- Endeavour Group now operates retail liquor stores, hotels, and related businesses with omnichannel distribution.

- Investors have been influenced by friction at the company’s board of directors, contributing to a declining share price.

- The company’s forward strategy calls for increasing focus on its hotel operations, which have outpaced retail in financial performance of late.

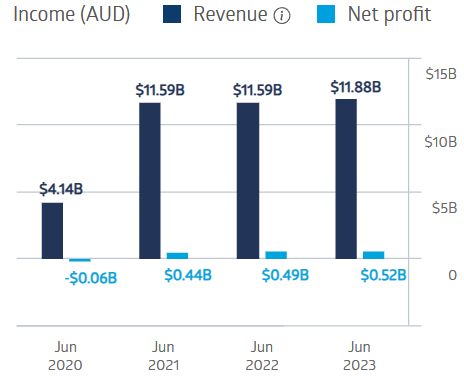

Endeavour Group operates retail stores and hotels across Australia, emerging from the divestiture of Woolworth’s retail liquor business. Going public in June 2021 following the 2019 spin-off, Endeavour posted a profit in its last year of operation before listing on the ASX and has grown each financial year since.

Endeavour Group Financial Performance

Source: ASX

The company’s now fully restored hotel business is driving its growth metrics with a trend that has been growing in strength since the hotel operation began to recover from the COVID-19 Pandemic in the second quarter of 2022.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

For FY 2023, retail sales dropped 1.8%, while hotel sales increased 31%.

The first quarter of FY 2024 saw retail sales growing 1.9% while hotels were up 2.8%. The company previewed this in the Full Year 2023 release – citing the six-week growth in Q1 of 2.5% in retail and 4.6% in hotels as a harbinger of a strong Full Year 2024.

Endeavour paid $0.07 per share dividends in FY 2021, increasing to $0.22 in FY 2023, with a current yield of 4.28%.

The stock price is down 26.45% year over year.

Source: ASX

An analyst at Catapult Wealth has a BUY recommendation on Endeavour Group shares, citing the company’s most recent slide in share price and the view that “downside risk appears to have been already priced into the shares.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy