Home ownership has long been touted as a wealth building investment over time. While that may be true, the problem for retail investors looking to expand beyond their own home is simple – it takes wealth to build wealth.

Branching out from one’s home to other residential or commercial ownership requires an up-front investment beyond the reach of most retail investors. Not so with the multiple opportunities for property investing available on the ASX.

Retail investors can rind stocks of companies that develop, own, or manage residential, commercial, or industrial properties. In addition there are real estate investment trusts (REITs) that invest in multiple income producing properties via ownership or management. REITs are like mutual or exchange traded funds focusing on property. Like the shares of real estate companies, REITs can target a single property sector or diversify in multiple sectors.

Both trade on the ASX, free of the burden of the curse of “it takes money to make money.” Share prices allow for starting out with whatever discretionary cash a retail investor has on hand.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Here are three of the best real estate management and development stocks and three of the best REITs on the ASX.

Three of the Best ASX Real Estate Management and Development Stocks

Three of the Best ASX Real Estate Investment Trusts (REITs)

Servcorp LTD (ASX: SRV)

Servcorp saves its business customers both time and money by providing a variety of office services to its customers, from physical and virtual office space, to coworking and work at home services. Services include wi-fi access, secretarial help, meeting and conference rooms, and phone services. The company’s customer base spans more than fifty thousand businesses of all types and operates internationally in 41 cities from 20 different countries. Perhaps its most famous serviced location is the new One World Trade Center in New York.

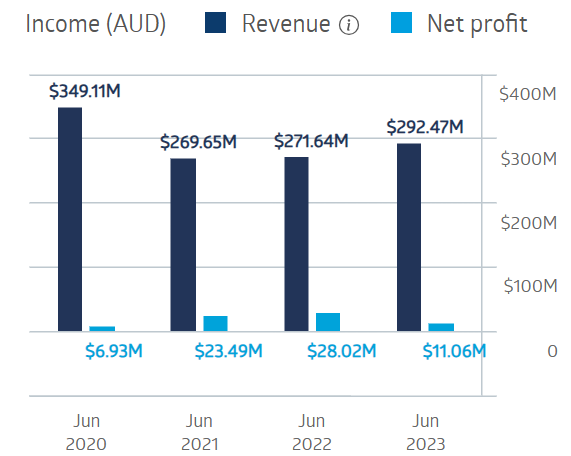

COVID 19 in both the initial onset and the variant stages impacted the company’s revenues, with profit recuperating in FY 2021 and FY 2022 before profit dropped 60% in the face of inflation and high interest rates in FY 2023.

Servcorp Financial Performance

Source: ASX

Half Year 2024 results may be signaling a rebound, with underlying operating revenues up 8% and underlying operating profit up 25%. Statutory net profit after tax rose 42%. Dividend payments increased 12%. Servcorp reaffirmed its positive guidance for the full year 2024.

Dividend payments in FY 2023 were $0.24 per share, up from $0.22 per share in FY 2022. The five-year average dividend yield is 6.4%.

Year over year the stock price is up 26.2%, with five-year share price appreciation of 53.7%, as of 12 April.

Source: ASX

Finbar Group (ASX: FRI)

Finbar Group (ASX: FRI) proudly claims its place as Western Australia’s leading apartment developer. The company is moderately diversified with commercial office and retail space in many of its seventy-six developments, but the majority of its revenue comes from the development of high-end residential properties for sale or rent.

Finbar has four developments under construction, with three scheduled for completion in 2024 and one in 2026. Finbar properties include resort style facilities and top of the line fixtures and fittings.

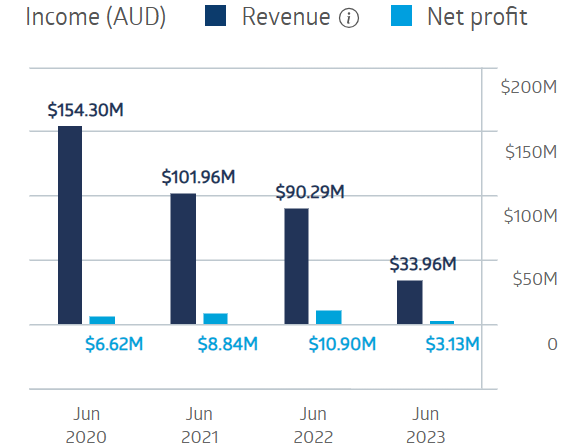

FY 2023 was a challenging year for companies dependent on interest rates. With a surprising track record of declining revenues with increasing profits going into the year, interest rate increase crushed the company’s financials in FY 2023.

Finbar Group Financial Performance

Source: ASX

Half Year 2024 results showed the same pattern, with major improvements. Although revenues from ordinary activities fell 64%, net profit after tax came in at $1.3 million dollars, up from the Half Year 2022’s loss of $765,000, an increase of 271%!

Finbar is not a prolific dividend payer, eliminating its dividend in 2023, although in the pre-COVID year of 2019 the company paid $0.06 per share and still has a five-year average dividend yield of 4.95%.

Year over year the share price is up 30.3%. Over five years the share price is down 5.9%, with a recovery following the drop from COVID, crushed by the rising interest rates.

Source: ASX

Eureka Group Holdings (ASX: EGH)

Eureka Group Holdings (ASX: EGH) provides affordable rental living accommodations for independent Seniors in six states across Australia. The company also offers property management services for other Senior Villages, although it derives the majority of its income from company owned rental properties.

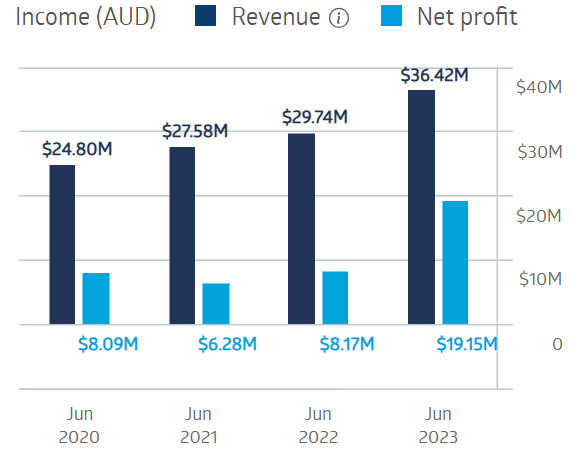

Eureka manages fourteen Senior Villages and owns and operates more than thirty. The company has posted an admirable record of financial performance, with profit more than doubling in FY 2023.

Eureka Group Holdings Financial Performance

Source: ASX

Half Year 2023 results stuttered a bit, with revenues rising 16.1% while net profit dropped 18.7%.

Larger rival with an existing minority stake in Eureka – Aspen Group (ASX: APZ) had a takeover offer in play. On 7 April Eureka issued Full Year 2024 earnings guidance in defence of its recommendation to shareholders to reject the offer. Eureka is expecting 19 to 21% growth in underlying earnings before interest taxes depreciation and amortisation (EBITDA) and 8.3% EPS growth (earnings per share.)

On 8 April Aspen cancelled the offer.

Year over year the EGH share price is up 25.2%. Over five years the share price is up 109.6%.

Source: ASX

Dividend payments are not a compelling reason to invest in Eureka Group, with payments of $0.01 each year since the company began paying in FY 2019, with a five-year average yield of 2.51%.

More compelling is the company’s “bargain basement” valuation metrics, with a price to earnings ratio (P/E) of 8.44; a price to earnings growth (P/EG) ratio of 0.20; and a price to book (P/B) ratio of 1.11.

Three of the Best ASX Real Estate Investment Trusts (REITs)

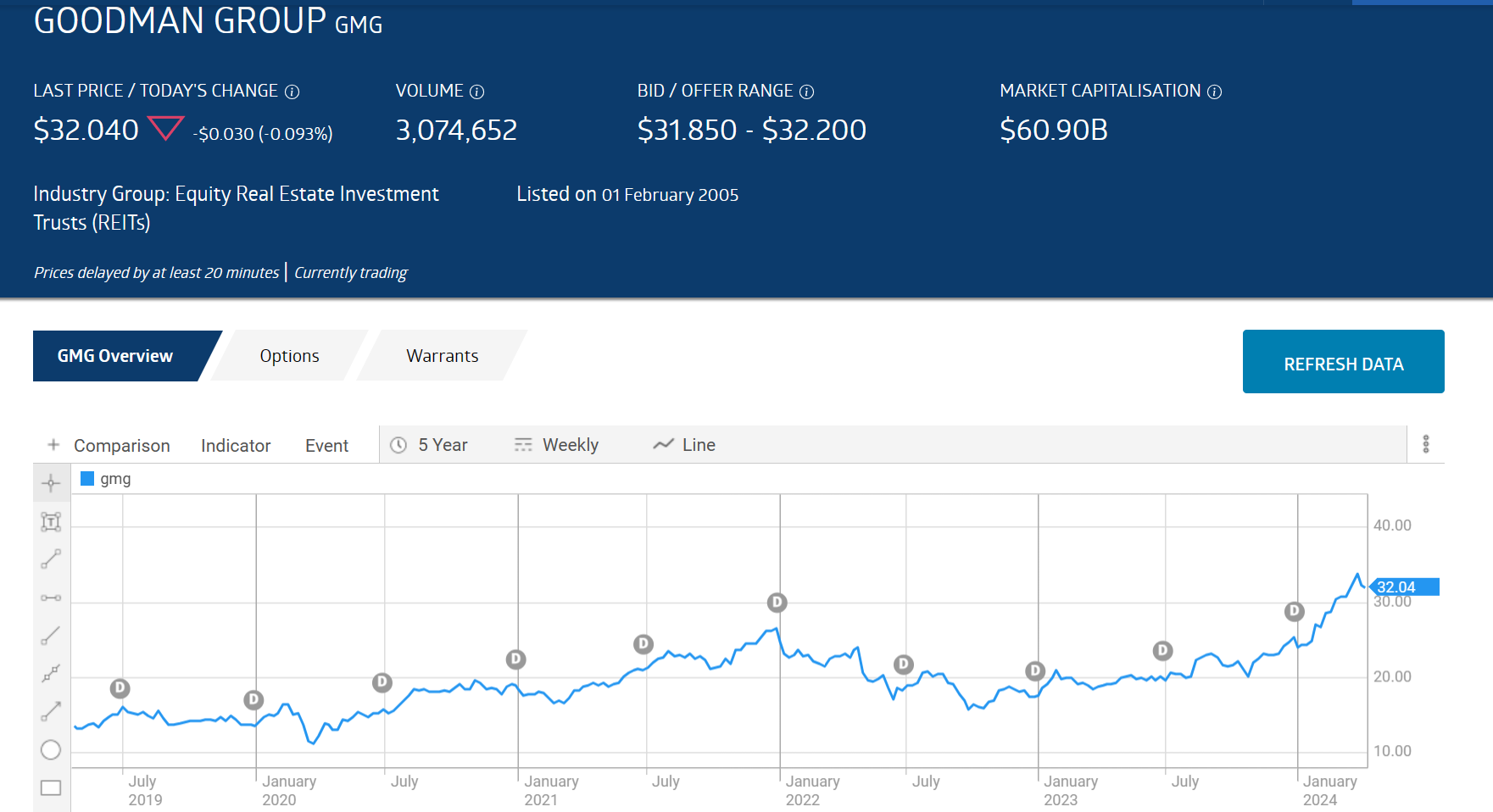

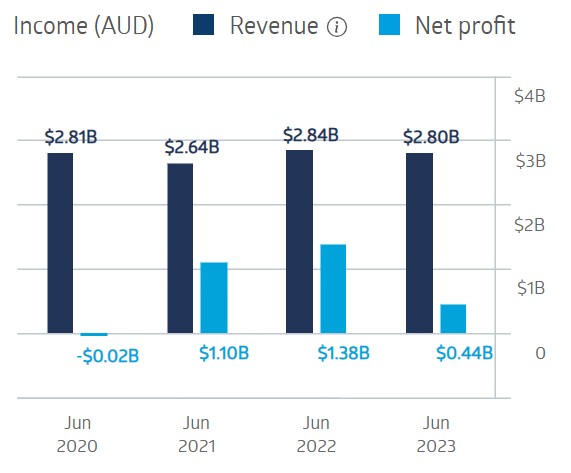

The Goodman Group (ASX:GMG)

The Goodman Group (ASX:GMG) is the largest real estate stock on the ASX with properties in “key consumer markets” in fourteen countries around the world. The company owns, develops ,and manages industrial properties for retail, automotive, and logistics, with sites ranging from industrial parks to warehouses, data centres, and transportation depots.

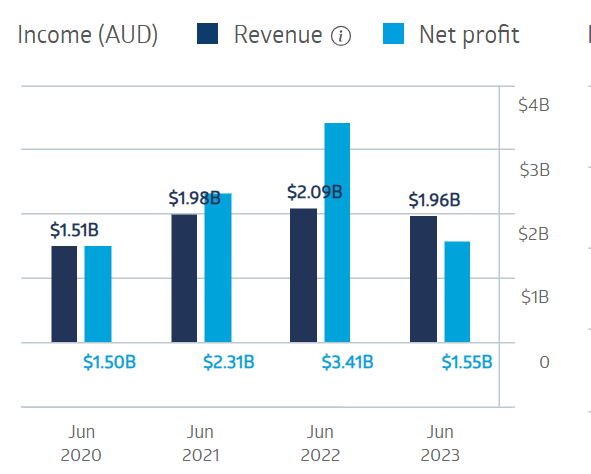

The company’s sold record of financial performance took a dip in FY 2023 in challenging macroeconomic conditions, most notably high interest rates.

Goodman Group Financial Performance

Source: ASX

Half Year 2024 results showed improvement, with revenues up 5% and operating profit up 28.6%, but still falling below the FY 2022 result, The company did post a statutory loss due to a host of non-recurring items. Goodman raised its earnings per share (EPS) guidance for the full year 2024 by 11%.

The company is a consistent dividend payer with a five-year average yield of 1.97. In FY 2023 the dividend payment was $0.30 per share.

Year over year the stock price is up 67.4%. Over five years the share price is up 140%.

Source: ASX

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

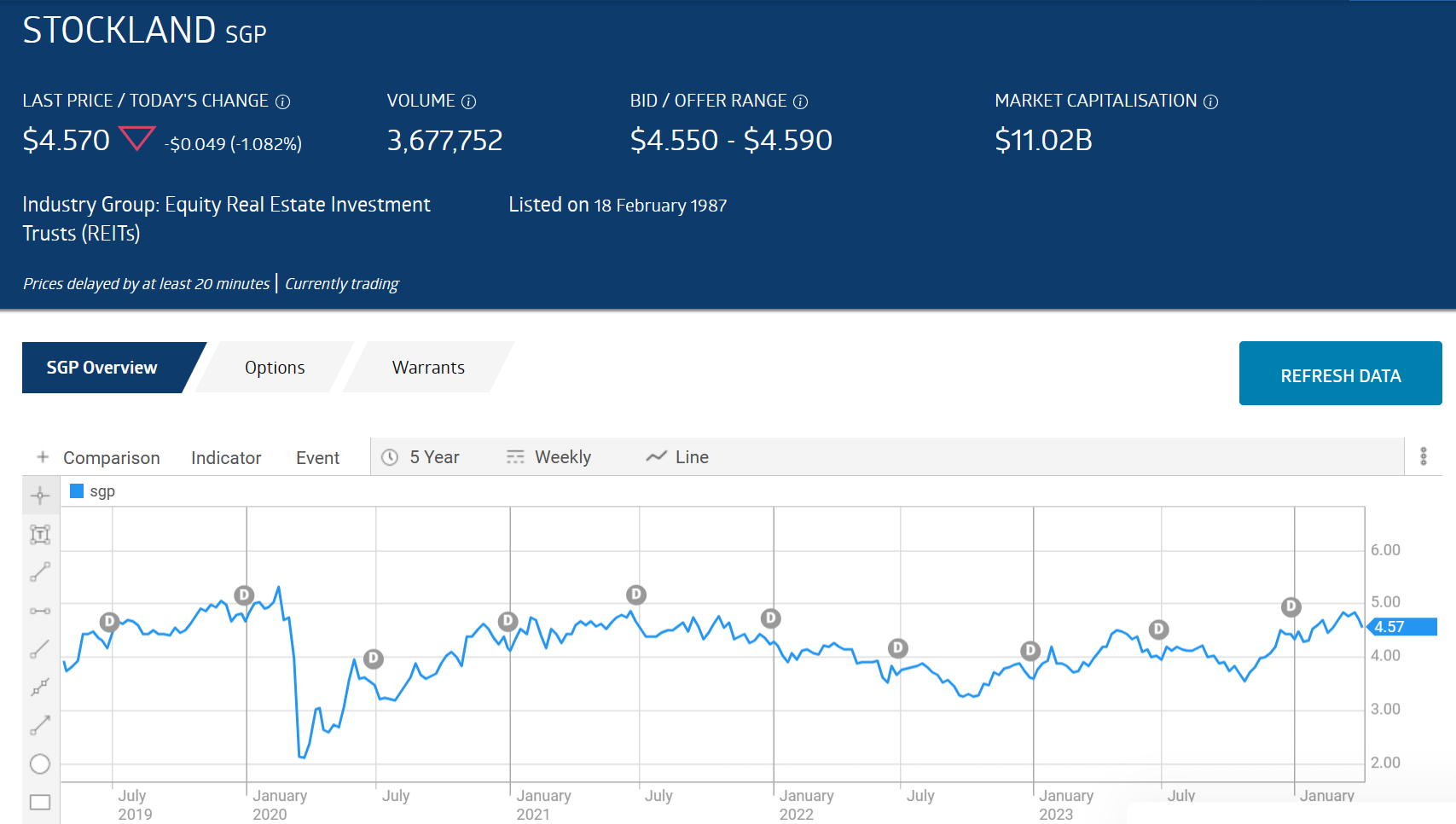

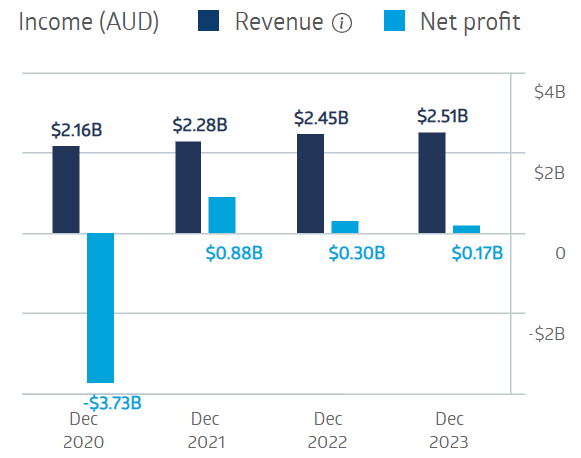

Stockland Corporation (ASX: SGP)

Stockland Corporation (ASX: SGP) is a diversified property group, creating “connected communities” of residential, retail, workplace, and logistics assets. Its residential portfolio includes land lease communities freeing seniors and others from the financial burden of owning both their residence and the land on which it is built.

The company’s logistics property portfolio includes distribution centres and warehouses. Office space, residential communities, retail town centres, and shopping centres round out Stockland’s diversified property portfolio, offering investors access to a broad range of properties. The company operates here in Australia with property assets in Queensland, New South Wales, Victoria, South Australia, and Western Australia.

Stockland took a big hit in the first year of the COVID 19 Pandemic, recovering quickly before suffering a substantial loss in the difficult conditions of 2023.

Stockland Group Financial Performance

Source: ASX

On their face the Half Year 2024 financial results were sub-par, with statutory profit dropping to $102 million from $301 million in the first half of 2023. Management attributed the drop to “the material skew in Masterplanned Communities (MPC) settlement volumes to 2H24.”

While funds from operations of commercial properties rose 2.9%, the company is moving forward with its strategy of rebalancing its portfolio, adding 12 master planned communities (MPCs) and 5 land lease projects.

In FY 2023 Stockland paid dividends of $0.22 per share, down from $0.26 in FY 2022. The five-year average dividend yield is 6.09%.

Year over year the stock price is up 7.93%. Including the massive drop at the onset of COVID 19, the Stockland share price has risen 18.7% over five years.

Source: ASX

Scente Group (SCG)

Scente Group (SCG) is an opportunity for investors seeking relative safety in large cap equities regardless of diversification. The company owns and operates premium mixed use Westfield Centres with more than twenty million people in close proximity of the thirty-seven centres in Australia and five in New Zealand. Each centre has a mix of fashion, entertainment, dining, and grocery outlets.

Scentre was hard hit by both waves of COVID, posting a massive loss in the first year before rebounding slightly and then dropping again.

Scentre Group Financial Performance

Source: ASX

Positives from the report included net operating income up 8.8%; customer visitation up 6.7%; Westfield memberships up 0.6 million, and dividend distributions up 5.4%. The company maintained positive guidance for the full year 2024. FY 2023 dividend payment came in a $0.17% per share with a five-year average dividend yield of 5.16%.