Predictions about when the current supply chain bottlenecks will end range from “who knows” to maybe in a year or so.

Somewhere in the midst of this crisis lies opportunity for investors. The COVID 19 Pandemic is credited with creating a “perfect storm” scenario, plunging global supply chains into chaos. However, some industry experts point out the system was overburdened and inefficient prior to the onset of the Pandemic. The intense focus on fixing the system suggests the possibility a new and improved “normal” will eventually emerge.

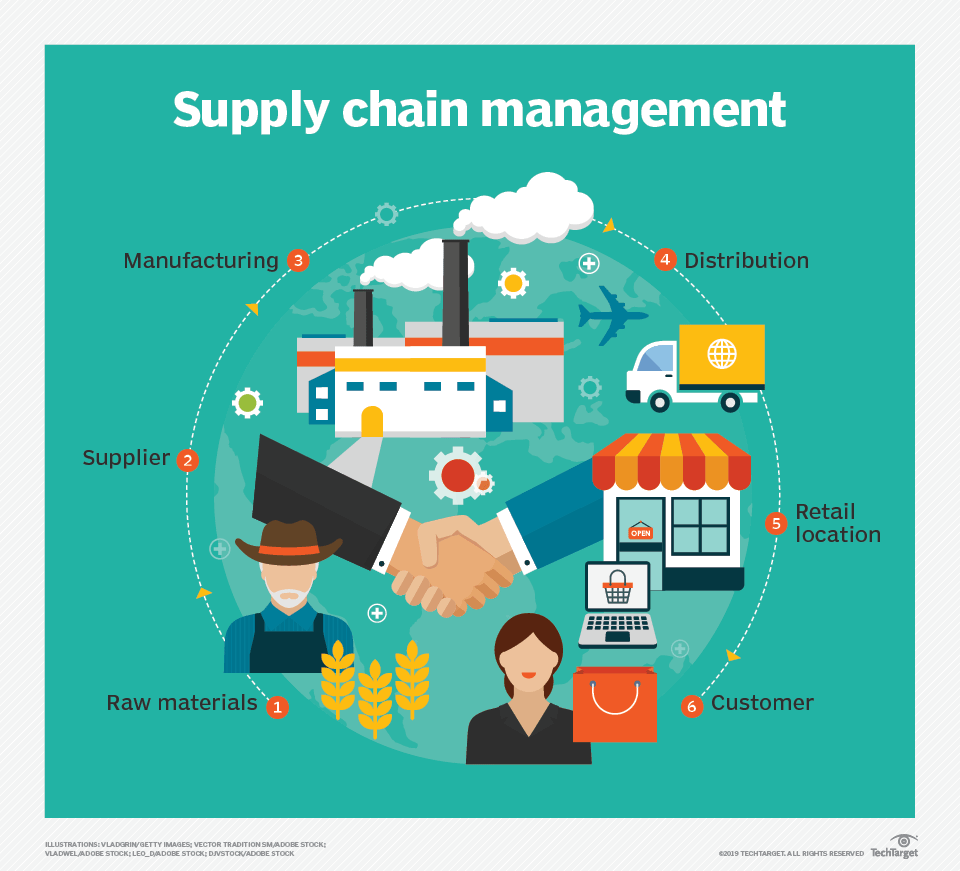

Although the term “global supply chain” is bandied about in the financial news constantly, the fact is each provider of goods and services has its own unique supply chain. The following pictogram from the website techtarget.com provides a simple tool for visualising the process:

Raw materials encompass whatever the manufacturer or service provider needs to produce an end product, typically coming through a supplier. The distribution method varies as does the point of sale location and end user. Many supply chains require storage and warehousing along the way.

Top Australian Brokers

- City Index - Aussie shares from $5 - Read our review

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The pandemic drained employees at each point in the chain, with many businesses shutting their doors completely. The employee shortage remains an issue as some have not returned to work, creating significant labor shortages in many industries.

To add to the storm, goods and services providers expected steep and long lasting declines in what they produce, leading to decreased production and inventory once lockdowns began to ease.

What most missed was what the consumers around the developed world did with the government largesse distributed to keep economies afloat. Staying at home flush with cash led to a steep increase in demand for online goods and home improvement goods, a demand spike providers could simply not match.

So although there is no such thing as a “supply chain” stock, there are multiple logistics companies on the ASX with some performing the entire set of logistical functions and other performing limited functions. Logistics is the process of moving goods through the chain, with transportation being one of the most important functions fulfilled by logistic companies.

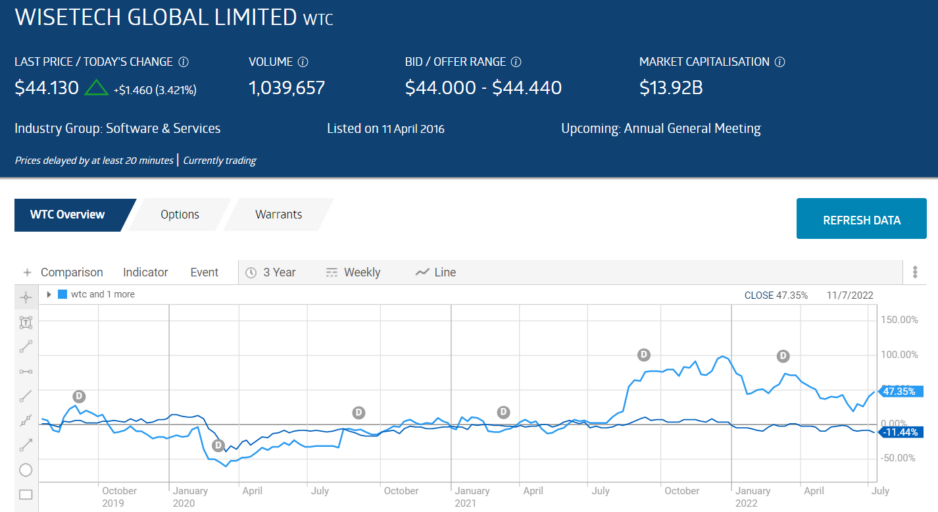

Although the ASX listed logistics companies are classified in the transportation sector, the company many Aussie investors associate with logistics is actually a technology company – Wisetech Global (WTC).

Wisetech is a software as a service (SaaS) provider for logistics industry operators. Its software platforms allows logistics providers to manage the movement and storage of goods and information. The company’s flagship platform – CargoWise – allows management of complex logistical requirements, from “point of origin to point of destination.” Wisetech counts among its customers 24 of the top 25 global freight forwarding companies in the world, including DHL Global.

The company listed on the ASX in April of 2016, closing its first day of trading at $4.04 per share. At the end of the calendar year of 2021 the share price hit an all-time high of $59.90, before cratering to the current 42.08. Since listing the share price is up % and has fallen 27% year to date.

Wisetech is a high-tech company with global exposure to the world’s top logistics operators, offering investors a level of diversification lacking in the stocks of logistical services providers.

The biggest ASX logistics and transportation company is Qube Holdings (QUB). The company’s Operating Division provides a range of logistical services to the Australian import/export market. The company specialises in container cargo, serving the heavy transport, automotive, mobile crane, and renewable energy sectors with both physical and documentary support.

The company also operates a Property Division with the Moorebank Logistics Park Project under development for rail and logistics services, including transportation hubs and warehousing facilities.

Both Wisetech and Qube maintained revenue growth over the last three fiscal years while seeing declines in profit. The following three year share price movement chart from the ASX website shows the shares of both companies falling in the early days of the pandemic and participating in the quick initial recovery. Wisetech made a strong recovery beginning in mid-2021 with both collapsing at the start of 2022.

Analyst consensus has BUY recommendations on both stocks.

Wisetech’s Half Year 2022 financial results were strong, with revenues increasing 18% and both statutory and underlying profit increasing 74% and 77% respectively. The company’s guidance for the remainder of the year released at that time called for a $10 to $15 million dollar increase in EBITDA (earnings before interest taxes depreciation and amortisation) and reaffirmed its revenue guidance. On 15 July Wisetech increased its EBITDA guidance, with revenue guidance expected to hit the top of the previously announced range.

Qube’s Half Year 2022 Financial Results disappointed moderately when amortisation issues dragged statutory profit down 2.3% but revenues rose 26.7% and underlying net profit from operations went up 16.9%. Full Year Guidance called for ”strong underlying earnings growth reflecting volumes across most parts of the business.” Investors were pleased with the mid-May announcement of a phased $400 million dollar share buyback.

The following table includes some relevant share price movement and growth metrics for the two companies.

|

. Company (CODE) Market Cap |

Share Price 52 Week High 52 Week Low |

Share Price % Change Year to Date Year over Year |

P/E Ratio P/EG Ratio |

5 Year Growth Rates Earnings Dividends |

Total Shareholder Return 3 Year 5 Year 10 Year |

2 Year Growth Forecast Earnings Dividends |

|

Wisetech Global (WTC) $14.4b |

$44.14 $60.40 $29.91 |

-24.67% +44.93% |

88.65 2.87 |

+46.1% N/A |

+11.6% +44.6% N/A% |

+30.9% +65.8% |

|

Qube Holdings (QUB) $4.9b |

$2.71 $3.46 $2.64 |

-14.51% -9.06% |

27.48 4.98 |

+6.7% +2.2% |

-2.6% -3.0% +9.0% |

+5.5% +19% |

Wisetech did not begin paying dividends until 2017 but now is rewarding shareholders handsomely. The high P/E and P/EG ratios for both stocks are generally considered indicators of growth stocks. The P/EG ratio uses future estimated earnings in its calculation, unlike the traditional Price to Earnings Ratio that uses historical earnings.

Wisetech shares have arguably suffered more because the company is classified in the tech sector.

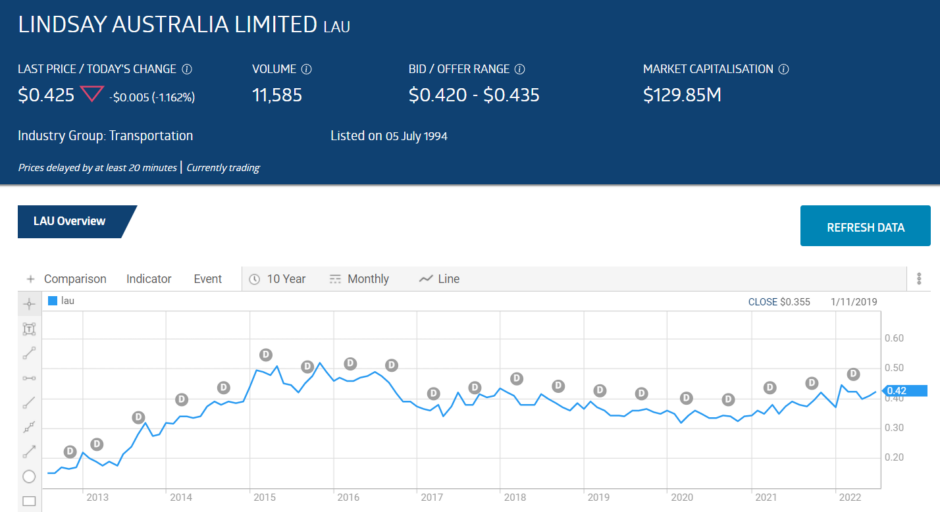

There are two other logistics stocks of particular interest. First, Silk Logistics Holdings (SLH) is brand new to the ASX, having listed in early July of 2021 . Unlike Silk’s diversified customer base, Lindsay Australia (LAU) serves primarily rural businesses here in Australia.

Lindsay’s self-description aptly describes its principal focus – We move the most valuable freight there is. The food that feeds your families.

The company has three operating divisions serving providers in each step of the agricultural logistical supply chain.

- Lindsay Transport – provides producer to supplier end-to-end refrigerated and dry transport and warehousing;

- Lindsay Rural – delivers agricultural supplies from fertilisers to irrigation equipment to producers and transports fresh produce to markets;

- Lindsay Fresh Logistics – a special facility in Brisbane provides pre-export/import fumigation, quarantine, inspection rooms, and rapid cooling equipment.

Investors interested in mega-trends know agricultural growth is one of them. Lindsay works with all companies involved in providing food – from horticulturists to primary food producers to food processors and distributors and storage operators.

The company maintained revenue growth but saw profit declines in both FY 2020 and FY 2021. Half Year 2022 Financial Results were strong, with operating revenues up 25.3% over the Half Year 2021 and underlying profit up 44%. Lindsay is adding more refrigerated rail containers in the second half of FY 2022 and expects strong growth in all group services in the second half and on into FY 2023.

Over 10 years the company’s stock price has risen 175%, with an average dividend growth rate over the period of 10.4%. Year over year the share price is up 10.39% and up 7.59% year to date.

Silk Logistics Holdings has a suite of software platforms enabling “port to door” solutions. The company’s Port Logistics Segment serves customers in the FMCG (fast moving consumer goods), retail, food, light industrial, and other business sectors on contract or on terms.

The Silk Tier 1 technology has developed warehouse management and transportation systems. The systems enable integration between port logistics and warehousing and distribution.

The company’s Contract Logistics segments serves the order needs of “blue chip” businesses, with integrated systems for receiving, inventory storage, product picking and packing and delivery.

On 28 April, the company completed the deal for the Kemps Creek land purchase in New South Wales to construct warehousing facilities in conjunction with ESR Australia, a developer of commercial, industrial, and logistics properties.

Silk’s Half Year 2022 Financial Results bested its IPO guidance in every category except statutory NPAT (net profit after tax) due to one off charges. Underlying net profit before one offs was up 50.9% and revenues rose 18.5%. The Full Year 2022 Outlook continues the company’s rapid growth, with revenues forecasted between $370 and $380 million dollars, and underlying NPAT in excess of $16 million dollars.

Silk Logistics has a market cap of $162 million dollars and closed the trading week ending on 15 JULY AT $2.05 per share with a 52 week high of $2.11 and a 52 Week Low of $1.83. The share price is down 7.24%, year to date. Silk has two analysts covering the stock, with BUY recommendations.