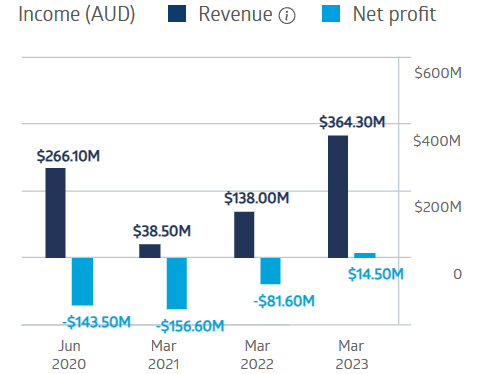

- The leading online travel agency in Australia and New Zealand, Webjet was crushed by the COVID 19 Pandemic

- The company’s financial performance is back on track.

- Webjet suspended dividends at the onset of COVID and has announced no plans to resume in the near term.

Webjet is lauded for its use of technology in travel needs, from bookings to hotel and car rentals to travel insurance, and holiday package deals.

The company’s Full Year 2023 Financial Results showed returns exceeding pre-pandemic levels, with both revenues and net profit more than doubling.

Webjet Financial Performance

Source: ASX

Webjet cancelled dividend payments following the onset of COVID. Over five years pre-pandemic the average dividend payment was $0.13 per share with an average yield of 2.07%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

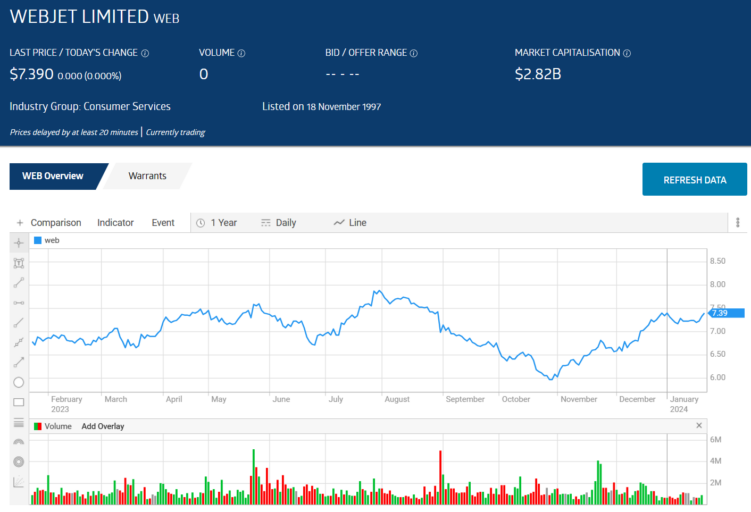

The share price’s upward movement was interrupted following a 31 August of 2024 trading update. Key metrics across the board were up, but management disappointed investors apparently eager for a return to dividend payments with the following statement:

Five months into FY24 we are confident in the markets we serve and the demand for our products, without forgetting that the pandemic caused us to raise significant capital in bleak circumstances. For that reason, there is no near-term proposal to resume paying dividends.

Source:ASX

An analyst at Marcus Today has a BUY recommendation, pointing to the company’s 50% revenue increase in the Half Year 2024, supporting the expectation the company will generate solid growth in the second half as global airline passenger traffic returns to normal levels. “

Marketscreener.com is reporting an analyst consensus rating of OUTPERFORM, with ten of the seventeen analysts reporting at BUY, two at OUTPERFORM, four at HOLD, and one at SELL.

The Wall Street Journal has a consensus OVERWEIGHT rating, with ten analysts reporting a BUY recommendation, two at OVERWEIGHT, four at HOLD, and one at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy