Vaccine euphoria propelled the US DJIA (Dow Jones Industrial Average) to an all-time high, exceeding 30,000 points before the cold reality of the breath and depth of the spread of COVID 19 in that country doused the rally with icy water.

Added to the mix leading to the pause was the second straight week of worse than expected unemployment claims in the US.

All appears well here in Australia as the ASX has not followed the decline in US markets and experts continue to tell us we have reasons to remain confident. Markets in both countries posted weekly gains.

Although there are some claims trading volumes for the month of October dropped close to five percent, it does not appear most retail investors have lost their appetite for equities.

Now more than ever, the question is what to buy, given the uncertainties of the end of the pandemic and what the post pandemic world will look like.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Some investors in search of potential targets ignore the top shorted stocks in the belief the infinite risk involved in shorting a stock draws only the most knowledgeable investors.

To short a stock an investor needs supreme confidence the stock price will decline. Shorting a stock at $10 per share involves “borrowing” shares to be repaid later through “covering,” replacing the borrowed shares by buying them at the current market price.

If the stock drops to $5 and the investor “covers” he or she reaps a handsome profit. However, if the stock goes up instead of down the investor is faced with a loss if forced to cover at a price higher than the shorted price. While a traditional share purchase has a maximum loss, the potential loss of a shorted stock is infinite as the losses accumulate as the stock prices goes against the short.

Those who assume the shorts always get it right have only to look at a ten year share price history of electronics retailer, JB HiFi (JBH), a stock that has been in the Top Ten Short List multiple times over the last decade. From the ASX website:

Healthcare is a sector on virtually all analyst and expert lists expecting upcoming tailwinds, due to increased consumer awareness of all things promoting their own health.

The 15 November Top 30 Shorted Stocks List appearing on thebull.com.au includes the following five healthcare stocks , listed by the stock’s position on the list:

- Mesoblast Limited (MSB) #6

- Clinuvel Pharmaceuticals (CLV) #13

- Avita Therapeutics (AVH) #14

- Polynovo Limited (PNV) #15

- Pro Medicus Limited (PME) #24

A 22 November Short List appearing on the website shortman.com.au shows Polynovo dropping to #25 on the list while Pro Medicus dropped to #34.

Regenerative medicine company Mesoblast traces its origins back to 2004, making its first appearance on the favored stock radar of Aussie investors in 2010. The company’s annual report featured positive results from preclinical trials for the treatment of back pain from degenerative disc disease. The stock price began an upward climb, culminating in an all-time high reached in July of 2011 and has been in decline ever since as the company has arguably established a reputation for teasing its investors with positive news only to followed by repeated stumbling blocks.

The company’s “proprietary mesenchymal lineage adult stem cells (MLCs) are found in multiple tissues where they play vital roles in maintaining tissue health.”

That description comes from the Mesoblast website, an excellent source for a layperson’s attempts to understand this challenging and promising source for medical treatments.

What investors need to know is that the originating cells are found throughout the human body where they act as guardians of the human immune system and mechanics of tissue repair.

The resultant and readily available Mesenchymal Precursor Cells (MPCs) and Mesenchymal Stem Cells

have the potential to treat a wide variety of conditions, acting like the body’s naturally occurring corrective measures.

Right now the company lists four treatments in Phase 3 Clinical Trials:

- RYONCIL™ (remestemcel-L) for steroid-refractory acute graft versus host disease (acute GVHD) in children

- Remestemcel-L for moderate to severe acute respiratory distress syndrome (ARDS) due to COVID-19 infection

- REVASCOR® for advanced chronic heart failure

- MPC-06-ID for chronic low back pain due to degenerative disc disease

The range of treatments that stand to benefit from the Mesoblast technology is extensive, from orthopaedic conditions to respiratory and cardiac issues to cancer and blood disorders.

Following a steep decline in share price as many medical procedures were curtailed in the early onset of the COVID 19 Pandemic, Mesoblast shares got a boost when the company received approval from the US FDA (Food and Drug Administration) to submit an IND (Investigational New Drug Application) to use its cell therapy treatment, the remestemcel-L treatment, on COVID-19 ventilator-dependent patients.

The shorts leaped for joy when in early October the FDA withheld approval of the treatment, requiring further evidence although final approval remains a possibility.

On 20 November Mesoblast investors got a dose of good news that should make the short sellers nervous. The ongoing trials on the company’s mesenchymal stromal cell product Remestemcel-L as a treatment for COVID-19 Acute Respiratory Distress Syndrome (ARDS) impressed global pharma powerhouse Novartis enough to ink an exclusive licensing and collaboration agreement with Mesoblast for the manufacture and distribution of Remestemcel-L worldwide. The initial phase calls for an upfront payment to Mesoblast of $50 million dollars with a focus on treating ARDS (acute respiratory distress syndrome) not limited to COVID 19 patients. In mid-2020 Mesoblast joined the ASX 200.

While Mesoblast shares got a boost from the pandemic, the remaining four stocks on the Top 20 Shorted List were crushed by the restrictions of some medical treatments and the lack of access to facilities either already packed with COVID patients or awaiting a surge in cases.

The shorts may be betting on continued headwinds for these companies until the anticipated COVID vaccines return the healthcare world to some semblance of normalcy.

Currently, Clinuvel Pharmaceuticals has a treatment – SCENESSE® – for a rare genetic disease that attacks the skin of the affected through exposure to the sun. The treatment is approved in both the US and Europe, and the company is one of only two healthcare stocks on the Top 30 Shorted List generating both revenue and a profit. The other is Pro Medicus Limited.

Clinuvel has bold ambitions beyond its current treatment for the rare skin disorder. According to the company website, their longer term goal is “developing and commercialising treatments for patients with genetic, metabolic, and life-threatening disorders, as well as healthcare solutions for the general population.”

The company has a pipeline of treatments for the use of melanocortins (small groups of peptide hormones, small chains of amino acids) on other skin disorders and has launched a first of its kind human study using the lead compound in SCENESSE®, afmelanotide, to treat patients with acute strokes. In the last trading week of October Clinuvel thrilled investors with three consecutive days of positive news, beginning with the scientific evidence supporting the use of afmelanotide to not only protect skin from UV and light but also to repair UV-induced DNA damage; followed by the news of the TGA (therapeutic goods administration) approval for use of SCENESSE® here in Australia; and finally the announcement of the trials for stroke treatment.

Avita Therapeutics is another regenerative medicine company with a proprietary technology for treating burns, scalds in children, and wounds with a “Spray-on Skin™” produced from small samples of the skin of the afflicted patient. The product is called RECELL® and has been approved for use in the US since September of 2018.

Avita is pursuing the technology for use in other applications, including vitiligo (loss of skin pigmentation), scar reconstruction and aesthetic uses. In their recent quarterly update, management noted the first trial for treating stable vitiligo using the RECELL® system was underway. Revenues for the quarter in both the US and globally were up more than 55%, continuing the recovery began as lockdowns eased in June. Since the company generates most of its revenue from RECELL® sales in the US Avita has “redomiciled” itself, headquartering in the US and trading there on the NASDAQ exchange while continuing its ASX listing.

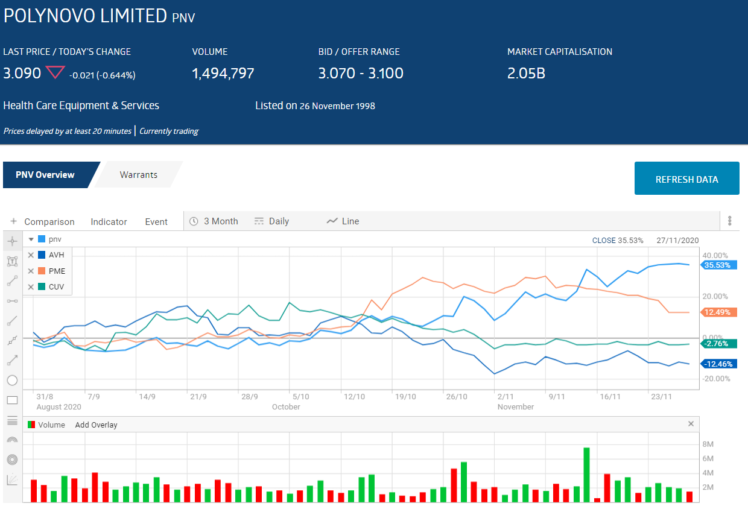

PolyNovo and Pro Medicus both have shown share price appreciation over the last three months, while Clinuvel and Avita fell into the red, with the Avita move reflecting the share price change in Avita since the US shift.

PolyNovo is a medical device manufacturer with a patented technology called Novosorb®. This is a polymer technology used to make biodegradable wound dressings for severely damaged tissue that would normally require extensive skin grafts. The company’s lead product is Novosorb® BTM (Biodegradable Temporizing Matrix) that when applied helps the body’s natural healing process, leaving behind a healthy dermal skin layer when the sealing layer of the BTM is removed.

On 13 November investors learned the US FDA, which had restricted the use of Novosorb® BTM to surgical wounds outside of full thickness burns, gave the company its approval to begin a pivotal trial under the investigation device exemption (IDE). If successful, the company would expand its target market in the US for Novosorb® BTM.

PolyNovo posted solid Full Year 2020 financial results, despite the lockdown impact. Total sales of BTM products increased 104% while US record sales in March in the US climbed another 36% as the lockdowns eased in June.

The company has been expanding its international footprint rapidly, adding Belgium, Netherlands, Luxemburg & Sweden, announced on 19 November.

Pro Medicus is now off the Top 30 Shorted Stock List but the short sellers are still holding on. The company is a global provider of high tech medical imaging systems, from radiology information systems (RIS) to picture archiving and communication systems (PACS).

In business for more than 30 years, the company has a stellar financial and stock appreciation track record but was still impacted by the restrictions on elective and other medical procedures in the early days of the pandemic.

Pro Medicus has increased both revenue and profit in each of the last three fiscal years, absorbing the slowdowns in the fourth quarter of 2020. Shareholders have been well rewarded, with superb average annual rates of total shareholder return, in excess of 50% over three, five, and ten years. Dividend payment growth rates over five years stand at 48%.

Investors eager to hear Pro Medicus management expound on a quick recovery were shocked and dismayed to learn while highly positive in their outlook, management stated the growth anticipated for FY 2021 would not occur until the second half of the year.

The outlook came at the company’s Annual General Meeting on 25 November, erasing the investor exhilaration over the announcement of an AUD$10 million dollar contract award with one of Germany’s leading universities in October.