- Medibank (ASX:MPL) is Australia’s largest private health insurer, with 3% market share.

- In 2022, Medibank suffered a massive data hack with hundreds of thousands of customer records stolen.

- Profits have slowly recovered following the hack, with the share price also steadily rising.

Medibank Private Ltd was one of several big-name Australian companies hacked in 2022. The news came out piece by piece with the final tally worse than originally believed.

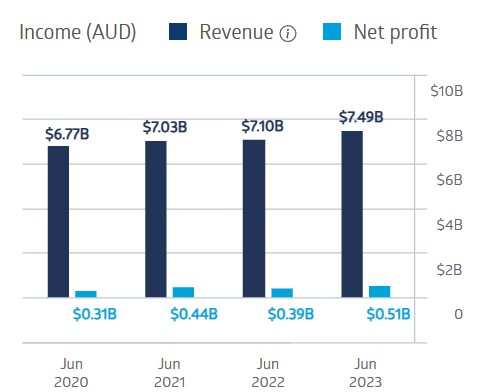

Medibank’s (ASX:MPL) revenues have risen modestly in each of the last four fiscal years, with net profit falling following the breach but recovering handily in FY 2023.

Source: ASX

Profit from the Health Insurance segment rose 9.8%, while the Medibank Health segment saw profits rise 4.2%, with the company’s FY 2023 Financial Results Report proudly proclaiming that “Momentum has returned.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While other companies suffer from higher interest rates, Medibank benefits from higher rates paid on cash held for claims payments.

Medibank began its life as a government non-profit insurance provider, first turning for profit in 2009 and listing on the ASX in 2014 following privatisation.

By 2021, the company covered about 3.9 million Australians. The share price is up 69.59% since listing.

Source: ASX

Medibank has paid dividends every year since listing, with a five-year average dividend payment of $0.13 per share and a five-year average dividend yield of 4.13%. Full year 2023 dividend payment of $0.146 per share was fully franked.

In a sign of full recovery from the hack, the share price hit an all-time intraday high of $3.75 on 9th January 2024.

Marketscreener.com has an OUTPERFORM rating on MPL shares, with four of the 12 analysts reporting at BUY, two at OUTPERFORM, and six at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy