- Aurumin listed on the ASX in 2020 with early positive drilling results on its Mt Dimer Project.

- After hitting an all-time high in mid-2021, the share price collapsed.

- Aurumin has now sold Mt Dimer, coupled with a capital raise, fully funding the company’s work at its Sandstone project.

In December of 2021, junior gold explorer Aurumin acquired the 784koz Sandstone Gold Project in a Western Australia region with production history. Sandstone came with existing infrastructure in place, including camps and office access along with a processing plant.

By May of 2022 drilling at Sandstone had begun, with continued progress unveiling a larger resource base, pushing market announcements on progress at Mt Dimer out of the limelight.

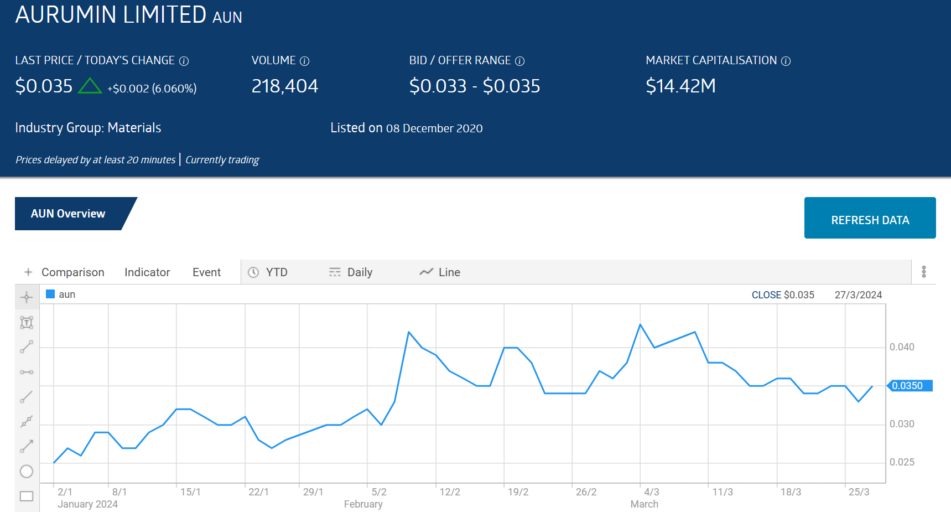

Source: ASX

By November of 2023, Aurumin had sold Mt Dimer, leaving lithium exploration at its Mt Palmer Gold Project asset as its sole active exploration site along with the now flagship Central Sandstone Project. A 7 March update to the market announced the company’s capital raise fully funded work at the prospective sites within the Central Sandstone Project while the company “evaluates its options for Mt Palmer.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Since listing the share price has dropped 87%, but investors appear to be linking interest in the company with the rising price of gold. The share price is now up 34.6% year to date.

An analyst at Peak Asset Management has BUY recommendation on Aurumin shares, citing the company’s debt free status with all planned exploration activities in 2024 fully funded, with the share price “leveraged to an increasingly strong gold price.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy