- Current economic conditions continue to weigh on Harvey Norman shares.

- The company cut its dividend payments in FY 2023.

- Analysts are cautious on the company’s growth prospects.

Harvey Norman is a multi-channel, multi-product retailer with a company-owned and franchise business model.

Before COVID-19 lockdowns began to cripple retailers with brick-and-mortar operations, Harvey Norman reported a 75% increase in net profit after tax in FY 2021.

The Half Year 2023 results showed that the company’s troubles continue.

While revenue was flat, underlying net profit fell 14.5% and dividends were cut by 35%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

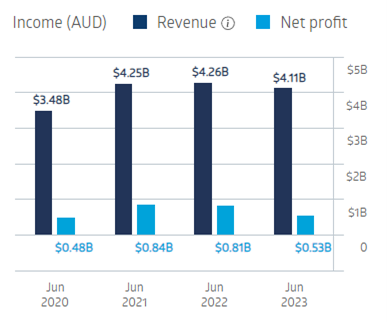

Harvey Norman Financial Performance

Source: ASX

Harvey Norman has been a dividend powerhouse, with a five-year average dividend payment of $0.31 per share, fully franked, and a five-year average dividend yield of 7.46%.

As seasoned investors know, dividends are not etched in stone. Harvey Norman cut its FY 2022 dividend of $0.38 per share to $0.24 per share.

Full Year 2023 results continued the trend, with revenue down 3.8%, net profit down 33.5%, and dividends cut by 33%.

Year over year, the share price is down 12.85%.

Source: ASX

An analyst at Bell Potter Securities has a SELL recommendation on Harvey Norman Holdings stock, citing weakness in the latest sales update from HVN, interest rates potentially being higher for longer, and the continuing cost-of-living pressures.

Consensus analyst opinion leans towards HOLD, with one analyst at BUY, eight at HOLD, and three at SELL.

Australian retail sales fell 0.2% in October, following gains in September – up 0.9% – and August – up 0.2%.

Forecasters predicted that Black Friday sales would surpass 2022 by 3%.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy