- Multi-commodity miner South 32 was spun off from BHP Billiton on 25 May of 2015.

- South 32 has mining operations in six countries, producing ten different commodities.

- Five of the commodities mined contribute to a low-carbon future.

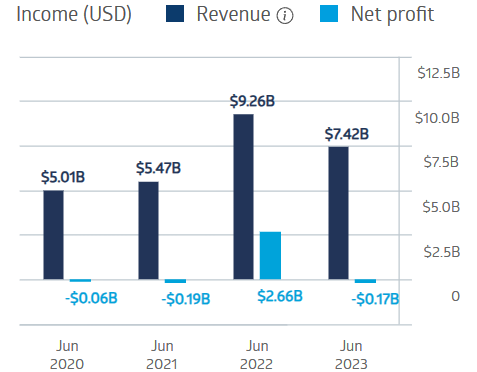

The company had a banner year in FY 2022 following two disappointing financial outcomes in FY 2021 and FY 2020, only to fall hard in FY 2023 with declining revenue and a profit loss.

South 32 Financial Performance

Source: ASX

The loss was due in part to a one-off asset write down, coupled with lower prices on some of the commodities South 32 produces. On 21 January of 2024 the company issued its Quarterly Report for the December Quarter of 2023. Production was mixed, with alumina, copper, zinc, and metallurgical coal showing declines. South reported headwinds from lower commodity prices during the period.

South 32 began paying dividends in its first year of operation following the spin off from BHP Group in 2016. The five year average dividend payment is $0.14 per share, with a five year average yield of 3.94%. FY 2023’s fully franked dividend of $0.12 per share represented a substantial cut from FY 2022’s total dividend of $0.37 per share.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

An analyst at Morgans has a BUY recommendation on South 32 shares, pointing to “a stronger performance to follow an anticipated recovery in Chinese and global growth and metal prices.”

Marketscreener.com has a consensus BUY rating on South 32 shares, with six of the thirteen analysts reporting at BUY, four at OUTPERFORM, and three at HOLD.

Based on their favourable outlook for many of the commodities South 32 produces, global investment firm Goldman Sachs has a BUY rating on S32 with a $3.80 price target, as of 23 January of 2024.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy