- CSL is considered one of the premier growth stocks on the ASX.

- Half Year 2024 Financial Results showed an both revenue and profit increases, beating market expectations.

- The share price sold off on unrelated negative news.

In December of 2021 CSL added global kidney care biotech Vifor to its existing revenue generating segments – blood plasma provider CSL Behring and vaccine provider CSL Seqirus.

The company’s Half Year 2024 results showed an 11% revenue increase and a 13% profit rise, but management chose to point to “challenges for near term growth” for the company’s latest acquisition – kidney disease biotech Vifor. Coupled with an earlier release of disappointing clinical trial results, the share price dropped 6.76% over five days.

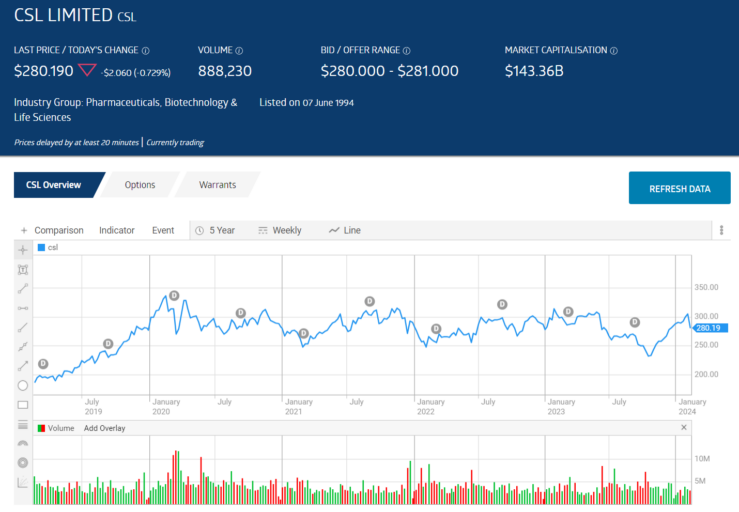

Source: ASX

Over five years the CSL share price is up 43.8%, with multiple opportunities for buying this top ten ASX stock by market cap on the dips.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

From FY 2014 to FY 2020 CSL increased its dividend payments every year and maintained FY 2020’s payment of $2.94 per share in FY 2021 before increasing the dividend payment again, to $3.18 in FY 2022 and $3.63 in FY 2023. The five year average is $2.94 per share with a five year average yield of 1.08%.

An analyst at Shaw and Partners has a HOLD recommendation on CSL share, calling the company one of “Australia’s greatest growth companies, continuing to grow at double digit rates.”

Marketscreener.com has an analyst consensus rating of BUY on CSL shares, with eight of fifteen analysts reporting at BUY, three at OUPERFORM, and four at HOLD.

The Wall Street Journal has an analyst consensus rating of OVERWEIGHT on CSL, with nine of seventeen analysts reporting at BUY, three at OVERWEIGHT, and five at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy