- International online employment marketplace provider Seek Limited posted disappointing Half Year 2024 financial results.

- Outlook for the full year points to coming in at the low end of earlier guidance.

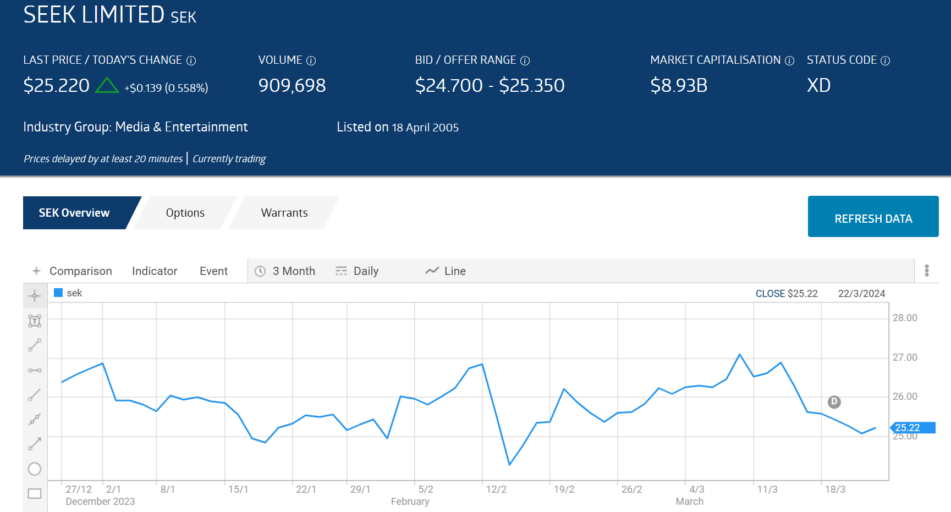

- The share price fell, rebounded, and fell again.

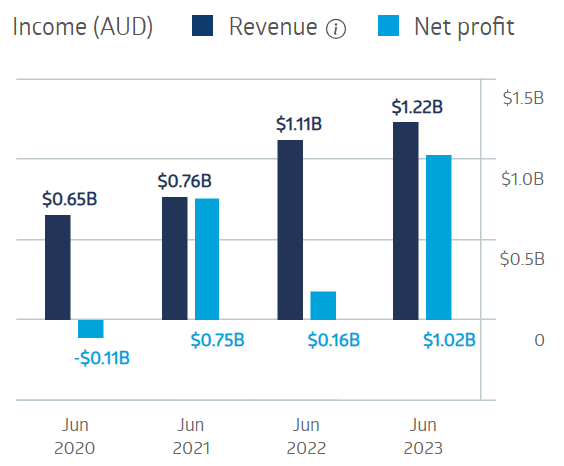

Seek Limited was an early fintech (financial technology) disruptor, moving classified print ads for employment to online platforms. Financials were heavily impacted by the COVID 19 pandemic, with a strong rebound in FY 2023.

Seek Limited Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Half Year 2024 financial results showed a 20% decline in posted job ads from the company’s core market – Australia and New Zealand. Total group revenues for the period dropped 5% with adjusted net profit falling 24% and dividend payments reduced by 21%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Investors rushed to exit the stock, only to return to push the share price back above pre-announcement levels before selling off the stock again. Over three months the stock price is down 3.04%.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

An analyst at Catapult Wealth has a BUY recommendation on Seek shares, pointing to future benefits over the next two to three years from the company’s technology improvements, concluding the attraction to Seek comes from the potentially strong growth and an appealing valuation compared to peers.

Marketscreener.com has an analyst consensus rating of OUTPERFORM on SEK shares, with six of fourteen analysts reporting at BUY, two at OUTPERFORM, three at HOLD, two at UNDERPERFORM, and one at SELL.

The Wall Street Journal has an analyst consensus rating of OVERWEIGHT on Seek shares, with seven of fifteen analysts reporting at BUY, two at OVERWEIGHT, three at HOLD, one at UNDERWEIGHT, and two at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 25th March 2024

- Gold Explorer Saturn Metals (ASX: STN) Under the Radar of Investors and Analysts

- Hansen Technologies (ASX:HSN) Bolsters Market Position by Solidifying Partnership with Bixia

- Resilient Australian Markets Capitalize on Surge in Gold and Materials Amid Rising Employment