- The COVID-19 Pandemic negatively impacted CSL’s blood plasma business.

- The company now faces high-interest rates, inflationary pressures, and foreign currency headwinds noted in a February market update.

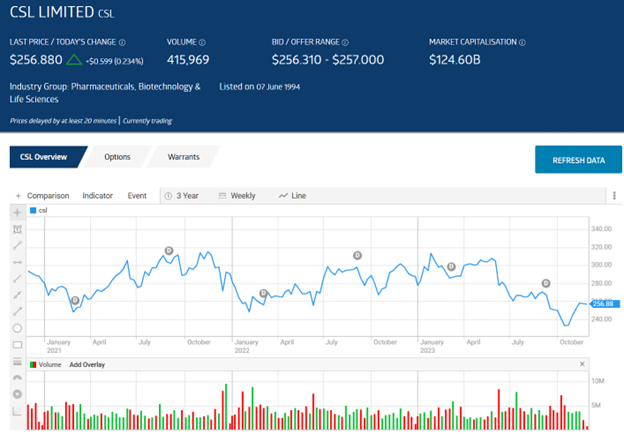

- The ASX stock price went into a tailspin from which it has not recovered.

CSL Limited, a global giant biotechnology company, has added a third revenue-generating business to its existing CSL Behring blood plasma operation and vaccine producer Seqirus.

In August 2022, CSL completed its acquisition of Vifor Pharma, a pharmaceutical company producing commodities in the form of treatments for iron deficiency and diseases of the kidneys (nephrology).

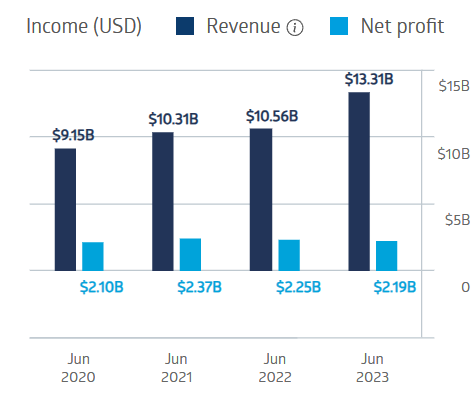

Despite worldwide challenges, the company has managed to post more than $2 billion dollars in net profit in each of the last four fiscal years.

CSL Financial Performance

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

The company’s Half Year 2023 financial reporting included guidance for anticipated foreign currency headwinds of $175 USD million dollars. A 14 June market update warned that the company could now face headwinds of between $230 USD million and $250 million. As a result, investors pushed the panic button, cratering the stock price. Year over year, the stock price is down 13.35%.

In an 11 October release of the results of the company’s annual general meeting to the market, management outlined the company’s macroeconomic challenges. Despite the management’s contention that the company would continue to grow, investors again dumped shares, sending the stock price to a three-year low.

Source: ASX

Investors may have turned bearish on one of the crown jewels of the ASX, but analysts remain decidedly bullish.

An analyst at Seneca Financial Solutions has a BUY recommendation on CSL shares, citing the company’s positive FY 2024 guidance as evidence the CSL blood products group is undervalued, given its brighter outlook.

Analyst consensus is BUY with nine BUY recommendations, five OUTPERFORM, and two at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy