It might seem like an eternity since the world began to heave a sigh of relief on 9 November of 2020 as global pharma giant Pfizer announced its COVID 19 vaccine candidate was found to be more than 90% effective in preventing COVID.

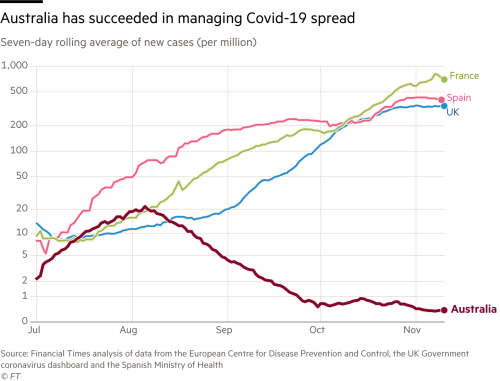

At that time Australians could take some pride in the stellar performance here in reducing the number of infections. A12 November 2020 article appearing in the Financial Times headlined “How Australia brought the coronavirus pandemic under control”, compared the spread of COVID 19 here against three European countries.

The exuberance over the announcement had a decided impact on share markets everywhere, as investors came to believe the time for gains from stocks in the winner’s circle due to COVID had already had their day in the sun. Even in countries still seeing rising COVID rates investors began to rotate out of COVID “winners” to COVID “losers,” sure to rebound as the pandemic gradually faded into history.

Prominent among the winners were any company involved in diagnostic testing or treatments for COVID, and manufacturers of personal protective equipment (PPE). The eCommerce sector had exploded as lockdowns spurred the already growing trend of online shopping.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

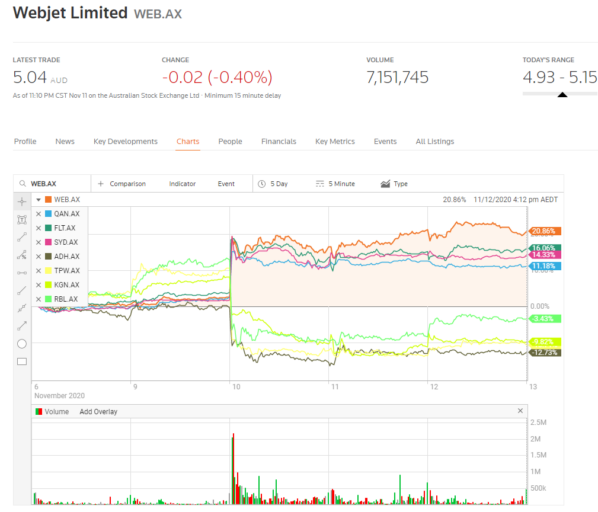

With an economy showing signs of recovering, Aussie investors turned to the beaten down travel sector and shed eCommerce stocks. A price movement chart from the time on the Reuters financial website tells the tale of the “winners”:

- Webjet Limited (WEB)

- Qantas Airways (QAN)

- Flight Centre Travel Group (FLT) and

- Sydney Airport (SYD)

Losers included:

- Adairs Limited (ADH)

- Temple & Webster Group (TPW)

- Kogan.com Limited (KGN) and

- Redbubble Limited (RBL)

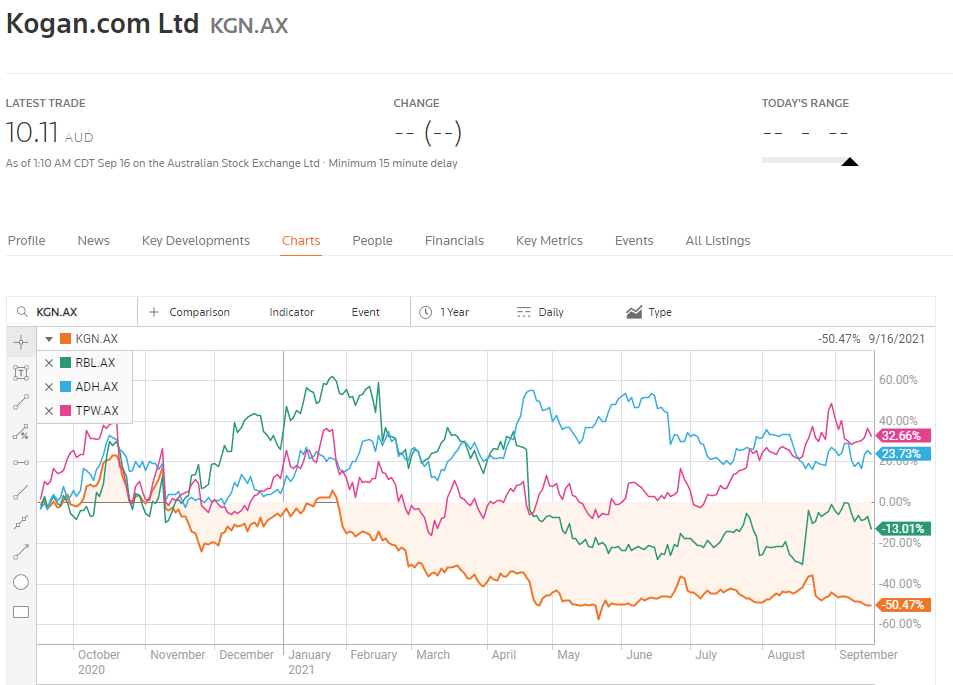

Despite the current rise of cases and accompanying lockdowns here in Australia and the upcoming recession threat, all of the winning travel stocks along with Adairs, and Temple and Webster have seen double digit share price gains year over year. Kogan.com and Redbubble, both former market darlings, remain in a downward spiral.

Kogan.com is the only ASX listed “pure play” online ecommerce retailer to make the Top Ten List of Australian eCommerce Sites. Other ASX listed companies on the list are all “omni-channel” distributors with both brick and mortar stores and online platforms. They include:

- Woolworths Group (WOW)

- JB HiFi (JBH) and

- Coles Group (COL)

Regardless of platform or store, recent research from the Australian Retailers Association and Roy Morgan suggests a ‘gift wrapped” outlook for the holiday season.

According to their survey, Australians plan to spend $11 billion dollars on gifts alone. A 13 September article on businessinsider.com.au begins with the bold headline:

- Australians are preparing to spend $11 billion on Christmas gifts – and analysts predict the December quarter will smash e-commerce records

2,400 Australians were surveyed with close to 50% saying online platforms would be their destination for most, if not all, of their Christmas shopping. In comparing this year to last year, 58% say they are already buying more – or considerably more – online,

Investors worried about the state of the Australian consumer should be pleased to learn 79% of the respondents said they would be spending at least the same amount as in 2020, if not more.

Roy Morgan CEO predicted “a Christmas retailing season that is set to see a record amount spent online.” E-Commerce analytics and intelligence firm Power Retail forecasts 17% year over year growth in eCommerce revenue, with $16.9 billion dollars in the December Quarter.

While the stock price of some eCommerce Retailers may have slipped year over year, eCommerce revenue continued to grow, although not at the outsized pace in the early days of the pandemic when lockdowns and stay at home orders crushed brick and mortar only retailers.

Should lockdowns fade away as we approach the Holiday Season, historical trends suggest eCommerce retailers will still stand to benefit from consumers buying online.

Based on depth and breadth of the suitability of their product offerings for gift giving, Kogan and Redbubble appear to have an advantage over Temple & Webster and Adairs.

Adairs and Temple & Webster both provide home furnishings and homewares. Temple & Webster operates an online only platform while Adairs is omni-channel, with more than 160 stores across Australia supplemented by its own online platform and the company’s December of 2019 acquisition of online only furniture retailer Mocka.

Adairs and Mocka operate independently of each other, although both follow the same business model of designing products in house, with collaboration with the Australian arts community.

Adairs has grown revenue and profit in each of the last three fiscal years, although dividend payments of 14.5 cents per share in 2019 fell to 11 cents per share in 2020 before more than doubling in FY 2021 with a payment of 23 cents per share.

Adairs began in 1918 as a family owned company and listed on the ASX in 2015. Over the past five years the company has averaged earnings growth of 18.7% and dividend growth of 14.9%.

The FY 2021 Financial Statements made a strong case for omni-channel distribution, with store sales up 18.1% and online sales for both platforms up 50.6% while net profit rose 101.5%. The results were achieved despite “a third of all store trading days impacted by lockdowns and store closures,” according to the report.

The results for the first quarter of FY 2022 should not be surprising. Store sales at Adairs are down 27% due to lockdowns but online sales are up 12.9% and 16.1% at Mocka. Due to the ongoing COVID 19 impact, the company declined to present full year 2022 guidance.

Some investors might see omni channel distribution as a drag on a company’s revenue and profit producing capability. Yet if brick and mortar stores are condemned to the ash bin of history, why are internet only giants like Amazon and Alibaba opening physical stores?

The Temple & Webster business model eliminates a cost common to both online and brick and mortar retailers – inventory management. The company sells online only and uses “drop shipping” for delivery direct from the goods manufacturer to the customer.

In sharp contrast to the picture at Adairs, revenues from 1 July to 27 August were up 49% at Temple & Webster. For FY 2021, revenues rose 85% and earnings before interest, taxes, depreciation, and amortisation (EBITDA) were up 141%.

Temple & Webster allows its users access to over 200,000 homeware and furniture products from suppliers all across Australia. The company also offers private label products from international suppliers.

Founded in 2011, the company made a key strategic move in 2020 when it acquired the Australian operations of international online only furniture and homewares E-Commerce retailer Wayfair. In 2016 the Temple & Webster reached the pinnacle as Australia’s leading online furniture and homewares retailer when the company added Milan Direct to its private label branded offerings.

During 2021 Temple & Webster launched mobile apps for both Android and iOS smartphones. In addition, the company launched a 3d “augmented reality” tool to its platform, allowing customers to “see it in your room.” Temple & Webster is investing in incorporating artificial intelligence (AI) into an interior design startup.

Management declined to offer full year 2020 guidance, citing instead the company’s strong start to the year and the numerous tailwinds pushing the company forward, including the shift to online shopping, accelerated by lockdowns, strong housing market growth, and increased discretionary income from travel restrictions.

Redbubble’s unique business model earned the company market darling status as bored consumers staying at home in the early days of the Pandemic flocked to the company for custom designed and made products.

Redbubble enlists Australian artists to post custom designs on the website where consumers can select the design of their choice and apply it to the product of their choice – a shirt, a purse, a wallet, a jacket, a vase, and a host of other applications. Redbubble then turns to third party servicers to create the product. Redbubble’s costs are limited to maintaining the site and paying artistic and manufacturing service providers.

The company has grown revenue in each of the last three fiscal years and reduced a 2019 loss of $27.7 million dollars to a loss of $8.8 million dollars in 2020 before rebounding to a profit of $31.2 million dollars in FY 2021. Redbubble gets 55% of its revenue from the company’s mobile app.

Despite the share price performance, consumer performance appears strong as repeat purchases increased 67% over FY 2020 and first time buyers rose 52% over FY 2020. Redbubble’s gross transaction value in the US was up 67%. The company expects total revenues for FY 2022 to be slightly above FY 2021 revenues.

The attraction for most investors should be the broad range of products available for custom designs, which make great holiday presents.

While Adair, Temple & Webster, and Redbubble all feature products suitable for Holiday giving, none can match the product offerings at Kogan.com, Australia’s answer to Amazon in the eyes of some.

Unique and beautiful custom designs and furniture and homeware items will surely make the Holiday list of many Australians, but like Amazon, the range of what can be purchased from Kogan is virtually limitless.

Like Amazon, Kogan features a Marketplace where third party sellers can ply their wares on Kogan.com, giving third party sellers access to the award winning, AI driven Kogan eCommerce platform. Customers number in the millions, all searching for things to buy – name brands through Kogan.com direct along with the Marketplace Sellers and Kogan.com private label brands.

The website lays claim to containing over ten million items, a fact that surely contributed to Kogan rising to market darling status. Kogan revenues are overwhelmingly derived from the eCommerce operation, but the company is broadly diversified. While contributing little to Kogan’s revenue at this time, these businesses are growing. Kogan service businesses include:

- Kogan Mobile

- Kogan Broadband Internet

- Kogan Travel

- Kogan Insurance

- Kogan Health

- Kogan Money

- Kogan Cars

- Kogan Energy

- Kogan Marketplace

The company grew revenue and profit between FY 2019 and FY 2020 but stumbled in FY 2021. Although revenues rose 56.8%, profit fell from $26.8 million dollars to just $3.5 million dollars.

Inventory appears to be the culprit taking Kogan.com down. The company’s demand forecast going into FY 2021 led to expanding inventory and operating capacity significantly to meet demand, which didn’t come. With too much inventory, Kogan was forced to incur marketing costs of expanded promotional offerings at lower prices to shed excess inventory while still having higher costs due to inventory purchases, storage, and maintenance.

Although management gave no FY 2022 guidance, they expect strong growth from exclusive brands, marketplace sellers, the full integration of Mighty Ape (acquired in December of 2020), and Kogan First memberships (Kogan’s version of Amazon Prime.)

Analysts remain bullish on Kogan with a two year earnings growth forecast of 244.3%, rising from 4.1 cents per share to 36.8 cents per share in FY 2022 and 48.2 cents per share in FY 2023.

The Temple & Webster drop shipping business model may account for the company’s massive share price outperformance over the last five years. All four companies listed around five years ago. The following price movement chart from the ASX website shows the difference.