For many of us around the world, the New Year is a time to reassess past endeavors and make plans for the future.

Share market investors of all ages and in all places are no exception, as existing portfolio holdings are scrutinised and new holdings are considered.

For investors, the New Year offers a unique opportunity – readily available rankings of the prior year’s share price performance.

Investors who prefer high growth stocks will typically look at the year’s top performers and research their potential to remain hot.

Bargain hunting value investors will look at the worst performers to assess their potential to rebound in the coming year. In the case of 2021, an obvious issue is how much the company was hurt by the Covid 19 Pandemic.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

There is some recent academic research that supports going with the biggest losers.

US based Bespoke Investment Group examined 25 years of price performance of the DJIA’s (Dow Jones Industrial Average) biggest winners and losers at the end of the trading year.

They found the stocks with the highest losses come close to doubling their share price performance in the new trading year. The biggest losers on the Dow averaged percentage gains of 12.1% in the year following, with a median gain of 15.8%. Overall, 58% of losers saw some level of positive returns.

The big winners in a given year averaged gains of 6.71% in the new year, with positive returns in 45.8% of cases. The company does note the 25 year trend has modified in recent years.

For example, between 1997 and 2006 the biggest losing stocks turned in gains averaging 32% in the following year. During the last eight years, the average performance in the following year was continued pain – a loss of 3.96%.

As always in share market investing, past performance is no guarantee for the future. However, given the unique nature of FY 2021 and half of FY 2020 stemming from the COVID 19 pandemic, a strong case can be made for considering the biggest losers of the trading year 2021.

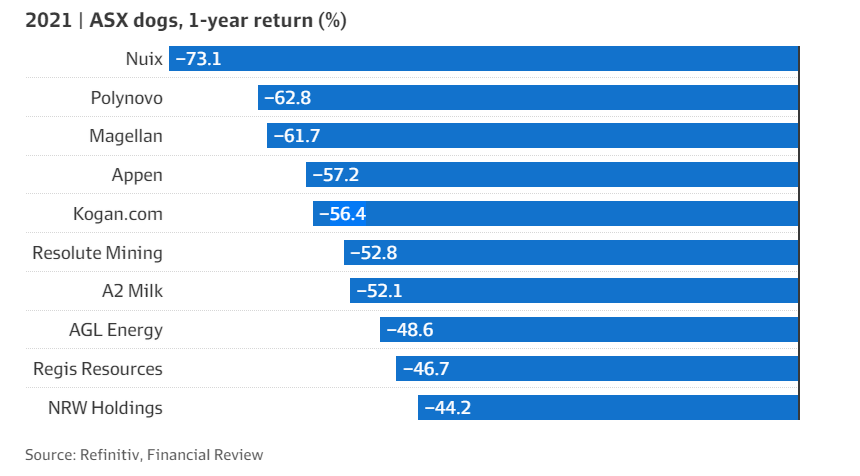

An article appearing in the Australian Financial Review (AFR) at the close of 2021 entitled “From darlings to the doghouse: the worst stocks of 2021” included a table of some of the stocks once deemed “market darlings” that morphed into “market dogs” in FY 2021.

Market darling status comes about as rapid investor enthusiasm over the company’s rising share price breaches recognised boundaries of company value. Market darlings are frequent targets of analysts and experts cautioning of earnings multiples unrealistically “reaching the moon.” Yet unbridled investor optimism remains until the often times inevitable wake-up call that comes with growth that fails to meet expectations

Two of the premier market darlings on the ASX in the last decade were dairy and infant formula producer The a2 Milk Company (A2M) and ecommerce powerhouse Kogan.com (KGN.)

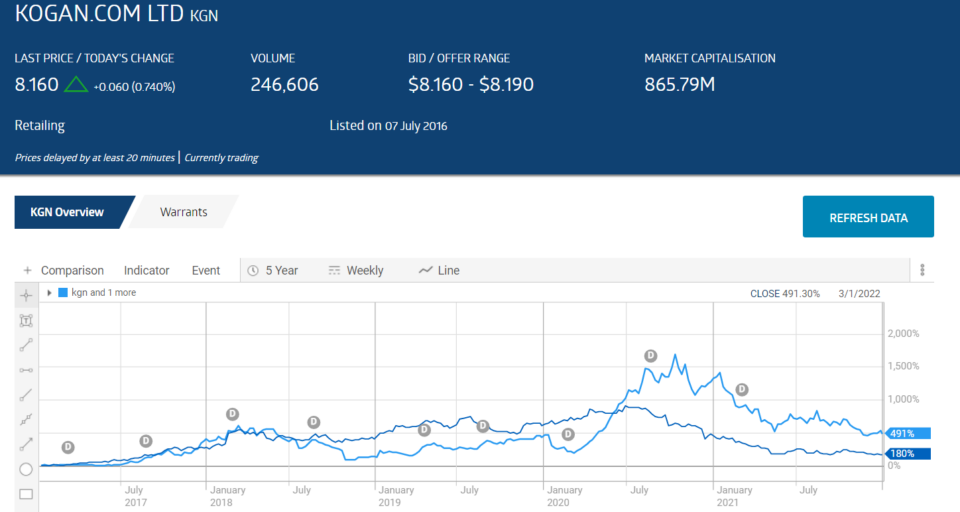

Kogan.com listed on the ASX in mid-2016 while the a2 Milk Company listed in mid-2015. The stock price of the two companies had opposite reactions to the onset of the COVID 19 Pandemic. Kogan caught fire with its massive online presence as consumers were forced to remain at home. A2M had the same benefit from its online operation but the first potential issue came in a 21 April of 2020 trading update in which A2M management failed to provide guidance for the Full Year 2020, citing uncertainty in supply chains and consumer demand in core markets.

Hyper-enthusiastic investors were willing to ignore the news and the A2M share price kept rising until the price began a slide from which it has yet to recover, following an even more dismal outlook for FY 2021 included in the Full Year 2020 Financial Results.

The Kogan.com share price maintained its “stay at home” fueled momentum until 14 October of 2020, hitting an all-time high. Within a month the dip worsened as the hopes for diminished impact from the pandemic drove investors out of many stocks that had benefited from lockdowns to stocks that would benefit from a semblance of a return to normalcy.

An uninterrupted series of positive trading updates did little to reverse the course as many investors may have realised expectations that Kogan.com could continue its financial performance brought on by a Pandemic were unrealistic.

Some of the company’s releases contained hints of what was to come, with comments like these, taken from the trading updates listed in the Announcements section of the ASX website:

- “There has been an increase in variable and marketing costs as a result of the significant growth of the Business. While delivering a significant YoY increase in Adjusted EBITDA, we have also made a series of the largest ever monthly marketing investments into building the customer base and brand, which we expect will have long term benefits for the Company”

- “We are investing into building strong customer relationships by expanding our logistics capability, our marketing reach and our systems and infrastructure – giving us the foundation to continue delighting customers as the business further scales.”

In April of 2021, some brokers began to suspect the company found itself with an inventory and cost problem, as Kogan.com management bought inventory and spent on marketing and infrastructure in expectation of rising customer demand that failed to materialise.

In late April, the Australian was reporting the company acknowledged the problem but claimed the promotions and discounting of merchandise were alleviating the surplus.

Full Year 2021 Financials showed a profit decline from $26.8 million dollars in FY 2020 to $3.5 million dollars.

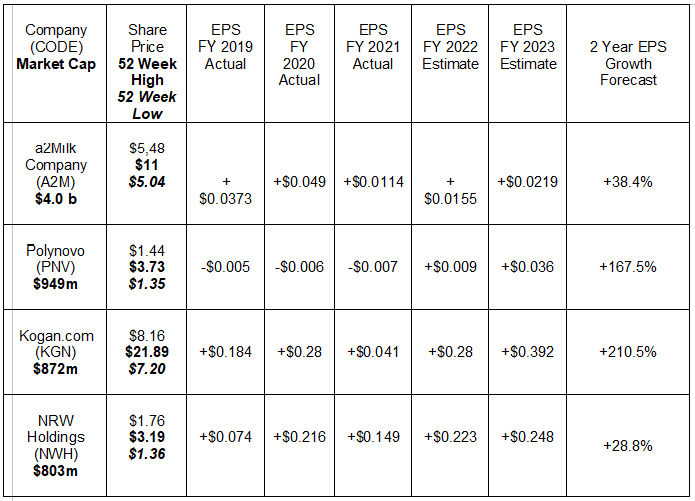

A starting point for investors to assess the chances the Kogan.com and the other “dogs” highlighted by the AFR is historical earnings performance and growth estimates.

There are two companies with triple digit EPS growth forecasts, and two with double digit forecasts. The following table includes year over year share price performance and actual and forecasted EPS from FY 2019 to FY 2023.

Positive EPS does not always lead to rising share prices and EPS forecasts can be wrong. Of the four stocks, only Polynovo, a manufacturer of polymer based treatments for wounds, was reporting negative earnings prior to the onset of COIVID 19.

Factoring in both historical earnings performance and future growth estimates, Kogan.com appears most likely to rebound, with substantial EPS improvements in FY 2022 and continuing to FY 2023.

NRW Holdings (NWH), a “diversified provider of contract services to the resources and infrastructure sectors” also looks poised to rebound, albeit below the levels forecasted for Kogan.com.

The NHW share price is already on an upward swing, rising from $1.60 per share around 21 December to the current $1.76 following news of the signing of a five year services contract valued at $702 million dollars. The company has a current dividend yield of 5.8% with forecasted growth over two years of 16.9%.

The a2 Milk Company is very much in the mix pending the successful implementation of its strategy to increase its offline infant formula sales in China and demand recovery following full border openings and the return of international tourists and students.

Both Citi and Bell Potter have BUY recommendations on A2M with price targets at $7.30 from Citi and $7.70 at Bell Potter.

While investors jumped onboard the Kogan.com online success, the company has multiple other businesses poised for growth. Here is a list of the impressive array of the company’s other endeavors:

- Kogan Mobile Australia/New Zealand

- Kogan Internet

- Kogan Travel

- Kogan Energy

- Kogan Life Insurance

- Kogan Pet Insurance

- Kogan Car Insurance

- Kogan Home Insurance

- Kogan Superannuation

- Kogan Retail

- Kogan Credit Cards

- Kogan Home Loans

- Kogan Cars

- Kogan Marketplace