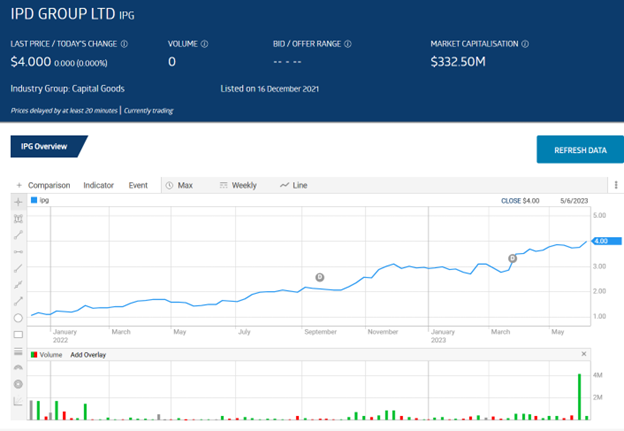

- This service and equipment provider to the Australian electrical market ASX listed IDP Group (ASX: IPG) came on the ASX on 16/12/2021.

- Since listing, the company has posted solid financial results and hefty increases in its share price.

- Trading volumes suggest IPG has not caught the attention of the broader ASX investing community.

IPD has served the Australian electrical industry with branded products for over seventy years. IPD’s customer base begins with power distribution, monitoring, tests, and measurements and extends into providing service expertise on low voltage applications, from installation to calibration and testing.

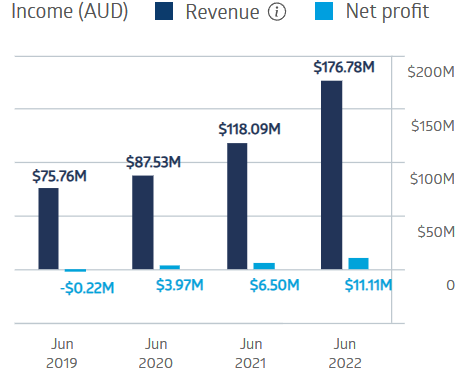

IPD Group has made three key acquisitions since 2018, pushing the company into profitability in FY 2020, with continued growth in both revenue and profit through FY 2022.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

IPD Group Financial Performance

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

Since listing, the share price is up 216.99%. While the price appreciation has been outstanding, the company’s 90-day average trading volume is 112,399 shares per day, well below the 362,842 90-day average of its ASX-listed competitor with a similar market cap, Emeco Holdings (ASX: EHL).

Analysts think the company has room to run, given the 20-fold increase in electrical infrastructure needs for the upcoming EV boom. According to another analyst, IPD Group’s financials pave the way for more acquisitions. Another analyst favours the stock for its ability to grab market share from its competitors and lauds the company’s acquisitions.