Twice a year Aussie investors who pick their own stocks run the gauntlet of earnings season. Full Year and Half Year Financial Results open the door for big and sustained gains or losses. To add to the mania there is the strong possibility the gains or losses will be fleeting, evaporating within days.

As is the case with all price movements in share market investing, the driving force is not reality, but perception. Astute investors look for two stories in the results presentations – historical performance and future growth.

A record breaking financial performance is no guarantee the stock price will rise, if market participants have reason to doubt the company can maintain or exceed its past history. Similarly, a dismal report is no guarantee of stock price declines if the company can make the case the worst is over, and the future is bright.

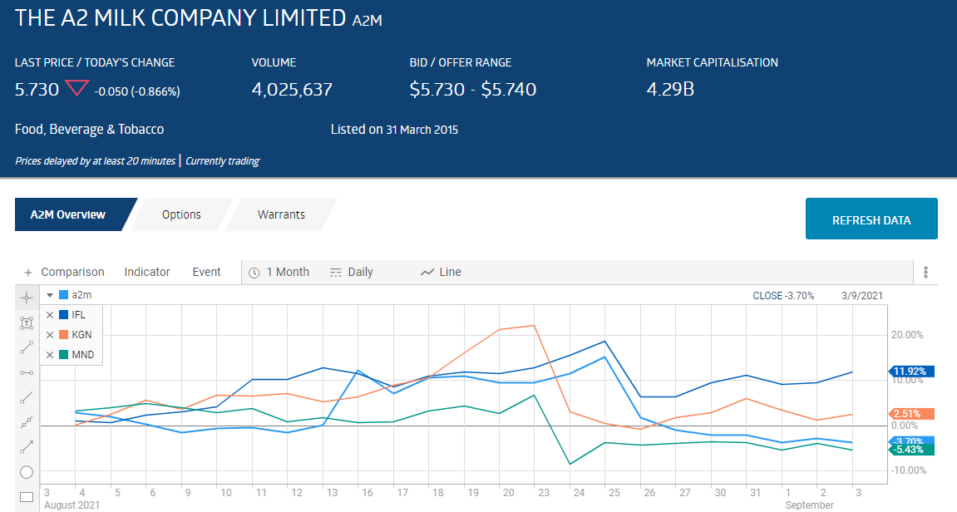

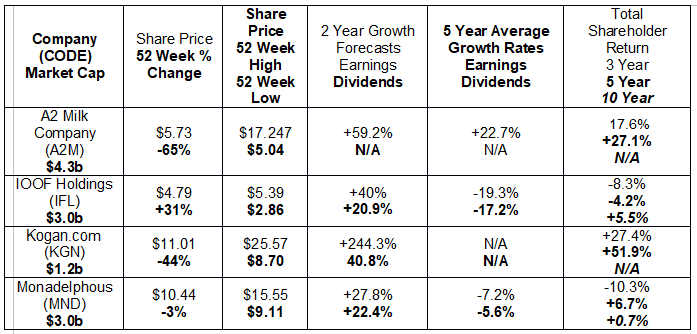

In the recent FY 2021 round of releases, four stocks were punished with double digit declines immediately following the market announcement. Two – A2Milk Company (A2M) and Kogan Limited (KGN) – once held status as ASX “market darlings.”

IOOF Holdings (IFL) and Monadelphous Group (MND) are the remaining two stocks that experienced double digit share price declines while maintaining double digit earnings growth forecasts, at least as of today.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

All four have seen their share price remain below their pre-announcement levels, despite all having double digit earnings growth forecasts. Some had less than stellar financial results in FY 2021 and all had lukewarm, at best, growth outlooks for FY 2022. Since releasing their financial results only the a2 Milk Company has continued its downward trend.

In some cases a pessimistic outlook is due to conditions unique to the company and/or the business sector in which the company operates. These four face a renewed concern – the resurgence of COVID 19 here in Australia and to a lesser extent, globally.

Lockdowns have returned and contributed to the decline in national GDP in the June Quarter from the positive 1.9% of the March Quarter to a meager 0.7% increase. While some had predicted negative GDP in the June Quarter, there is little doubt the economy will go negative in the September Quarter, with estimates ranging from a shrinkage of 2% to 3%. A fall to a negative 2.0% would mark the Australian economy’s worst performance since 1974, excluding the one-off collapse at the onset of the COVID 19 Pandemic. At the extreme, some forecasters expect a fall of 4%.

Not all stocks will be impacted to the extreme by the situation here in Australia. . The following table includes historical performance information along with growth estimates for earnings and dividends, where applicable for the earnings losers.

New Zealand based a2 Milk Company listed on the ASX in 2015, armed with a unique product and a2 Platinum® infant nutrition products.

At the time the company’s use of the superior A2 beta-casein protein type from cows specifically bred to produce that type of milk was unique. In 2013 the company launched the a2 Platinum® Premium in China, giving a2 Milk company “first mover” advantage in infant formula using the healthier A2 beta-casein protein, but now Nestles has introduced a competitive line In China as well as plans to challenge the a2 Milk Company in the Australia and New Zealand markets, a move a2 Milk is fighting

Although the company rose to market darling status due to its strong position in the Chinese infant formula market, the company sells A2 Milk products in the Asian and US markets, with Nestles, Walmart, and Costco joining in that reportedly healthier alternative milk product.

The Chinese demand for foreign infant formula exploded following a scandal that brought the safety of domestically supplied infant formula into intense scrutiny. The scandal was first uncovered in 2008, with around 54,000 children ending up in hospitals. As the market for foreign infant formula brought a confusing array of producers and distribution methods, the Chinese government eventually stepped in with a series of regulatory changes.

Initially, the a2 Milk company remained strong due to earlier compliance with new regulations. The COVID 19 Pandemic and the trade war with China has made a challenging business even more difficult to manage.

Beset by a range of problems, investors began to abandon the company following its all-time high reached in late June of 2020.

The pandemic continues to wreak havoc with the company’s ability to manage its inventory in face of disrupted distribution channels, most notably the Daigou channel – independent operators buying goods in a foreign country for import into China.

The FY 2021 Financial Results were devastating, coupled with a less than stellar outlook in the short term. Revenues dropped 30.3% while net profit after tax (NPAT) fell 79.1%. The company did not provide any forward guidance, although management did claim inventory levels were improving. Recognising the need to adapt to a changing market, a2 Milk management announced a “comprehensive review of the company’s growth strategy”, with an investor update on this strategic review to be released in late October.

Financial services provider IOOF Holdings saw its share price jump the morning after the release of a solid earnings report, only to see it crash by the close. The company offers investment management, stockbroking, financial planning services, and portfolio and estate administration.

For the Full Year 2021, the company’s revenues were up 31% and underlying net profit after tax rose 19%. However, reported NPAT fell from $147 million in FY 2020 to a loss of $147.5 million in FY 2021 due to one-offs associated with the key acquisition of the wealth management services division of the National Bank of Australia (NAB).

Guidance for FY 2022 was lacking in specifics with IFL management commenting:

- Through the transformation of our business, we expect to deliver synergy benefits during FY 2022 and beyond.

At least for now, investors drove the share price down further following a capital raise by IOOF to partly pay for the acquisition of the MCL wealth management operation from NAB. In December of 2020 IOOF signed a “Heads of Agreement” with another ASX listed financial services provider, HUB24 (HUB) to collaborate on “a range of solutions, including an investment and superannuation wrap platform utilising HUB24’s administrative and technological capabilities.

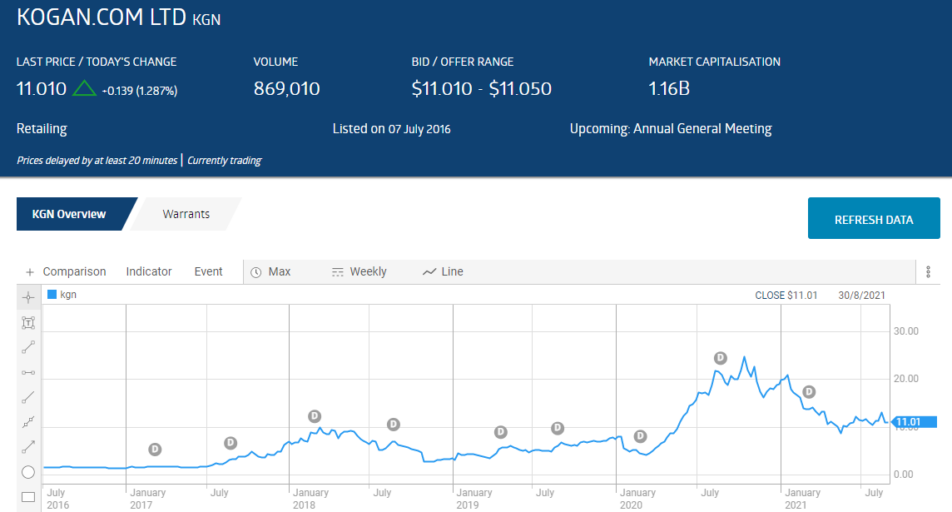

Kogan listed on the ASX in 2015 with the share price rise accelerating dramatically as the COVID 19 Pandemic began to shutter much of Australia in March of 2020. The stock price reached an all-time high in mid-December of 2020 before beginning a slow return to earth.

As the lockdowns gave way, the explosive growth from the “stay at home” consumer began to wane. As a result Kogan began to experience a problem foreign to them in the booming days – excess inventory.

Excess inventory must be stored, driving up the cost of doing business. Although revenue for FY 2021 increased 52.7%, net profit dived from $26.8 million dollars to $3.5 million, a drop of 86.8%.

- Cost of sales went up 55.4% in FY 2021.

- Cost of marketing went up 112.2%

- People costs went up 195.9%

- Variable Costs went up 123.7%

- Other costs went up 82.7%

Kogan also cancelled its final dividend payment, with no indication when or if dividends would resume. The final straw for many investors was the lack of any guidance and a lackluster start to FY 2022. For the month of July gross sales increased 5.1% over the same period in FY 2020. EBITDA (earnings before interest, taxes, depreciation, and amortisation) of $2.1 million dollars was impacted by high operating costs, according to Kogan management.

Kogan is an ecommerce powerhouse in Australia, similar to Amazon with marketplace sellers and its own branded items. The company is arguably the most diversified stock on the ASX with business operations far exceeding its principal ecommerce focus. The company offers mobile and internet service, life and pet insurance, travel services, credit cards, loans, cars, and energy.

Finally, the company acquired Mighty Ape, a gaming/toy/hobbies online operation, in December of 2020. In addition, Kogan took over the online operations of electronics retailer Dick Smith following that company’s collapse in 2016. Once again, Kogan stepped in to acquire the online operation of another failed retailer, assuming the online operations of furniture retailer Matt Blatt.

The Monadelphous Group is an engineering company servicing the resource, energy and infrastructure sectors with construction, maintenance, and industrial services.

On 22 July the share price got a boost on the company’s announcement of new contract signings here in Australia – with BHP and RIO – and in Chile with its subsidiary company there.

Investor reaction to the Full Year 2021 Financial Announcement was a classic example of focusing strictly on the outlook.

The results were solid. Revenues were up 18% while NPAT rose 29%. A final dividend payment of 21 cents per share raised the dividend for the full year to 45 cents per share, ten cents above the FY 2020 total dividend of 35 cents per share, an increase of 28.5%.

But then came the outlook for FY 2022, with management warning revenues in FY 2022 would be lower. Management cited two reasons for the grim outlook.

First, contract timing of awards and the beginning of new projects.

Second, labour shortages here in Australia.

As brokerage firms assess the results it is possible the two year earnings forecasts will be reduced.