- Cleanaway is the largest waste management company listed on the ASX.

- The company has a stable record of financial performance.

- Cleanaway publishes an annual Recycling Behaviours Report.

In December of 2023 a $50 million dollar facility for recycling plastic bottles began construction in Melbourne, with Cleanaway a major player in the multi-party joint venture behind the project.

Recycling at the consumer level has been in vogue for some time, now being joined by resource recovery on an industrial scale.

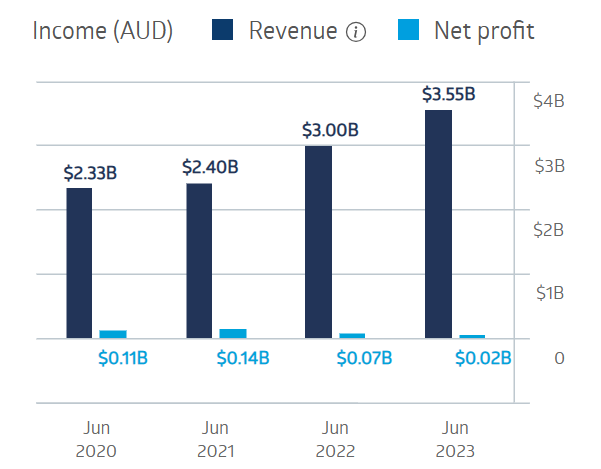

Cleanaway Waste Management Financial Performance

Source: ASX

Cleanaway is recognised as a “steady growth” stock but recycling efforts ramping up provide expanded revenues for the company. Over the last four fiscal years the company’s financial performance has remained stable in the face of COVID and challenging times marked by recession fears, high inflation, and high interest rates.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

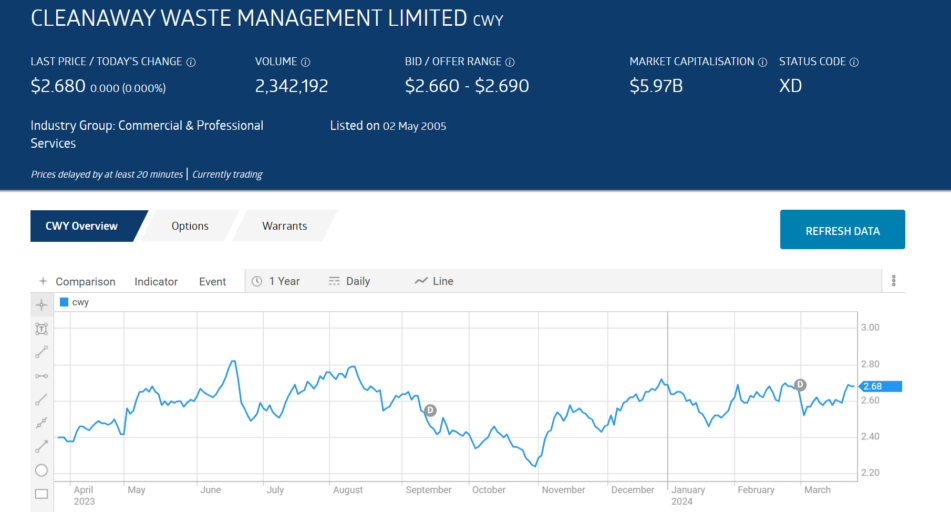

Half Year 2024 financials saw revenues up 5.3% and net profit up 51.6%. Year over year the stock price is up 12.1%.

Source: ASX

The company has paid dividends consistently over the past ten years, with an FY 2023 payment of $0.05 per share and a five-year average yield of 1.73%.

An analyst at Catapult Wealth has a BUY recommendation on Cleanaway Waste Management, citing consolidation in the industry and tailwinds from expansion into resource recovery and recycling.

Marketscreener.com has an analyst consensus rating of OUTPERFORM on CWY shares, with four of the fifteen analysts reporting at BUY, four at OUTPERFORM, five at HOLD, and two at UNDERPERFORM.

The Wall Street Journal has an analyst consensus rating of OVERWEIGHT on Cleanaway shares, with seven of the fourteen analysts reporting at BUY, one at OVERWEIGHT, five at HOLD, and one at UNDERWEIGHT.

Tipranks.com has a consensus STRONG BUY from analysts and BULLISH investor blogging sentiment.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy