- The Cochlear share price is dramatically outperforming major ASX healthcare rivals year over year.

- FY 2023 financials were positive, with positive guidance for ASX stocks to watch in FY 2024.

- Analyst views of Cochlear, with a consensus HOLD, include at least three SELL recommendations.

With a market cap of $19.4bn, Cochlear, the global leader in cochlear hearing implant devices, has seen its stock price outperform the two largest healthcare stocks on the ASX – CSL Limited (ASX: CSL) and ResMed Limited (ASX: RMD).

Source: ASX

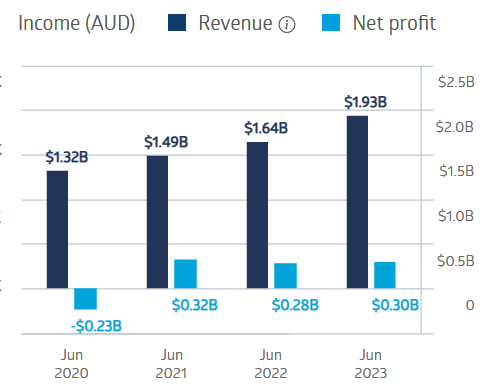

Record sales revenues were up 19%, and underlying net profit rose 10% (14% in constant currency.)

Cochlear Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Perhaps of greater significance to some investors, Cochlear’s net profit guidance for FY 2024 is for an increase ranging between 16% and 23%. However, analysts appear less enthusiastic about Cochlear than investors trading such commodities.

An analyst at Baker Young has a SELL recommendation on Cochlear shares, acknowledging the company’s solid FY 2023 financial results and stellar share price performance over the last three months, but feels investors might take some profits to pursue “superior opportunities in alternative sectors”.

Overall, analyst views on Cochlear are decidedly mixed, with the Wall Street Journal reporting a consensus HOLD rating with four analysts at BUY, two at OVERWEIGHT, six at HOLD, three at UNDERWEIGHT, and two at SELL.

Yahoo Finance Australia reports ten analysts covering Cochlear, with five at HOLD, four at UNDERPERFORM, and one at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy