Bannerman Energy Hits a Near Five Year High

Bannerman Energy owns 95% of the Etango Uranium Project in Namibia in Southern Africa. The company has been working on Etango since 2006. Bannerman has now met regulatory requirements and begun early construction. Work on Etango to date has been extensive, with completed scoping studies, a pre-feasibility study, and a definitive feasibility study, With various…

Will Webjet Return to Dividend Payments

The leading online travel agency in Australia and New Zealand, Webjet was crushed by the COVID 19 Pandemic The company’s financial performance is back on track. Webjet suspended dividends at the onset of COVID and has announced no plans to resume in the near term. Webjet is lauded for its use of technology in travel…

Champion Iron (ASX: CIA) Hits Record Production in September Quarter

Champion acquired the shuttered Bloom Lake Iron Ore Mine from Cliffs Natural Resources in 2016. Champion subsidiary Quebec Iron Ore reopened the mine in 2018, with plans to expand production. In 2024 the expanded Bloom Lake Mine hit record level production of high grade iron ore concentrate. Champion has a substantial portfolio of iron ore…

Boss Energy – Is it Time for Profit-Taking?

Boss Energy is a uranium exploration and development company listed on the /ASX. The company’s flagship asset is the Honeymoon Uranium Project in South Australia. Boss Is the sole owner of Honeymoon, a project spanning 2,595 square kilometres. In June of 2021 Boss released an Enhanced Feasibility Study for the once producing Honeymoon Mine, justifying…

Analysts Universally Bullish on NextGen Energy

NextGen listed on the ASX in 2021, with double digit share price appreciation since listing. The company is based in western Canada with multiple exploration targets. Although focused on the flagship Rook 1 Project, NextGen has exploration drilling and geophysical surveys underway in other targeted projects. NextGen has a completed Feasibility Study for its wholly…

Johns Lyng Group (ASX: JLG) Property Restorer and Rebuilder

Johns Lyng Group has a business model that fits a world beset by climate related property disasters. The company has been in business for 70 years, listing on the ASX in 2017. The share price is up 440.5% since listing. Johns Lyng’s operating groups of Insurance Building and Restoration, Commercial Building Services, and Commercial Construction…

Short Sellers Backing off of JB HiFi (ASX: JBH)

A longtime favorite target of short sellers, JB HiFi has dropped out of the TOP TEN, falling to the 20th most shorted stock. Short interest of 8.3% in August of 2023 has fallen to 5.17% and the twentieth position on the TOP 100 list. Despite a challenging environment, JBH reached an all-time high days ago….

Can Star Entertainment Group (ASX: SGR) Recover?

Year over year SGR has lost more than half its value. The company reported a $2.35 billion dollar loss in FY 2023. Star is facing licensing troubles and lawsuits in Queensland and New South Wales. Star Entertainment Group boasts the Gold Coast Convention Centre along with three more properties in Queensland and one in Sydney….

Has Medibank Regained the Public’s Trust?

Medibank (ASX:MPL) is Australia’s largest private health insurer, with 3% market share. In 2022, Medibank suffered a massive data hack with hundreds of thousands of customer records stolen. Profits have slowly recovered following the hack, with the share price also steadily rising. Medibank Private Ltd was one of several big-name Australian companies hacked in 2022….

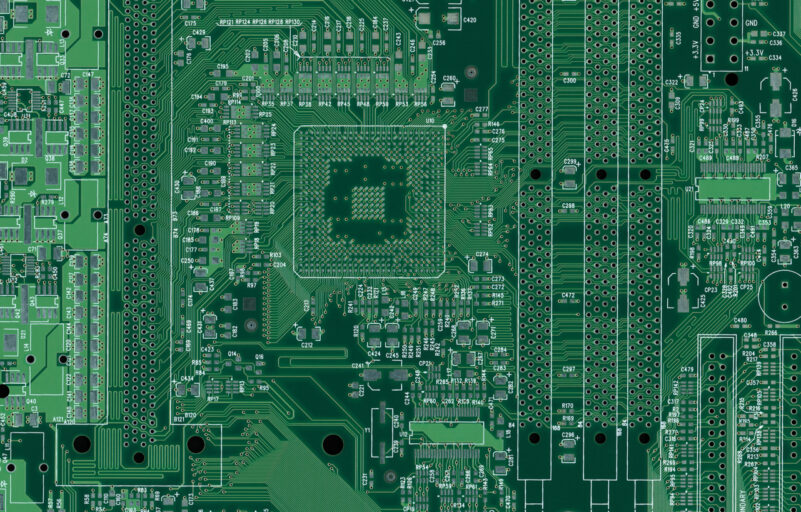

Altium Limited (ASX: ALU) FY 2024 Revenue Guidance up 20-23%

Altium Limited provides software solutions for the design and manufacture of electronic products including printed circuit boards (PCBs). The company’s Full Year 2024 financial results included double-digit revenue guidance for FY 2024. Dividend payments have averaged $0.40 per share over a five-year period. Altium Limited’s design software for PCB creators is augmented by Altium 365,…