Investors old enough to remember the bursting of the dot.com bubble at the beginning of the 21st century may recall the observation made by former Chairman of the US Federal Reserve, Alan Greenspan, that irrational exuberance explains a market driving asset valuations beyond their fundamental worth.

When the March bear market abruptly ended, the emerging bull stampede that continues regardless of some fundamental realities of the state of global economies appears to now justify the characterisation of irrational exuberance on steroids.

With increasing frequency it seems there are articles highlighting the disconnect between stock market and economic performance. Some argue market investors are defining a future economic reality that includes a rapid explosion of economic growth once COVID 19 comes under control. That reality is bolstered by the belief in never-ending government interventions to keep both consumers and companies afloat till the recovery materialises.

The underpinnings of the exuberance are questionable. While the Australian government has extended JobKeeper payments until 21 March of 2021, payments have been reduced for both full-time and part-time employees as well as eligible business participants. Welfare payments via the JobSeeker program will be cut as well.

In the US, unemployment benefits have been cut and the Paycheck Protection Program (PPE) for small businesses has expired. The US congress is deadlocked on a new round of stimulus.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Economic data bounces around a mix of positive and negative news, especially since businesses began to reopen in late May and early June. The chief economist for CommSec had this to say at the close of a report on the economics of COVID 19 posted on thebull.com.au on 31 August:

- The exit will take time and the path is uncertain. But what we know is that governments will support consumers and businesses despite the rhetoric of some of the more extreme and shrill commentators. And we know interest rates will remain at record lows for three years or longer.

The “shrill” commentators are suggesting irrational exuberance in stock markets could be a prelude to the formation of a bubble.

On 2 September it became official. The Australian economy is now in recession, posting the largest quarterly decline – down 7% – since quarterly records began in 1959.

The ASX 200 responded by closing at the highest level since 4 August, up 109.8 points, or 1.84 per cent. On the following day the market resumed its climb in the face of a cautionary article out of the AAP, pointing to an expected increase in unemployment, among other woes.

The US S&P 500 and the NASDAQ markets set new record highs in response to a duet of worrisome economic news.

First, private payroll payer Automatic Data Processing (ADP) announced an additional 428,000 jobs added in August month, far short of economist expectations of one million jobs.

Second, the US Federal Reserve publishes a “Beige Book” twice a quarter summarising current economic conditions. The release on the same day as the ADP report directly contradicted the expectation the growth seen in late May and early June as some businesses reopened would continue unabated. The Fed said, “continued uncertainty and volatility related to the pandemic, and its negative effect on consumer and business activity, was a theme echoed across the country.” …. “The pickup in activity seen in May and June has slowed over the past couple of months.”

On 3 September, the exuberance evaporated with a technology led rout culminating in an 800 point drop in the Dow Jones Industrial Average (DJIA) and the ASX 200 following the lead with a 3.06% decline on the last day of trading here.

The downtrend in US markets continued the following day, with the DJIA closing down 159 points, with an intraday rally briefly wiping out an earlier 600 point drop. The US financial website CNBC interviewed four professional investors with not one connecting the declines to the economy. Reasons ranged from algorithmic machine trading to profit taking to sector rotation. The disconnect appeared again as on both days US markets were treated to moderately positive employment data.

Investors large and small face unprecedented challenges navigating the economic situation in which we find ourselves due to an unexpected global event. The economic collapse had nothing to do with fiscal policy or weaknesses in supply or demand or a calamitous failure in a key sector like the GFC crash in the financial sector.

Traditional means of researching potential target stocks for retail investors managing their own portfolios such as the 52 Week Highs and Lows Lists now come with new challenges. In short, will there be a new-normal in a post pandemic world or will conditions return to pre-pandemic levels?

In the past week four stocks with business models that should do well in either condition hit 52-week highs. These companies have weathered the current storm and provide goods and services that should continue to be in demand whether a new normal emerges or not.

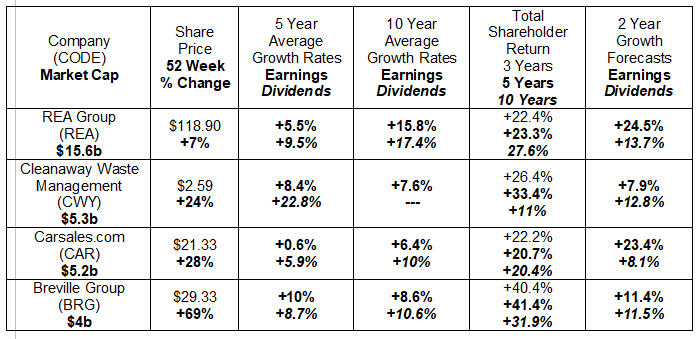

The four companies – REA Group (REA), Cleanaway Waste Management (CWY), Carsales.com (CAR), and Breville Group (BRG) – lack the explosive growth of the likes of Afterpay (APT), Zip Co (ZIP), and Pointsbet Holdings (PBH) – all up triple digits, but there are positive year over year.

However, all four have positive long term growth rates for both earnings and dividends and have rewarded their shareholders handsomely will triple digit average annual rates of total shareholder return over 3, 5, and 10 years.

REA Group and Carsales.com stand as lasting examples of the disruptive power of technology. Both saw print advertising for real estate properties and cars as prime targets for an emerging digital technology – the Internet.

REA Group, like other now famous startups, began in a garage in 1995. The company listed on the ASX in 1999 and within five years the website rea.com was reaching one million unique visitors each month.

By 2007 the company’s reach began to span the globe, first in Italy and now in China, the US, Malaysia, Singapore, and India through partnering arrangements and acquisitions. By 2009 the website was attracting five million unique visitors a month and the mobile app, launched in 2010, reached one million downloads by 2012.

REA Group now features more than 20 brands and has grown in its offerings as well to include commercial properties and rental units, home loans, short term and shared workplaces, property valuation services, homeowner moving assistance, and a senior living search site.

The company was already experiencing “challenging conditions” in the sector due to loan restrictions initiated as a result of the Royal Haynes Commission, yet managed to minimise its losses in the Half Year 2020 Results, with revenues dropping 6% and profit down 13%. On 18 March REA Group withdrew its full year guidance, with the results released in August repeating the 6% revenue decline while the loss improved slightly to 9%.

The company reiterated its view that challenging conditions will persist, but residential listings in Australia are going up, and regardless of a new normal or a return to pre pandemic conditions, people have to have a place to sleep and to work.

Carsales.com began in 1996 and has expanded its operations to include new and used car advertising, as well as advertising for motorcycles, boats, trucks and machinery for both consumers and dealers. In addition, the company offers valuation and pricing models, research and reviews for consumers, and an extensive Data and Research Services division offering software, analysis, website development and hosting services to a broad array of business customers. In addition to its core Australian business, Carsales has interests in operations in Brazil, South Korea, Malaysia, Indonesia, Thailand, and Mexico.

The company retracted its Full Year 2020 guidance back in March, but Carsales has weathered the storm better than some ASX companies. Full Year 2020 Financial Results were adjusted to reflect the sale of the company’s interest in Stratton Finance Pty, reporting a slight increase of 1% in revenue and a 6% increase in adjusted net profit after tax (NPAT).

Although garbage hardly qualifies as a glamorous investment, there will always be a need for the kind of waste management services offered by Cleanaway Waste Management (CWY). The company collects liquid and solid waste of all types, including hazardous and toxic waste, through a fleet of more than 4,500 vehicles and a network of state-of-the-art facilities, transfer stations, engineered landfills, liquid treatment plants and refineries.

The company reported revenues of close to $3 billion dollars, up from $2.49 billion or 2.2% and underlying NPAT of 152.9 million, up 8%.

Breville Group (BRG) designs, manufactures, and markets small kitchen appliances in more than 50 countries around the world, targeting markets demanding premium quality appliances under its own Breville Brand as well as two other company brands and co-branded and third party products. Distribution is multi-channel with both online and in store sales.

Breville operates a state of the art research and development operation in Sydney, earning the company a reputation for innovative products of premium quality.

Like most retailers the share price cratered as consumers and companies around the world shut down. However, Breville got an unanticipated boost as consumers shuttered at home began to cook for themselves and upgraded and enhanced their personal inventory of kitchen appliances.

Two major areas of speculation regarding a new normal in the post pandemic world are more people working at home and more people cooking for themselves. Surveys have shown the stay at home orders have yielded a new crop of consumers who enjoy cooking, also evidenced by the number of searches on the Internet for recipes.

On 27 March Breville joined the stampede of ASX companies withdrawing prior Full Year 2020 guidance due to the COVID 19 pandemic, but the announcement came with a twist. The company actually said their performance year to date “was consistent with the achievement” of the prior guidance.

On 13 May the company announced April sales had exceeded March sales but Breville management felt it prudent to reduce debt via a capital raise as a hedge against future impact of the pandemic.

Full Year 2020 Results sent the share price up. Revenues were up 25.3% and NPAT showed a small 1.8% decline, attributed to one off expense write downs of investments in the company’s proprietary IoT (Internet of Things) platform for smart appliance development. Management was cautiously optimistic about FY 2021.

The Breville Smart Oven will be joined by the Joule Oven Fryer Pro in 2021. The Internet of Things has earned the accolade of “next big thing” with smart appliances a key component, which bodes well for Breville’s future.