- In early December of 2023 Santos confirmed the merger negotiations in progress with Woodside Energy Group.

- Negotiations ended on 7 February with Woodside never putting forth a bid.

- Santos remains a player in the global LNG market with two assets with revenue generating potential.

In addition to oil production, Santos has producing assets in coal seam and shale gas, feeding the company’s three producing LNG (liquefied natural gas) facilities.

The company’s Pika 1 Project in Alaska and the Barossa Project here in Australia are the cornerstones’ of the Santos growth strategy.

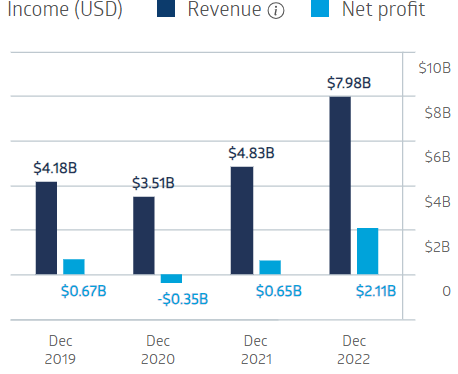

Santos Limited Financial Performance

Source: ASX

Santos rebounded from the COVID 19 pandemic, nearing pre-pandemic levels in FY 2021 and significantly exceeding revenue and profit in FY 2022.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

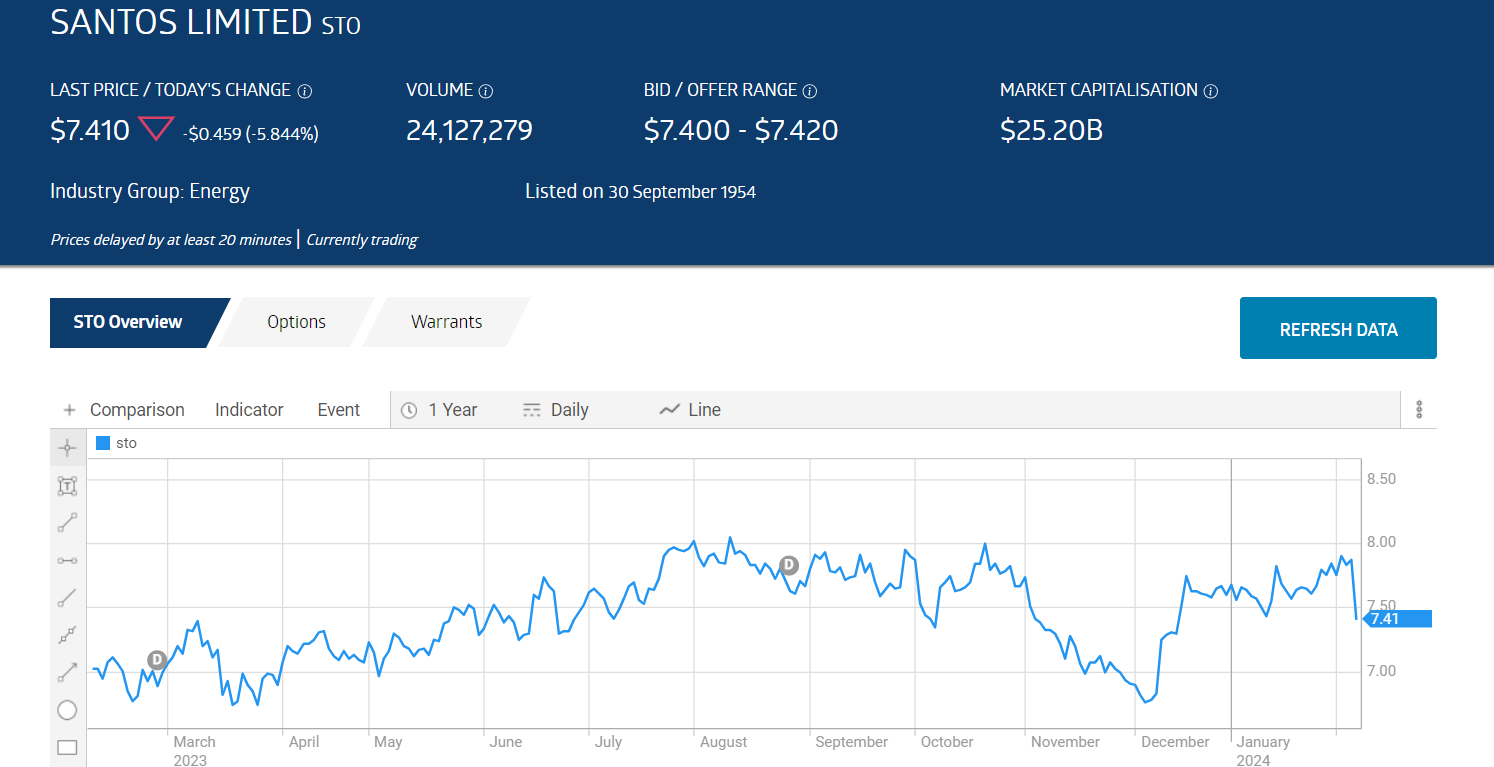

Year over year the share price is up 5.71%, with major spikes stemming first from the Israeli/Gazi conflict and the rise and fall of the Woodside merger.

Source: ASX

The five year average dividend payment for Santos is $0.18 per share with a five year average dividend yield of 2.66%.

An analyst at Seneca Financial Solutions has a HOLD recommendation on Santos shares, citing “slight production increases in the last quarter, cash flow from operations, and the possible deal with Woodside.”

Marketscreener.com has an analyst consensus BUY recommendation on Santos shares, with six of the eleven analysts reporting at BUY, four at OUTPERFORM, and one at HOLD.

The Wall Street Journal has an analyst consensus OVERWEIGHT rating, with six analysts at BUY, five at OVERWEIGHT and two at HOLD.

Santos has a current Price to Earnings ratio (P/E) of 9.18 and a Price to Book ratio (P/B) of 1.05.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy