- Macquarie Group is Australia’s only global investment bank.

- The company serves Australia, the Asia-Pacific region, Europe and the Middle East, Africa, and the Americas.

- The company’s solid financial performance stuttered with the Half Year 2024 financial results.

Macquarie Group has four revenue-generating operating units: asset management, banking and financial services, commodities and global markets, and Macquarie Capital.

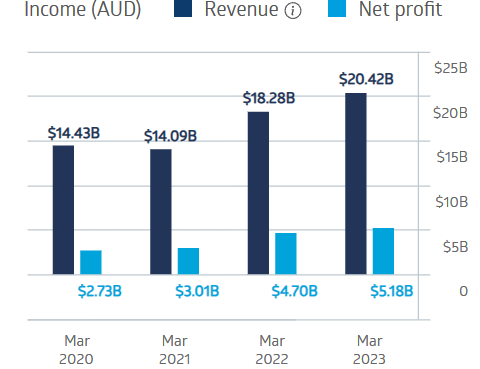

The company managed to grow profits in each of the last four challenging fiscal years, with only revenues taking a dip in FY 2021.

Macquarie Group Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The Half Year 2024 results reported on 2nd November broke the pattern, with net profit down 39%, along with other group metrics – however, the company announced that its cash position was strong enough to warrant a $2bn AUD share buyback.

The stock price is down 1.61% year over year, intraday on 8th December.

Source: ASX

Over the course of the last decade, Macquarie Group lowered its dividend payment once – in the midst of the COVID-19 pandemic in 2020.

Over five years, dividend payments have averaged $5.57 per share with a five-year average yield of 3.72%.

An analyst at Catapult Wealth has a HOLD recommendation on Macquarie Group shares, based on the strength of the company’s proposed $2bn share buyback, despite a lacklustre financial performance across all divisions.

Analyst consensus recommendation for Macquarie Group from 13 analysts is OVERWEIGHT, with four at BUY, three at OUTPERFORM, and six at HOLD.

The Wall Street Journal is reporting 14 analysts covering the company with an OVERWEIGHT consensus rating.

Five analysts are recommending that investors BUY, two rate the stock as OVERWEIGHT, and seven recommend that investors HOLD the stock.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy