The ASX healthcare sector was home to both winners and losers coming on the heels of the COVID 19 Pandemic.

Virtually any healthcare company working on COVID diagnostic testing, vaccines, or treatments, had their day in the sun.

Not so fortunate were some of the most well-known healthcare stocks on the ASX crushed by the impact of COVID on traditional medical care.

A former market darling – Ramsay Healthcare (RHC) – saw its most lucrative source of revenue from its many hospitals here in Australia, in France, and in the UK – elective surgeries – delayed and postponed.

CSL (CSL) saw drops in plasma demand and donors. Global leader in hearing implants – Cochlear (COH) – relies on industry leading products, all requiring surgical implanting.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The pandemic wreaked havoc on the global supply chain, impacting sleep apnea equipment provider ResMed (RMD), as well as Cochlear with both requiring multiple assembly parts for their products. The latest issue sparking investor selling is the prospect of rising interest rates. High growth stocks tend to be dividend payers and therefore can fall slightly out of favor in rising interest rate environments.

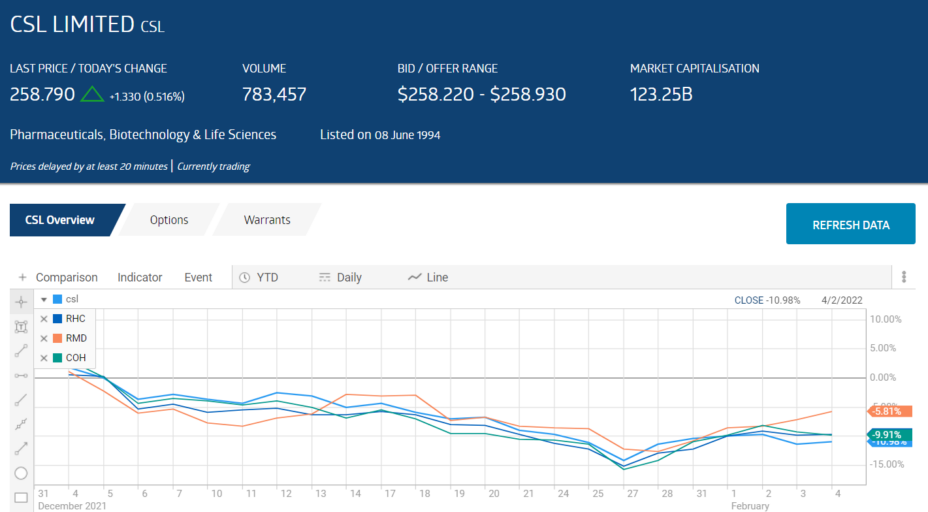

Year to date, all have seen negative share price appreciation.

The ResMed business model of sleep apnea and respiratory equipment, masks, ventilators, and its cloud base software suite allowing remote diagnosis shielded the stock from much of the pain. Yet lockdowns, stay at home orders, and supply chain issues impacted the company’s core businesses of sleep apnea equipment and COPD (Chronic obstructive pulmonary disease) treatments.

In FY 2020 the company reported solid revenue and profit growth before sliding in FY 2021, with revenues declining modestly by about 1.2%. However, profit dropped 30%.

In September of 2021 ResMed was added to the ASX 50. The company is US based and trades in the US as well, where quarterly earnings reports are required. The latest financial report for Q2 of FY 2022 showed both revenue and income up 12%.

Management acknowledges component parts issues stemming from global supply chain disruption, but claimed the company was managing. ResMed may have benefited from increased demand for its products following the June of 2021 recall and field safety notices for a major competitor’s products. However, the downside to that – consumer concerns over the safety of sleep apnea and respiratory care products – was addressed in an earlier release, with management assuring customers ResMed products were safe and not subject to the recall. The company did gain market share over time at the expense of the competitor, with some analysts suggesting ResMed may retain the gains.

ResMed produces CPAP (continuous positive airway pressure) machines, respiratory masks and four respiratory ventilation products (invasive and non-invasive.) The company provides a mobile app for users to assist with setup and ongoing monitoring.

ResMed invested $25 million dollars in research and development activities in FY 2021, up 12% from the previous year.

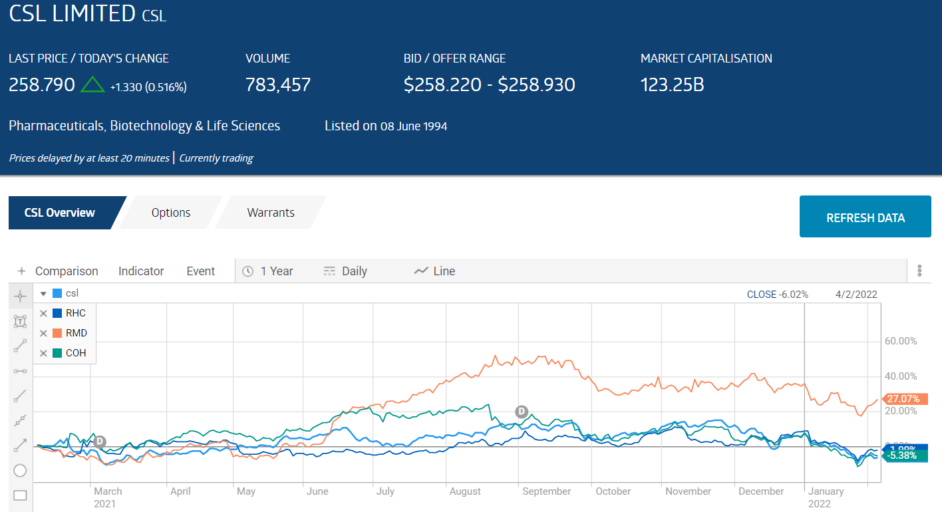

ResMed is the only one of the four with positive share price gains year over year.

CSL is one of the top biotechnology companies in the world, combining two unique operations – Behring plasma therapies business and the Seqirus vaccine business. Like ResMed, CSL invests heavily in R&D activities, with positive remarks from some brokers expecting the company’s recent acquisition to expand its research and development scope. CSL paid $6 billion dollars to acquire Vifor Pharma, a company with an extensive R&D pipeline and a focus on iron deficiencies, cardio-renal therapies, and nephrology (diagnosis and treatment of diseases of the kidneys.)

Vifor Pharma is based in Switzerland, is global in scope, and consists of four specialty focused subsidiary companies. The acquisition was an all cash transaction at a 40% premium, paid for with a stock tender offer, new debt, and cash reserves.

Analysts at Citi liked the deal, raising its target price to $340 per share and its recommendation to BUY. Some investors ignored the long term, focusing instead on the dilution of their existing shares and sold down the stock price by 8% following the announcement of the funding scheme for the acquisition.

The reaction might come as a surprise to investors skeptical of investing in CSL as its growth prospects in the company’s core competencies appear limited, despite CSL having a pre-pandemic R&D portfolio with five treatments in Phase 1 Clinical Trials; three in Phase II Trials, seven in Phase III Trials; and thirteen in Registration/Post Registration stage. The Vifor acquisition opens a new world of potential for the application of CSL’s long standing technological prowess.

Cochlear was one of the first ASX listed stocks to cut its Full Year 2020 profit forecast on 20 February of 2020 as hospitals across China delayed implant surgeries as COVID 19 was sweeping across the country. An article appearing on the Reuters website labelled the between AUD$20 and AUD$10 million dollar reduction in guidance a “surprise.”

At the time, nothing was said about the potential spread of the COVID 19 outbreak outside of China, with the company announcing expected demand declines in the second half of the year were factored into the renewed guidance. Management stated it was not sure when surgeries in China would resume but did express confidence the return to normal hospital operations could follow the same path taken by the SARS epidemic that hit in 2003.

JP Morgan reportedly referred to the demand reduction as a “short-term issue restricted to revenue from the China market in FY 2020 but went on to warn of the potential risk of widespread surgical deferrals should COVID spread beyond China.

With the Omicron COVID variant still plaguing many countries around the world – including Australia – and a new variant (BA.2) emerging, some analysts are recommending selling Cochlear as the global return to normal surgical status remains unclear. However, it appears as of early February the spread of the OMICRON variant may be stabilising.

Long-time holders of COH have been here before, when in 2011 the share price plummeted 17% on the announcement the company was voluntarily recalling a flagship implant product. Analysts underestimated the physician community’s loyalty to the brand and predicted Cochlear would not regain market share lost during the recall. A cochlear implant is a “gatekeeper” product with the buy decision not up to the consumer but to the physician.

Cochlear is the global leader in hearing implant technology but remains in the middle of the herd amongst analysts. Citi and Credit Suisse recently upgraded COH while Morgan Stanley and Goldman Sachs downgraded the stock. Others remain neutral on the stock while virtually all cite valuation, not company fundamentals, as their primary concern.

In 2011 investors who overcame their uncertainly on Cochlear’s future have been well rewarded. Following the share price dip in the recall aftermath in 2011, COH embarked on a long upward trend, interrupted by occasional volatility. From the ASX website, the following share price movement chart along with the history of dividend payments makes a strong case that now may be another buying opportunity.

The Cochlear recovery story may already be underway with improving outcomes in the company’s markets where the pandemic has been better managed. FY 2020 was a disaster for the company, with a $100 million dollar drop in revenue and a profit fall from a gain of $276 million dollars to a loss of $238 million. For the Full Year 2021 Cochlear reported revenues up from $1.3 million dollars to $1.497 million and profit climbing back into positive territory at $326 million dollars.

The company’s substantial R&D investment yielded another new sound processor in the Cochlear™ Nucleus® Family – the Kanso® 2.

Ramsay Healthcare was once used as a yardstick for the potential of other stocks as financial articles repeatedly referred to a promising stock as “the next Ramsay’”, as investors appeared to be enamored with the company’s acquisition binge, swallowing a growing number of private hospitals, first here in Australia and then in France and the UK.

Perhaps a more significant factor here in Australia was the decline in Aussie consumers appetites’ for private insurance as premiums rose. A June of 2018 article appearing on the Australian Financial Review (AFR) website pointed to the drop in Australians seeking PHI (private health insurance) coverage from 47.4% in 2015 to 45.55 in mid-2018. Without PHI, consumers opt for public hospitals, cutting into the core of Ramsay’s business.

The article included the views of an analyst at Citi, who commented on the presence of a “viable and free” network of public hospitals here in Australia and the rising cost and lower numbers of private hospitals for acquisition.

In November of 2021 Goldman Sachs acknowledged the continuing headwinds from cancellations and delays in elective surgeries and other hospital services, but Goldman saw improving conditions potentially beginning in early 2022. At that time, the price of a share of RHS stock was around $69.38, following a dismal trading update where the company announced a meager revenue increase (+1.2%) for the first quarter of FY 2022 along with a 39% decline in net profit. Operating expenses were up as well as Ramsay experienced problems in parts of Australia and in the UK.

Relief may be in sight as the latest company announcements were positive. On 1 February Ramsay announced the New South Wales government reduced its cap on elective surgeries to 75% of ‘usual activity.”

Less than a month prior, on 6 January Ramsay announced new restrictions on non-emergency surgical procedures in NSW. Similar restrictions remain in Victoria, but the situation in the UK has improved somewhat. Ramsay signed a new agreement with the National Health Service of England (NHSE). The agreement in place with the NHSE calls for Ramsay to provide hospital services to NHSE patients to meet medical demands stemming from COVID. The agreement ends on 31 March but could be extended.

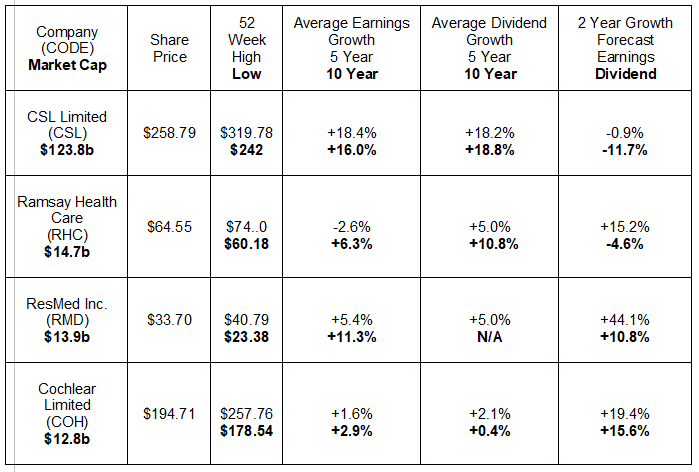

The following table includes share price information and historical and future earnings performance and growth.