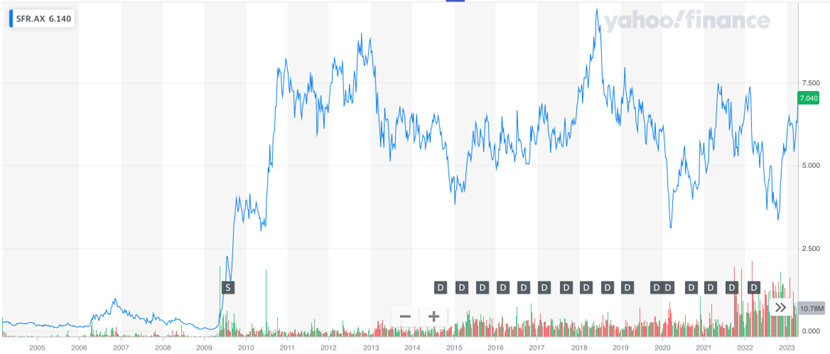

- Sandfire Resources is an international miner based in West Perth. Here, we dive into why it might be a good stock investment.

A cross-section of metals and minerals continues to see an influx of capital expenditure. Sharply growing international production has done little to dampen runaway consumer inflation. One of the companies benefiting from the macroeconomic environment is Sandfire Resources ASX:SFR (SFR)

SFR is a multinational, varied mineral producer focusing on copper. The company is headquartered in Western Australia. With international copper prices buoyed by global inflation, SFR has seen impressive growth. It more than doubled its top-line revenue between July 2019 and today.

Sandfire Resources ASX:SFR (SFR)

SFR presents several compelling reasons why it might be a good stock investment. Firstly, the company is actively engaged in the exploration, evaluation, and development of mineral tenements and projects, focusing on copper, gold, silver, lead, and zinc deposits. This diversified portfolio provides exposure to multiple commodities, reducing the risk of relying on a single resource.

The company’s ownership of the DeGrussa copper operations in Western Australia and the MATSA Copper operations in Spain demonstrates its successful track record in operating and managing mining projects. These existing operations contribute to SFR’s revenue and profitability, providing a stable foundation for investors.

SFR’s 87% interest in the Black Butte copper project in the United States and its participation in the Motheo copper project in Botswana offer additional growth opportunities. The imminent production from the Motheo mine serves as a catalyst for short-term growth prospects. Moreover, the company aims to achieve a 25% increase in copper production by late 2025, demonstrating its long-term growth aspirations.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

SFR has reported record first-half revenue, indicating its ability to generate substantial income. The company’s financial performance is robust, with revenue of $431.7m USD, a 38% increase compared to the prior corresponding period.

Considering SFR’s diversified portfolio, successful mining operations, upcoming production, and strong financial performance, it appears well-positioned for both short-term gains and long-term growth.

Source: Yahoo!Finance