- Like many of the world’s greatest tech companies, REA Group was born in a garage in the suburbs of Melbourne.

- The company was one of the first to see the internet as a means to revolutionise advertising.

- The company now operates multiple branded property sites in Australia, Asia, and North America.

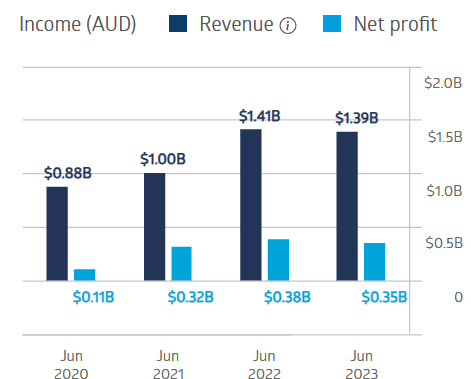

The company’s solid financial performance over the last four fiscal years slipped slightly in FY 2023.

REA Group Financial Performance

Source: ASX

REA Group’s latest financials for the first quarter of 2024 showed revenues up 12% and EBITDA (earnings before interest taxes depreciation and amortisation) up 13%.

The company’s outlook acknowledged the risk of continued rate increases impacting market sentiment. Management pledged “new features across all REA’s product suites” as a means of “underpinning future growth.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The company has paid dividends each year over the last decade, with payments over one dollar per share beginning in 2018. The five year average dividend payment is $1.32 per share with a yield of 1.09%. The FY 2023 total dividend payment of$1.58 per share was fully franked.

An analyst at Marcus Today has a HOLD recommendation on REA Group shares, pointing to the 8% increase in property prices across Australia in 2023, which may “moderate in calendar year 2024 in response to higher mortgage rates and cost of living pressures.”

The consensus analyst rating of HOLD appearing on Marketscreener.com shows one of the analysts reporting at BUY, two at OUTPERFORM, eight at HOLD, and 3 at UNDERPDERFORM.

The Wall Street Journal also has a consensus HOLD rating with two analysts at BUY, one at OVERWEIGHT, seven at HOLD, and three at UNDERWEIGHT.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy