- Aeris Resources has an expansive portfolio of copper, gold, and zinc projects.

- In FY 2023, the company experienced setbacks at two key assets.

- The company’s largest investor and financial backer is now Washington Soul Pattinson (ASX: SOL).

For a junior miner with a market cap under $100m, Aeris Resources (ASX: AIS) has an expansive portfolio of six assets spread across four Australian states:

- Flagship, revenue-generating Tritton Copper Operations

- Revenue-generating Cracow Gold operation

- Jaguar Zinc/Copper operation

- North Queensland Copper Operations

- Stockman Copper/Zinc project

- Canbelego Copper project – 30% JV partner with Helix Resources (ASX: HLX)

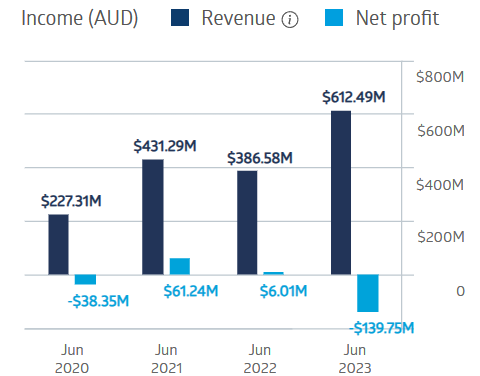

The company’s volatile financial performance over the last four fiscal years may be due to the challenges of managing so many assets.

Aeris Resources Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

FY 2021 results represent the company’s financial high water mark and the best share price performance period. Revenues rose 89.7%, while net profit from ordinary activities was up 259.7%. In its FY 2023 Full Year results presentation, the company acknowledged that “operational challenges at Tritton and Jaguar significantly impacted production and cash generation.”

Over five years, the share price has been down 98.49%.

Source: ASX

Year over year, the share price is down 81.69%.

Following the sale of its subsidiary company Round Oak Minerals interest in the Jaguar project, ASX-listed investment company Washington Soul Pattinson became Aeris Resources’ largest shareholder.

An analyst at Medallion Financial Group has a BUY recommendation on Aeris Resources shares, citing the participation of high-quality investor Washington Soul Pattinson in the upcoming $30m capital raise to fund “working capital and financial flexibility” at Aeris.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy