“Past performance is no guarantee of future results.”

It seems in the blink of an eye newcomers to share market investing will come across this omni-present cautionary adage on the perils of investing in equities.

The puzzling contradiction in this advice is readily evident in what these newcomers find dominating the data presented on financial websites – historical performance. A smattering include analyst earnings and dividend forecasts but the pitfall there is many worthy stocks do not yet have analyst coverage.

One could make a strong case that investors delving into the long term history of stocks in the commodities sector can find valuable lessons to be learned.

Key among them is the cyclical nature of most commodity pricing, where the laws of supply and demand exert more impact on stock prices than in any other business sector.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The cycle is devilishly simple – boom and bust. When demand for a commodity, such as iron ore, rises dramatically, so does the price of the commodity and often along with it the companies that produce and sell the commodity. This explains the iron ore boom in the waning days of the first decade of the twenty-first century as China embarked on a building spree of historic proportions.

Miners rushed to increase production of iron ore or shift their focus from other assets into iron ore. When the demand in China weakened, the price collapsed. The lesson learned there came as iron ore eventually recovered, hitting an all-time high of USD$200 per tonne in July of 2019, eclipsing the high of just under $200 per tonne at the peak of the so-called boom days in November of 2010. At the onset of the COVID 19 Pandemic the price again collapsed, recovered to reach another all-time high of USD$230 per tonne in May of 2022, before collapsing again as recession fears began to drive investor behavior.

Some momentum and short term investors that sold their holdings at the price drop had no chance to regain their losses while longer term investors fully aware that iron ore was not a commodity in danger of long term declines benefited from holding on.

The same lesson could have guided investors who joined the rush to cash in on the expected lithium boom in 2016. Expectations for rapidly rising demand growth were not met and the rush of miners to get in on the boom created an oversupply condition. The result was not surprising. Prices fell but those investors who believed in the Warren Buffet advice to hold onto a stock as long as the fundamental investment case remained intact were eventually rewarded.

In the case of lithium, negative industry experts and analysts opinions on the world’s largest EV manufacturer – US based Tesla Motors – and oversupply warnings from the likes of global investment banking powerhouse Goldman Sachs dashed cold water on the boom.

However, the investment case that the use of lithium to power a growing array of electronics devices along with electric powered vehicles, buses, trucks, and energy storage capabilities remained intact. The price has rebounded dramatically.

Yet the warnings of oversupply have crept back into the discussion which, coupled with recession fears, have once again cast doubt on the future of lithium.

Those who believe the investment case has not changed are supported by some expert opinion claiming lithium is about to enter a commodities “Supercycle.” In a Supercycle increases in demand reach levels so high the normal boom and bust cycle could take in excess of a decade or more to play out.

Skeptics should consider some apparent facts. First, it can take the multitude of newly christened lithium explorers from five to ten years to bring a mine into production. Experts also tell us it takes as little as two years to build a new EV or a battery factor.

Second, the demand wave is far from cresting. The news media – financial and otherwise – is filled with stories of automobile manufacturers announcing plans for new EV models and in many cases abandoning internal combustion engine (ICE) vehicles entirely.

A 23 September article appearing in the US website of the Smithsonian magazine highlights the growing number of airlines looking to put electric powered planes on shorter regional routes. Last week, Air Canada ordered 30 battery-powered passenger aircraft from a Swedish manufacturer Heart Aerospace. United Airlines already has one hundred of the planes on order, and made the US news on 7 October, announcing its intention to have battery-powered planes ferrying passengers on select routes in the United States by 2030.

The federal government’s September Resources and Energy Quarterly had this to say about Australia’s lithium exports in the short term:

- “Lithium export earnings are forecast to increase by more than tenfold in just two years from $1.1 billion in 2020–21 to almost $14 billion in 2022-23 before easing to around $13 billion in 2023-24,”

Other forecasters appear unphased by the potential slowdown in 2024. l Bloomberg New Energy Finance is forecasting not only that demand for lithium could increase fivefold by 2030, but also that an estimated $19 billion dollars will need to be invested in new lithium production capacity to meet that 2030 demand target.

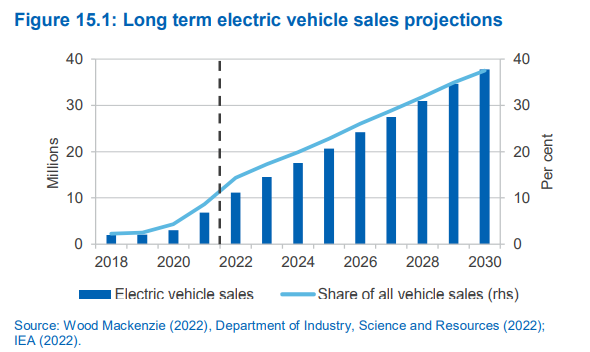

Seventy five percent of current lithium production goes into lithium batteries for EV’s, where demand is rising rapidly. From Woods Mackenzie as appearing in the Resources and Energy Quarterly:

The boom and bust cycle takes time to play out, which suggests buying select miners on intermittent or even prolonged dips makes some sense as long as the fundamental case remains intact. For the risk averse, some forecasters predicting a price drop in 2024 claim it likely will be “moderate”.

In mid-April of 2022 global markets began to stutter a bit in considering inflation, interest rates, and recessions. Over six months the price of some previously thriving ASX lithium miners have fallen. They are:

- Core Lithium (CXO)

- Lake Resources (LKE)

- Galan Lithium (GLN)

There are only three ASX listed lithium currently producing lithium – Allkem Limited (AKE); Pilbara Minerals (PLS), and Mineral Resources (MIN).

Core expects to have its flagship asset in production by the end of this year, with Lake Resources not far behind and Galan with projects in advanced development stages. The common element that links these stocks for investors is their current share price. All three have “dipped” double digits over the last six months, while posting massive gains over longer time periods. The following table includes six month, one year, and three year share price appreciation information along with current share price and year over year highs and lows.

|

Company (CODE) Market Cap $ |

Share Price 52 Week High 52 Week Low |

6 Month Share Price Movement |

1 Year Share Price Movement |

3 Year Share Price Movement |

|

Core Lithium (CXO) Market Cap $1.9b |

$1.16 $1.68 $0.40 |

-11.2% |

+180.4% |

+3,008% |

|

Lake Resources (LKE) Market Cap $1.4b |

$1.02 $2.65 $0.53 |

-49.1% |

+76.5% |

+492.6% |

|

Galan Lithium (GLN) Market Cap $365 |

$1.22 $2.33 $0.93 |

-42.1% |

+28.5% |

+600% |

Core Lithium’s flagship asset is the Finniss Lithium Project, located near Darwin Port in the Northern Territory. Core Lithium extracts lithium from hard rocks in contrast to the lithium from brine operations at Lake Resources.

The Finnis Project is wholly owned by Core Lithium with a DFS (definitive feasibility study) in place as of March of 2021 and construction nearing completion in anticipation of first mine production by the end of 2022 by some accounts and in the first half of 2023 in others. The project has been awarded Major Project Status by the federal government.

The company has a five-year non-binding Memorandum of Understanding (MOU) in place for 50,000tpa of spodumene concentrate with Geneva-based Transamine Trading, as well as offtake agreements in place and in progress with interested parties. The crown jewel of the offtake agreements in progress is the potential four year agreement with global EV powerhouse Tesla for up to 110,00 dry metric tonnes of lithium spodumene concentrate. The time for completing the deal has been extended to 26 October.

The company is well positioned to finish the startup and expand into other planned developments within the mining region, having successfully completed a $100 million dollar institutional placement.

Lake Resources has been bedeviled by a series of troubles outside the prospects for its flagship asset, the lithium from brine Kachi Project in the lithium triangle in Argentina. Lake had touted its “direct extraction technology” provided by the company’s partner Lilac Solutions. A dispute between the partners over key dates for achieving milestones has drawn additional fire from short sellers, who first began targeting the company following the Goldman Sachs pronouncement on 1 June that the lithium bull market was over, with prices declining over the next two years. Next came the resignation of the Lake Resources CEO, followed by the sale of all the shares held by the former CEO – in excess of ten million. Then a caustic opinion piece challenging the validity of the direct extraction technology, which returns brine water to its original source once the lithium has been extracted, eliminating the need for evaporation ponds.

Updates during September and early October gave the share price a bit of an upward bounce, first on positive news on the Kachi project and then on the government estimates of lithium demand

Lake management ensured investors all was well in the Lake/Lilac partnership and the pilot plant was progressing well. The planned test program will create enough lithium concentrate to allow conversion into lithium carbonate for testing and specification validation by a battery manufacturer.

Galan Lithium has three lithium projects in development – two brine projects in Argentina and a hard rock asset here in Australia.

The Greenbushes South Project in Australia is a Joint Venture (JV) with Galan controlling a majority interest of 80%. Current activity involves targeting exploration sites through geological mapping for an initial drilling program.

Galan is the sole owner of the Argentinian projects – Candelas and the flagship Hombre Muerto West lithium project.

Hombre Muerto West is well underway, with pilot brine ponds and pumping and testing facilities in place. A definitive feasibility study is underway, with completion expected in late 2022 or early 2023

The company released a PEA (preliminary economic assessment) for the Candelas Project in November of 2021. A PEA is a rough equivalent of the more common JORC (Joint Ore Reserves Committee) only in place of mineral reserves estimates the PEA estimates potential net value over the life of the project. The PEA was extremely positive, projecting a net present value (unleveraged and pre-tax) of AUD$1.72 billion dollars at a construction cost of AUD$574 million dollars and annual output of 14,000 tonnes of lithium carbonate over 25 years.