade. Following the sale, Scali, via his family investment company, retains more than 6.439 million NCK shares, or 7.95 per cent of the shares on issue. The shares fell following the announcement. Moving forward, discretionary retailers, such as NCK, are up against higher interest rates and soaring cost of living expenses.

SELL – Appen (APX)

This artificial intelligence data provider is undertaking a $30 million equity raising in a bid to return to profitability.The latest equity raising follows a $60 million equity raising earlier this year. These equity raisings are hugely dilutive. Unaudited revenue of $US223 million for the 10 months ending October 31, 2023, was 29.3 per cent below the corresponding period.

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

BUY – Endeavour Group (EDV)

Endeavour operates liquor outlets, hotels and gaming facilities. The company delivered sales growth in retail and hotels in the first quarter of fiscal year 2024. The share price has fallen from $6.31 on July 4 to trade at $4.94 on November 30. We believe EDV presents decent value as downside risk appears to have been already priced into the shares. A weaker Australian dollar and softer share price could see overseas investors start to show some interest in EDV.

BUY – Pilbara Minerals (PLS)

The lithium price has been tracking down and the bottom may not have been reached. But on a long- term view, this weakness presents a buying opportunity given the strong electrification theme. The shares have fallen from $5.37 on August 10 to trade at $3.51 on November 30. Investors may want to consider accumulating on upwards momentum.

HOLD RECOMMENDATIONS

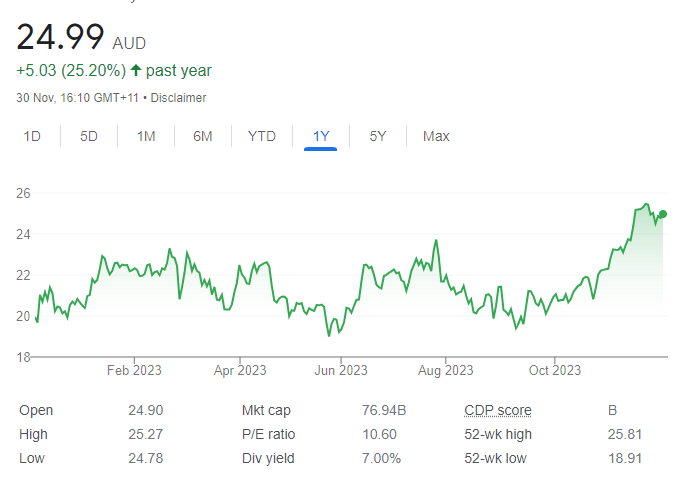

HOLD – Macquarie Group (MQG)

This diversified financial services group announced a first half 2024 net profit of $1.415 billion, down 39 per cent on the prior corresponding period. Apart from banking and financial services, other business divisions were down. Group capital surplus was $10.5 billion at September 30, 2023. The board announced an on-market share buyback of up to $2 billion.

HOLD – CAR Group (CAR)

This digital marketplace business performed well in fiscal year 2023. It holds a strong position in Australia. The network extends across the US, South Korea and Latin America. Formerly known as carsales.com, the company posted proforma revenue of $942.2 million in fiscal year 2023, up 18 per cent on the prior corresponding period. The shares appear fairly priced, but we’re watching out for weakness.

SELL RECOMMENDATIONS

SELL – Champion Iron (CIA)

This iron ore company sold 5.4 million tonnes of iron ore concentrate for the six months ending September 30, 2023. This compares with 4.8 million tonnes in the prior corresponding period. Revenue also increased year-on-year. The shares have risen from $5.94 on October 5 to trade at $7.565 on November 30. In our view, the company recently pushed past its full valuation, so investors may want to consider cashing in some gains.

SELL – Ingenia Communities Group (INA)

This retirement and lifestyle communities developer benefits from an ageing population. Revenue of $394.5 million in fiscal year 2023 was up 17 per cent on the prior corresponding period. However, statutory profit of $64.4 million was down 33 per cent. Operating cash flow of $82.5 million was down 28 per cent. The shares have fallen from $4.87 on February 3 to trade at $4.09 on November 30. The company operates in a competitive sector.

Related Articles:

- How to Start Trading Stocks

- The Best Australian Trading Apps

- Forex Trading Platforms in Australia

- Crypto Brokers in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.