When starry eyed newcomers to share market investing begin their due diligence process to find attractive stocks for their first portfolio holding, healthcare stocks are often at the top of the list.

With global population ageing and healthcare demand increasing among all age groups, the sector has strong tailwinds propelling it forward. It does not take much searching to identify start-ups, small caps, and even major players experiencing massive upward share price movement following some positive announcements.

Limiting their focus to rising share prices can lead some new and some old investors to ignore the adage – the higher the risk, the higher the potential reward.

Arguably the major risk to rising healthcare stocks is cash. Another adage applies here – it takes money to make money. Healthcare stocks need cash to fund operations while waiting for final product development, revenue generation, and ultimately profitability.

“Cash burn” is the phrase found in analyst and expert commentary on most healthcare stocks unable as yet to finance operations from revenues. Stocks with more debt than cash on hand are at greater risk than stocks with low gearing ratios, where gearing is the company’s total debt against the value of its ordinary shares. Double digit gearing means the company is at greater risk as is a low current ratio. The current ratio measures the company’s ability to manage short term debt, with ratios or 2 or higher desirable.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

A corollary risk is time. It can take years to bring a new medical device or treatment to market, with multiple clinical trials, along the way. Each trial carries the risk of dramatic share price declines should the trial not yield positive results.

These companies raise cash in three ways – infusions from a partnering company; taking on debt; or selling shares.

The third highlights one of the strange outcomes with start-ups in the sector. While borrowing money is not ideal, it does not arouse the anxieties of most investors in the same manner as does selling shares.

Selling additional shares waters down the value of the holdings of existing shareholders so a common reaction to the announcement of a capital raise to fund the growth investors crave is for those same investors to sell off the stock.

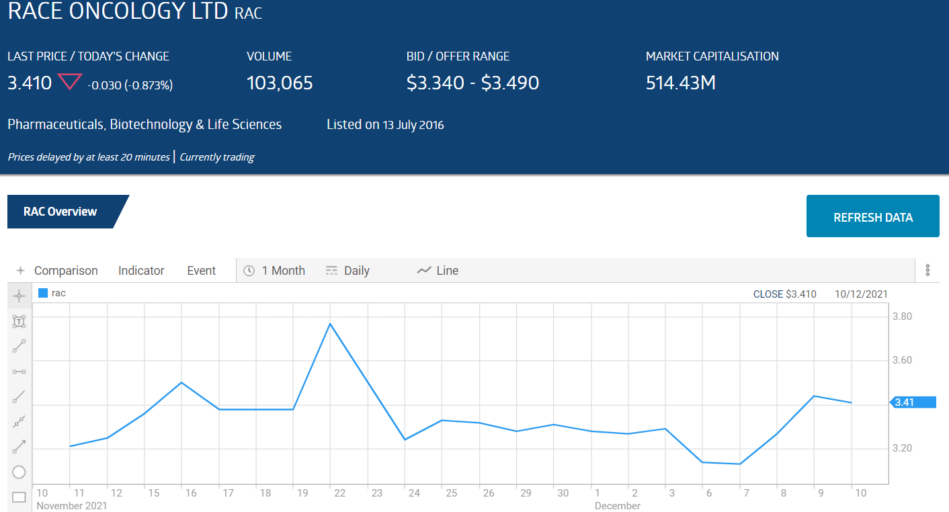

Race Oncology (RAC) is a case in point. The company listed on the ASX in 2016 with the intent of returning a previously registered “orphan” drug for use in rare cancers – Zantrene® – to current use.

Race now has multiple US patents for Zantrene® along with US FDA (food and drug administration) Orphan Drug Designation and has expanded the diseases targeted to include breast and kidney cancer, and melanoma. Orphan drugs are those treating diseases rare enough to raise concerns about their profit potential.

Zantrene® has had successful results in Phase II clinical trials. On 24 November, the company announced a share purchase plan for Sophisticated/Professional Investors to raise $29.7 million dollars. The share price fell more than 12% in intraday trading.

On 8 December, Race was out with another announcement on a new use for Zantrene® (the trade mark for the original drug, Bisantrene). Carfilzomib is a drug for the treating of multiple myeloma but carries with it the risk of serious heart damage in patients.

A pre-clinical study found that Zantrene® not only protects patient’s heart cells, but also improves the cancer cell killing efficacy when used in conjunction with Carfilzomib (owned by US pharma giant Amgen. Race immediately filed a patent application for the combination of the two drugs.

The share price rose close to 5% intraday.

Despite the company’s solid progress in the five years since listing and its growth potential, Race remains without revenues and profits. Investors have been rewarded with share price appreciation alone, with average shareholder returns over three years of +258% over three years and +76.5% over five years.

IDT Australia (IDT) is an ASX listed pharma/biotech/life sciences company that achieved its maiden profit in FY 2021. The company is multi-faceted, providing drug manufacturing capabilities for commercial scale clients, from active pharmaceutical ingredients (API) to finished dose forms (FDF). The company also offers packaging for clinical trials and client assistance with regulatory issues. Medical cannabis manufacturers are among its clients.

On 19 March, the share price got a boost when the company announced the Australian Government Department of Health had asked IDT to assess the feasibility of using the company’s sterile manufacturing facility to supplement production of COVID 19 vaccines. The share price shot up close to 65%.

In mid-August, the share price took another upward leap on no new announcements. In response to an ASX price query, the company cited general press commentary on the growing demand for vaccines here in Australia and the substantial profits going to vaccine manufacturing companies.

Three days after the 19 August response, IDT formally announced discussions with the government for the use of IDT facilities were continuing. On 7 September, the company announced of a formal “Sterile Readiness Agreement” with the government. On 30 November IDT announced it had successfully produced a mRNA COVID-19 receptor drug product for use in the Monash Institute of Pharmaceutical Sciences (MIPS) Phase 1 clinical trial to begin early next year.

For the Full Year 2021, IDT achieved its first profit since 2009, with NPAT (net profit after tax) up 209.6% with revenues up 17.5%.

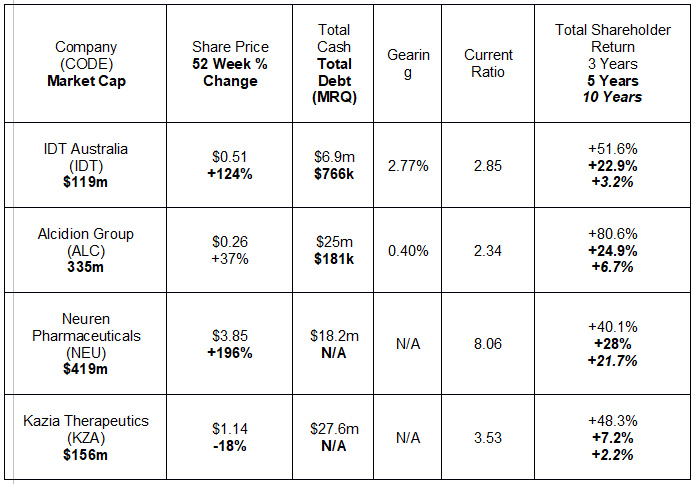

There are three additional prospects forecasted to reach positive earnings in the next two years,

Alcidion Group (ALC) is in the healthcare equipment and services sector, offering innovative, AI (artificial intelligence) based software solutions. The company serves more than three hundred hospitals and seventy healthcare organisations here in Australia and also in New Zealand and the UK.

The company offers four software platforms:

- Miya Precision

- Smartpage

- Patientrack, and

- ExtraMed

Product names are somewhat descriptive of the solutions provided, with Patientrack’s predictive algorithms alerting a physician or clinical practitioner of a patient’s condition in real time.

Smartpage is a secure messaging system allowing clinicians and non-clinicians instant communication.

ExtraMed digitizes patient management from entry to exit, with nursing and other clinical assessments during treatment.

The flagship Miya Precision Platform features sixteen individual customisable clinical-related platforms allowing full integration of clinical and operational workflows. Pulling together information from multiple sources into a single intuitive interface point allows quick and more accurate medical decision making. The platform is driven by artificial intelligence.

The company has grown revenue in each of the last three fiscal years while remaining unprofitable. For FY 2021 Alcidion reported earnings per share of a negative 0.1 cents per share, which is expected to turn positive in FY 2022 at 0.3 cents per share before ballooning to 15.5 cents per share in FY 2023, a 960% increase over three years.

Acquisitions that may spur growth but are costly is another source of investor irritation. On 3 December, fickle investors were thrilled when Alcidion announced a contract signing, sending the share price up 11% intraday before driving down the price on 8 December when the company emerged from a trading halt following the successful completion of a $43 million dollar share placement to fund an acquisition.

Neuren Pharmaceuticals (NEU) has six drugs for the treatment of neurological disorders in varying stages of clinical trials.

The share price went up 100% intraday on the announcement of successful Phase III clinical trials for its drug for the treatment of Rett syndrome – Trofinetide. The study was conducted by the company’s US partner, Acadia Pharmaceuticals (NASDAQ: ACAD). The study involved 187 young girls and women, ages five to twenty years. Trofinetide had already been granted Orphan Drug status by both the US FDA and the European Medicines Agency (MEA).

Acadia will meet with the FDA in the first quarter of 2022 to secure Pre-New Drug Application, followed by a New Drug Application in mid-year 2022.

All six Neuren treatments have in development for the treatment of multiple serious neurological disorders appearing in early childhood, have been granted Orphan Drug status by the FDA.

Trofinetide for treatment of another disorder is in Phase II trials, with an additional four Phase I trials for the compound NNZ-2591 underway, with completion anticipated in 2022.

Despite its Orphan Drug status, Neuren projects annual sales of the Rett syndrome treatment to reach AUD$500 million dollars. In FY 2020 the company reported earnings per share of negative 8.6 cents per share, with an FY 2021 estimate of a negative 8.3 cents per share before jumping to a positive 29.8 cents per share, a 133.8% increase.

Kazia Therapeutics (KZA) is listed on both the ASX and the US NASDAQ. The company is developing cancer treatments with its lead product, Paxalisib, targeting the most common and aggressive type of brain cancer – glioblastoma.

The company licensed Paxalisib from Genentech in late 2016 and has since then been granted Orphan Drug status by the FDA in 2018 and Fast Track status in August of 2020.

Kazia is currently recruiting for a Paxalisib clinical trial for treatment of primary central nervous system lymphoma and non-Hodgkin’s lymphoma in the US; a clinical trial in France for the company’s EVT801 treatment for solid tumours; and a US clinical trial for GDC-0084, a treatment for brain metastases.

In FY 2021 Kazia reported negative 5.0 cents per share, with a FY 2022 forecast of a loss of 9.9 cents per share before reaching positive earnings in FY 2023 with an estimated positive 1.3 cents per share.

The following table lists key metrics for four stocks on the brink of profitability.