A Sydney based financial research firm – Investment Trends – conducted a recent survey that yielded some interesting conclusions:

- over 400,000 Australians placed their first trade in the Australian securities market over the last 12 months.

- One in six first-time investors is under the age of 25.

Given the size and scope of market meltdowns all over the world in the immediate aftermath of the World Health Organisation (WHO) pronouncement that the COVID 19 was at global pandemic levels.

The head of research at Investment Trends attributes this phenomenal growth to two factors:

- “The spectacular recovery witnessed by US stocks in the second half of 2020 has captured the attention of a global audience, prompting many Australians to consider investing beyond local equities.”

- “A greater choice of investment platforms has been a key driver for uptake, with recent new entrants giving investors more choice than ever.”

Social media, where newcomers can recount how they are making a killing in the markets along with the proliferation of low cost online trading platforms have further fueled the trend.

However, the growth is not limited to the low-cost trading world, with some platforms accepting commission free trades. CommSec – one of Australia’s largest trading platforms – offers more services than most of the low-cost platforms and is therefore more expensive.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Recent news out of CommSec supports the findings of the Investment Trends survey.

CommSec data finds that nearly one in five traders on its platform are first-time investors. In the past six months, 230,000 Australians chose CommSec for their trading. Ten percent of the trades placed via CommSec are coming from first-time investors.

The good news has not come without concerns. Newcomers relying on social media for investing education may very well bring a new generation of punters to the investing world. Many online trading platforms offer bits and pieces of what could be considered investing education, but CommSec has now stepped in with a new offering – CommSec Learn – a series of educational topics covering the investing process from beginning to end.

There are other sources for a complete and detailed approach to learning the ins and outs of investing in share markets, among them investopedia.com, although there are differences between how US markets and Australian markets operate.

In a world racing forward at a dizzying pace, some newcomers may be unwilling to commit the time required for lengthy treatments of investment theory, philosophy, and strategies.

It is quite possible some investors rush from a social media post touting the latest market darling to sign up for an online trading account. The bull.com is an excellent source for finding an online platform, with both Broker comparisons and Broker reviews.

The process of making a trade is relatively simple, putting in your “bid” for a sale based on what the seller is willing to take, the “ask.”

But what do they buy? The more seasoned investors ready to give advice to anyone they know who is jumping into the markets right now without much education would tell them what they should buy depends on their goals. Why are they getting into the market?

There is much scholarly sounding information available about long term goals and short term goals, but it all comes down to this – how much money do you want to make and how long are you willing to wait.

Surely every newcomer would want to make as much as possible, but the risk of losing all you have invested sometimes means settling for a smaller return with stocks with less risk.

Newcomers looking to generate regular income might look for dividend stocks. There are two other groupings that likely dominate newcomers and old timers as well. Those who want to a big payday relatively soon and those who cannot resist a bargain.

Growth investors look for stocks with above average growth potential while Bargain hunters look for stocks whose value is not reflected in its share price.

It would be hard to imagine any newcomer that has not heard of one of the hottest growth stocks on the ASX – Afterpay Group (APT). For some newcomers researching a potential investment begins and ends with an ever increasing share price, which is a characteristic of growth stocks, and a recommendation from a family member or a friend.

The growth potential of some stocks can attract a stampeding “herd” of investors willing to pay top dollar for the stock. Buying a stock based solely on rising stock price is a fool’s errand. There are some financial ratios and other metrics readily available on financial websites and within some online trading platforms.

Here are some all newcomers should know:

- Price to Earnings Ratio (P/E)

- Price to Book Ratio

- Operating Margins

- Cash flow growth

- Revenue Growth

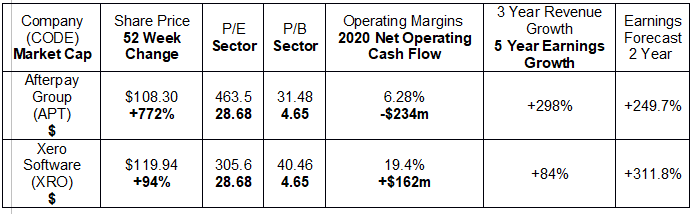

First, we have a table comparing Afterpay with another candidate for newcomers interested in growth stocks – Xero Limited (XRO).

Then we will get into what each of the above ratios and metrics mean.

The primary characteristic of growth stocks is outpacing the sector and the market as a whole. The first two ratios can tell an investor how highly market participants rate the stock by driving up the price.

High P/E (price to earnings) ratios indicate market participants believe the company’s earnings will rise. The P/B (price to book) ratio indicates how the current stock price reflects the company’s total net assets, or the value of the company. A high P/B means investors are willing to pay more than the company is currently worth for its future potential. A high P/E means investors are willing to pay more than the company’s current earnings in expectation of higher earnings in the future. Both have more to do with investor expectations than with company fundamentals. The price moves up based on investor demand and their willingness to accept the ever rising “ask” price at which current investors are willing to sell. Share price along is not a reflection of the quality of the company. It reflects what investors think the quality of the company is.

Ratios and metrics for a given company need to be compared with the sector in which they operate. We can see that the ratios for both Afterpay and Xero are far higher than the sector (Software and Services). Both meet the basic standards of growth stocks.

The remaining metrics reflect a company’s operational performance. While researching these ratios and metrics might seem a daunting task to newcomers and some old timers as well, all are readily available on internet financial sites as well as on most online trading platforms. Growth rates for some may need further calculation. Using operating margins as an example, current margins are easily found, but how much operating margins have grown requires three or more years of history.

Operating margins indicate how well a company translates its sales revenue into earnings. On some sites you can find a three to five year history, which can substitute for calculating a percentage.

For the past three fiscal years Xero has posted operating margins of +6.2%, 16.6%, and 19.4% while Afterpay posted margins of +16.4%, -0.8%, and + 6.8%.

Most growth stocks are newcomers whose primary concern is less with profit than with growing the business. Afterpay has yet to show a profit, while Xero posted its first profit in FY 2020 – $3.3 million dollars. In simplest terms, to post a profit, what the company earns must be higher than the operating and other expenses it took to generate those earnings.

Net Cash flow from operations is a metric that can make one growth stock riskier than another. Negative net operating cash flow means the company has more money going out the door than coming in the door. For aggressive growth stocks this should not come as a surprise, since the expenses of expanding into new markets and acquiring related companies can be exorbitant.

Xero appears closer to sustaining profitability based not on this measure only, but from the three year history of growth, going from $38 million in net operating cash flow in FY 2018 to $109 million in 2019 and $162 million in 2020.

Afterpay has posted negative net operating cash flow in each of the last three years. Perhaps reflecting the company’s substantial expansion measures, the numbers are going the wrong way, with negative $105 in 2018 rising to a negative $142 million in 2019 and a negative $245 million in 2020.

Since Xero, a company that provides accounting software and business services to small businesses, appears further along in the quest for sustainable profitability, it could be the stock of choice for any growth investor with moderate risk aversion.

One could make a strong case that the most important metric to consider for growth stocks is revenue growth. For newcomers, the simplest way is to determine growth is to look at the revenue history over at least the past three years.

Growth investors are willing to pay the higher price and take the risk for companies with explosive revenue growth in the belief sustainable profitability will follow.

Afterpay’s revenue growth over three years has been more than three times greater than Xero’s growth.

Analysts expect colossal earnings growth for both companies over the next two years, although Xero’s percentage increase is higher. Year by year, Xero reported 3.3 cents per share for FY 2020 with analysts forecasting an increase to 39.7 cents per share in FY 2021 and 56 cents per share in FY 2022. Afterpay reported a loss of 5.2 cents per share in 2020 with a forecasted increase to 1.4 cents per share and a big move is expected in 2022 at 52.8 cents per share.

Afterpay is a financial disruptor as a major player in the Buy Now Pay Later (BNPL) sector. BNPL providers could make credit cards obsolete.

While the market potential for Xero consists of small businesses, accountants, and bookkeepers, the market for Afterpay is virtually every consumer on the planet. Assessing the market potential of the product or service the target company produces can make the difference between exceptionally good returns and stellar returns.

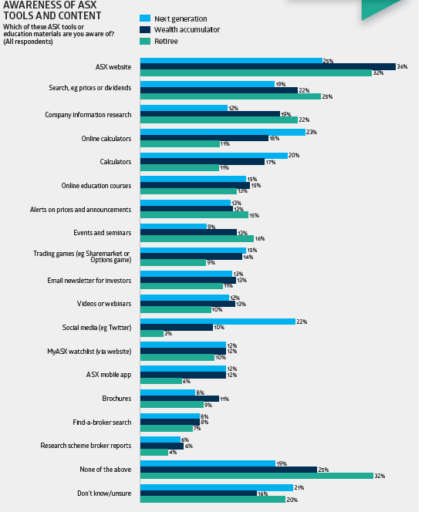

The ASX conducts regular surveys of investor behavior and the latest has some interesting findings on what they call “next generation” investors – age 18-24.

Some of the findings support the view these investors need help, whether from online learning or conversations with older investors who have been in the game long enough to have learned more than a thing or two.

The full surveys are available on the ASX website. The following comes from the March 2021 survey.

Twenty two percent of next generation investors list social media as an investment tool and only 12% make use of company information research.