Braden Gardiner, Tradethestucture.com

BUY RECOMMENDATIONS

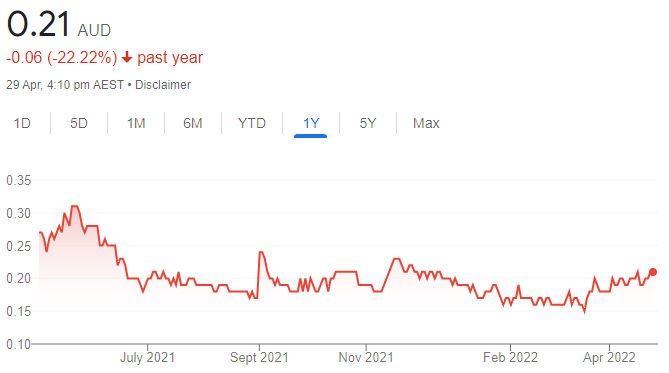

Alligator Energy (AGE)

The company has been supported by higher uranium prices. We believe positive momentum should drive uranium prices higher in 2022. The share price of this uranium explorer has retreated from recent highs, but remains in an uptrend. Explorers carry risk, but I expect buyers to support the stock in what recently became a cheaper entry level.

CSR (CSR)

This building products company has been trading in a range between $5.62 and $6.32 since the start of July 2021. It spent time consolidating a move up from $3.65 on August 31, 2020. My technical analysis suggests the price is in the early stages of a new uptrend. The shares were trading at $6.085 on April 28.

HOLD RECOMMENDATIONS

Zimplats Holdings (ZIM)

The platinum producer has been in a strong uptrend since early 2021, rising from $13.39 on January 4, 2021 to trade at $31.78 on April 28, 2022. The move higher appears extended, so I anticipate some profit taking before it starts climbing again.

Worley (WOR)

The share price rose from $5.79 on March 23, 2020 to $12.97 on November 23, 2020. It fell to $9.35 on November 22, 2021. The shares were trading at $13.87 on April 28, 2022. My analysis suggests further upside momentum for this engineering services provider on the back of a brighter financial metrics outlook in the second half of financial year 2022.

SELL RECOMMENDATIONS

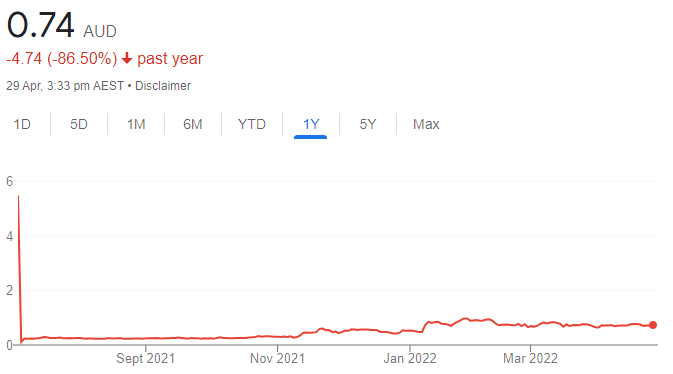

Talga Group (TLG)

The share price of this battery anode and advanced materials company has weakened since closing at $2.20 on November 9, 2021. It recently announced that new drilling had started at its graphite project in Sweden. The shares have fallen from $1.74 on April 4, 2022 to trade at $1.51 on April 28. The stock may remain under pressure, so I prefer others for capital growth.

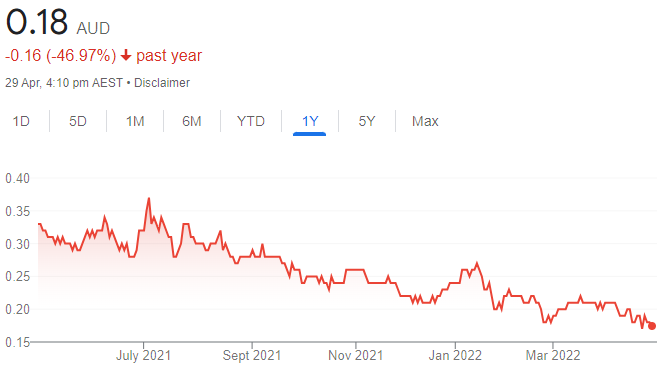

Hawsons Iron (HIO)

Hawsons is an iron ore developer and producer. It’s focusing on developing its iron project near Broken Hill. The share price has risen from 17 cents on March 1, 2022 to trade at 58 cents on April 28. At current levels, I believe the stock has moved too hard too fast, so investors may want to consider locking in some gains to manage risk.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Aurumin (AUN)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

AUN has completed the acquisition of the Sandstone Gold Project, with a resource of 784,000 ounces. The project includes a non-operating 500,000 tonnes per annum processing plant, operating licences and camp facilities. AUN recently announced it had identified lithium potential at its Mt Palmer Project. We regard AUN as an emerging gold producer, but lithium adds speculative upside potential given immense interest in electric vehicles.

Mako Gold (MKG)

The company continues to release encouraging drilling results from the Gogbala and Tchaga prospects in Cote D’Ivoire. It recently announced it had identified two new mineralised zones. MKG remains well funded to continue exploration and grow the resource base towards feasibility studies and production scenarios. I consider MKG a high risk/high reward opportunity in the gold sector.

HOLD RECOMMENDATIONS

Pacgold (PGO)

PGO is delivering encouraging results at the Alice River Gold Project in North Queensland. It has a major gold corridor to explore, with an emphasis on deeper drilling below the historical production pits. The share price has performed well since listing on July 8, 2021. We believe PGO offers an appealing growth profile.

Nyrada Inc (NYR)

NYR is progressing towards clinical trials for its promising cholesterol drug. There’s been a delay in manufacturing a drug in Shanghai due to COVID-19 lockdowns, resulting in a weaker share price. NYR is also progressing an oral treatment to reduce the impact of secondary brain injury and stroke. The company anticipates starting the first-in-human phase 1 study in the second half of calendar year 2022.

SELL RECOMMENDATIONS

Rio Tinto (RIO)

In my view, the mining giant reported lower than expected iron ore shipments in the first quarter, and flagged risks from sustained high inflation, new COVID-19 lockdowns in China and a prolonged war in the Ukraine. Strong commodity prices provide an opportunity to consider taking profits in markets that may become more volatile.

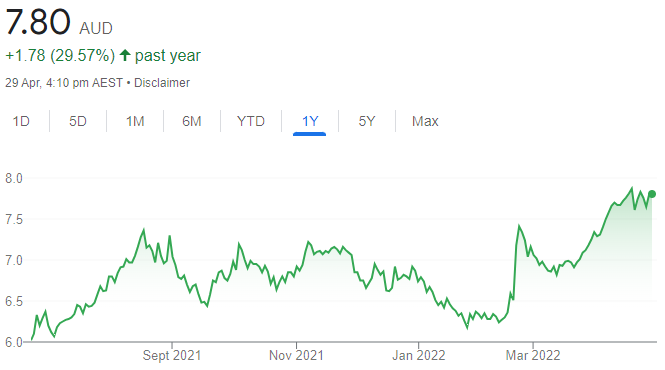

Macquarie Group (MQG)

The company’s commodities and global markets division has delivered strong results, making it the star performer of the group. The share price of this diversified financial services group has significantly risen since late February and was trading at $202.96 a share on April 28. Investors may want to consider locking in some profits in a time of near record high indices.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Silk Logistics Holdings (SLH)

This integrated logistics provider generated revenue of $182.5 million in the 2022 first half, an 18.5 per cent increase on the prior corresponding period. The company continues to deliver growth across all key metrics. Full year guidance has been subsequently upgraded by 6 per cent to 20 per cent. We believe if SLH converts potential into proven earnings growth, then investors should be rewarded. We retain our add recommendation and $3.25 price target at April 28.

Challenger (CGF)

This financial services firm is enjoying positive momentum and its outlook is bright. Recent robust sales growth in the Life business is encouraging. The company’s earnings trajectory has improved this year. CGF is trading on an undemanding price/earnings multiple and we retain our add recommendation and $7.74 price target at April 28.

HOLD RECOMMENDATIONS

Endeavour Group (EDV)

EDV operates liquor outlets, including Dan Murphy’s and BWS. The company has a big portfolio of hotels. Re-opening of hospitality venues amid removing COVID-19 restrictions paint a brighter outlook. We’re forecasting a forward gross dividend yield above 3.5 per cent in fiscal year 2022.

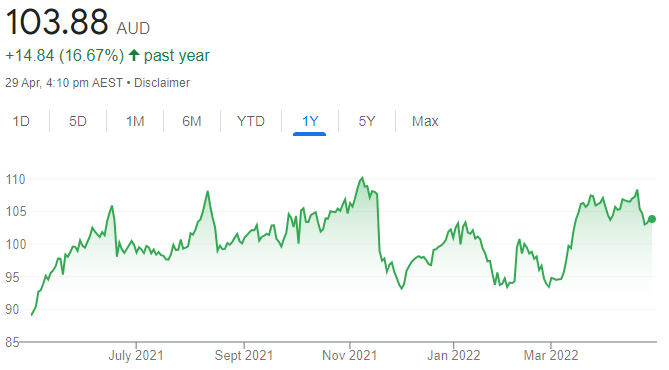

Macquarie Group (MQG)

MQG is a global provider of banking, advisory, investment and funds management services. The company’s exposure to long term structural growth sectors, such as infrastructure and renewables, is a shrewd strategy. Our valuation is $209.62 a share. The shares were trading at $202.96 on April 28. We’re forecasting a forward gross dividend yield of 3.7 per cent in fiscal year 2022.

SELL RECOMMENDATIONS

Commonwealth Bank of Australia (CBA)

The bank reported a first half 2022 statutory net profit after tax of $4.741 billion, a 26 per cent increase on the prior corresponding period. The result was better than we expected and beat consensus forecasts. We retain a reduce recommendation on valuation grounds. Competitors are trading on more appealing price/earnings multiples, in our opinion.

ASX Limited (ASX)

We acknowledge ASX as a stable and quality company. But, in our view, the ASX is trading on a lofty price/earnings multiple for a company we consider has a modest growth profile at this point. We retain our reduce recommendation and continue to look for a more attractive entry point.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.