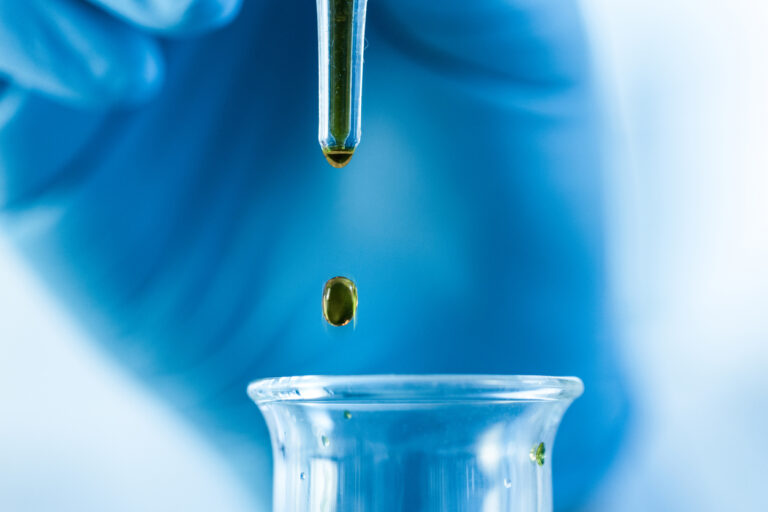

Botanix Pharmaceuticals Planning for FDA Approval in Mid-2024

Botanix holds an exclusive licence for Permetrex™, a direct-to-the-skin drug delivery system. FDA denied approval for a treatment for excessive sweating based on confusing packaging instructions. Botanix is resubmitting its application, with approval expected in mid-2024. Eager investors attuned to the company’s promising pipeline of skin treatments from acne to psoriasis welcomed the 7 December…

Junior Miner Meteoric Resources (ASX: MEI) Ripe for Takeover

Rare earth element explorer Meteoric Resources has acquired a major asset in Brazil. Speculation in the analyst community suggests the company is a takeover target. The share price is up substantially year over year. Like many junior miners exploring for a range of commodities in multiple countries, Meteoric Resource moved into the green metal space,…

Orora Limited’s (ASX: ORA) Trading Below Price to Sales Ratio

Orora’s current Price/Sales ratio of 0.54 beats the Index P/S of 2.16. Orora’s current Price/Earnings ratio of 12.53 beats the Index P/E of 15.33. The share price has been dropping since the company posted positive FY 2023 financial results. Orora provides packaging solutions to the grocery, fast-moving consumer goods, and industrial sectors in Australasia and…

Cochlear Limited (ASX: COH) for Contrarians

The Cochlear share price is dramatically outperforming major ASX healthcare rivals year over year. FY 2023 financials were positive, with positive guidance for ASX stocks to watch in FY 2024. Analyst views of Cochlear, with a consensus HOLD, include at least three SELL recommendations. With a market cap of $19.4bn, Cochlear, the global leader in…

Buying Opportunities for Mineral Resources (ASX: MIN) on the Dips

Mineral Resources offers investors the chance to diversify their holdings with one stock. The company’s historical stock price movement is exemplary, but the stock is down this year. In the past five years, investors have had opportunities to buy Mineral Resources stock on the dip. Mineral Resources (ASX: MIN) mines two commodities – iron ore…

Will PolyNovo (ASX: PNV) Turn Profitable in FY 2024?

PolyNovo’s patented bioabsorbable polymer technology, Novosorb®, has created a family of revolutionary medical treatments. The company has expanded its market, generating revenue, but there is no profit to date. Some industry analysts believe PolyNovo will become profitable in FY 2024. PolyNovo has a range of medical treatments to treat deep tissue wounds. They are derived…

Aeris Resources (ASX: AIS) to Raise $30 Million from Institutional and Retail Investors

Aeris Resources has an expansive portfolio of copper, gold, and zinc projects. In FY 2023, the company experienced setbacks at two key assets. The company’s largest investor and financial backer is now Washington Soul Pattinson (ASX: SOL). For a junior miner with a market cap under $100m, Aeris Resources (ASX: AIS) has an expansive portfolio…

Nick Scali (ASX: NCK) Recovering from Insider Selling Dip

Economists and financial experts have wavering convictions on the impact of inflation and interest rates on consumer spending. Investors willing to weather the stormy economic conditions were quick to bail on the news of insider selling at Nick Scali. However, furniture retailer Nick Scali has navigated well through the storm, with the share price on…

Is Tabcorp Holdings (ASX: TAH) Transition Strategy on Track?

Following a series of moves with Tatts Group and UBET, in 2022, Tabcorp exited the group. Tabcorp is now strictly a wagering and media company without its lottery and keno operations. TAB – the multichannel wagering brand – is Australia’s largest. The media operations centre Sky Racing is owned by Tabcorp. Tabcorp has bold plans…

Macquarie Group (ASX: MQG) Outlook Cautious for Full Year 2024

Macquarie Group is Australia’s only global investment bank. The company serves Australia, the Asia-Pacific region, Europe and the Middle East, Africa, and the Americas. The company’s solid financial performance stuttered with the Half Year 2024 financial results. Macquarie Group has four revenue-generating operating units: asset management, banking and financial services, commodities and global markets, and…