Are ASX Miners the Best Way to Invest in Iron Ore in Australia?

Commodity analysts and experts claim iron ore trails only oil as the most essential commodity in the world. Iron ore is the primary ingredient used to produce raw steel. Iron ores are the hard rocks and minerals mined from the earth and processed by extracting metallic iron from the rocks or minerals in a cost-effective manner.

There are two main types of iron ore – hematite and magnetite – with each available in a global grading system. Not all iron ore is created equal, with the chemical symbol for iron – Fe – used in grading, as in iron ore rocks with a high grade of iron within them –72% Fe and lower in iron content – 62.9% Fe. Higher grades are known as DSO (direct shipping ore) since those grades can be fed directly into a blast furnace without further processing.

Virtually all of the iron ore mined around the world ends up used in the production of steel – 98%. Energy production and distribution in developed and emerging markets alike virtually guarantee future growth in the demand for the steel needed in these and other applications. Transport vehicles, agricultural infrastructure, electric motors and generators all require steel.

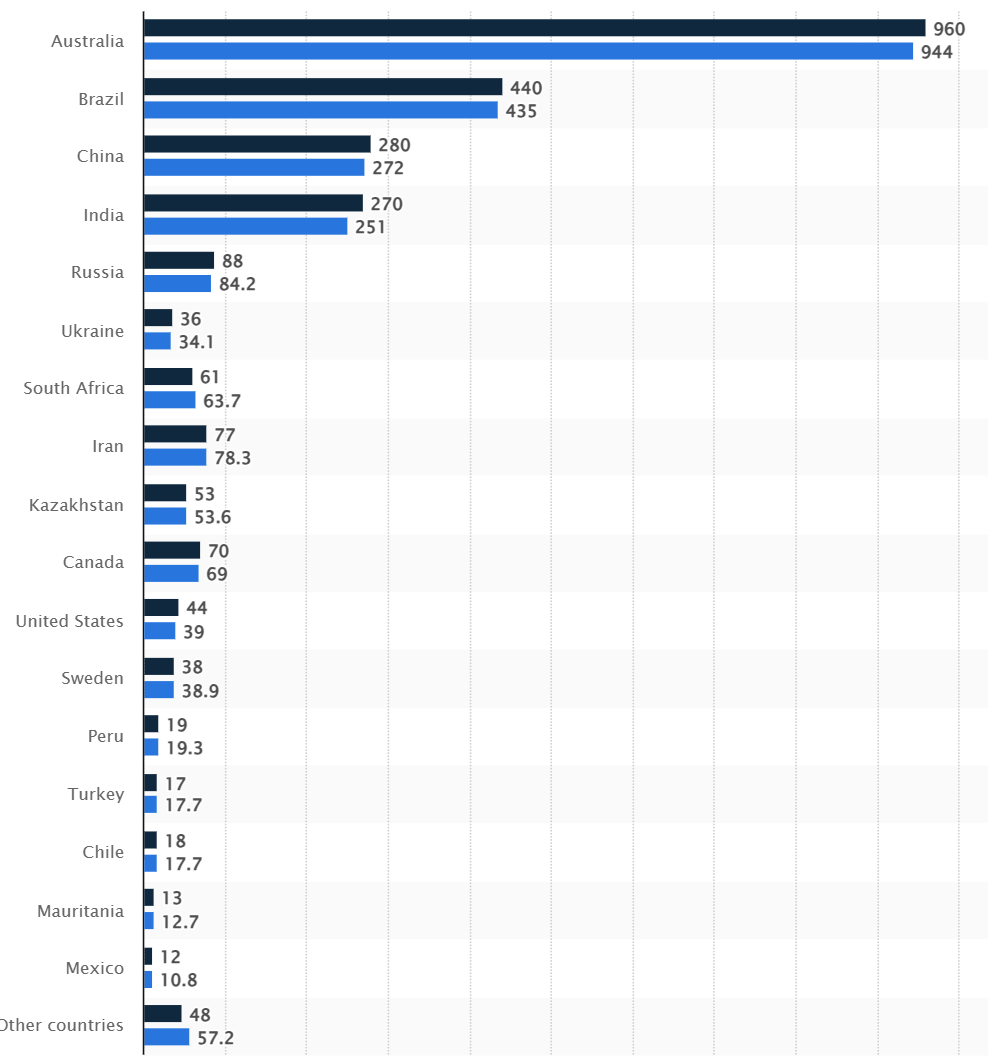

Australia is the largest producer of iron ore on the planet.

Here are the producing countries, listed by production in million metric tons.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: Statista 2024

China was the largest importer of iron ore in the world in 2023, importing 1.18 billion metric tonnes, with its largest source – Australia – accounting for more than half at 737 million metric tonnes.

All commodities have a degree of volatility in pricing fluctuating both with demand and the global economic conditions that impact demand. Given its dominance in steel imports, it would be hard to argue that the most important driver of the price of iron ore is Chinese demand for steel. China’s 2023 imports set a record not likely to be equaled soon given the country’s deteriorating property.

How to Invest in Iron Ore in Australia

There are multiple ways investors can bet on the growth in iron ore demand. Futures and options are derivative instruments allowing investors to speculate on the price of iron ore. They are high risk and complicated enough to be beyond the expertise of many Aussie investors.

There are both mutual and exchange traded funds (ETFs) that track iron ore miners or the price of the commodity.

The safest method and the one with the potential for the highest returns is investing in the best of breed iron ore miners, including promising explorers as well as proven producers.

Proven and Promising ASX Iron Ore Mining Companies

The ASX boasts three of the top iron ore miners in the world along with a multitude of smaller miners and exploration and development companies. The Big Three – BHP Group (ASX: BHP), Rio Tinto (ASX: RIO), and Fortescue Limited (ASX: FMG) – all have expanded what they do with an eye for minerals needed for the transition to a “clean energy” economy. Whether ranked by market capitalisation or revenue, BHP, FMG, and RIO are among the top ten mining companies on the planet.

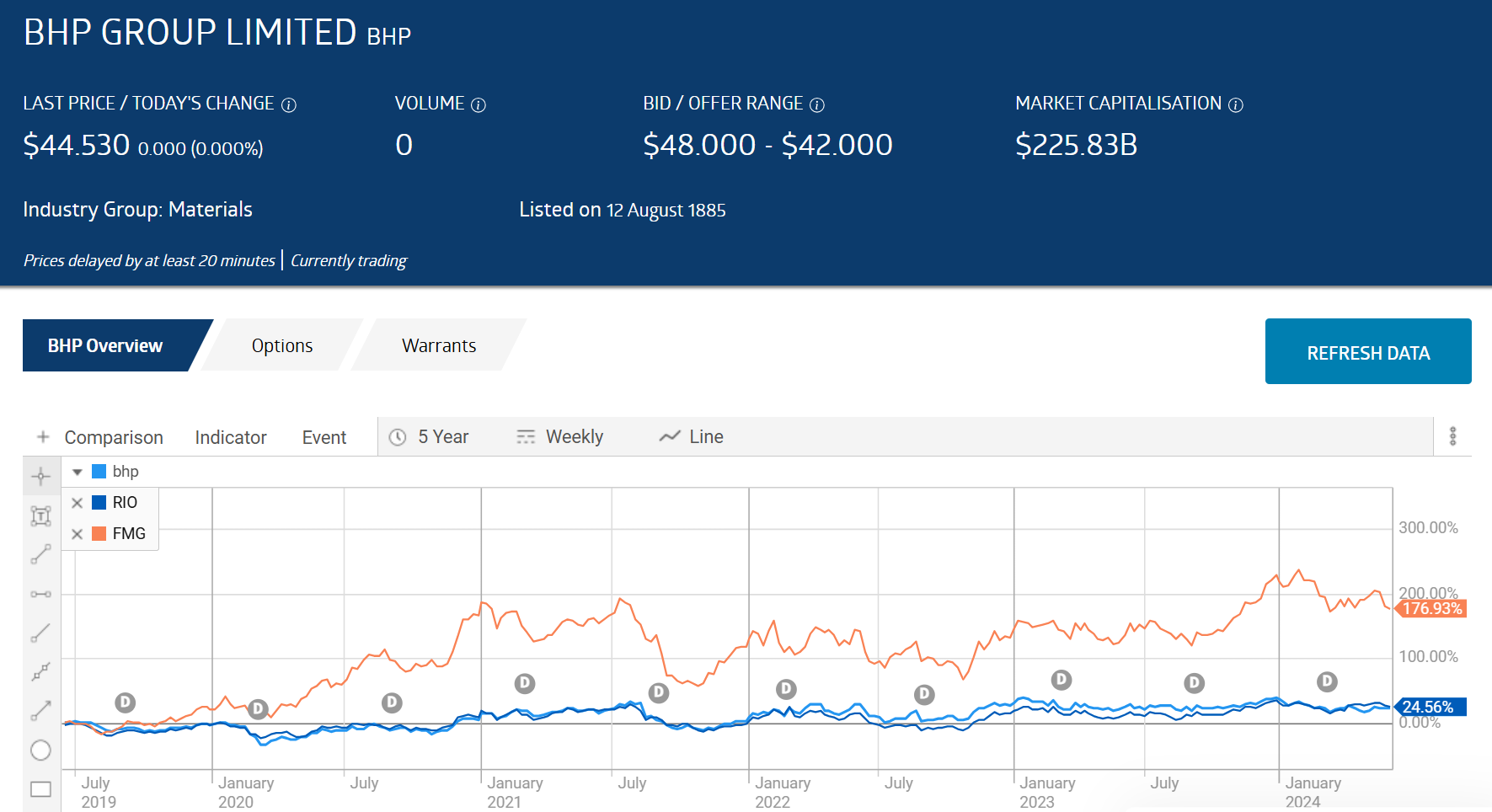

All three have seen declining share prices year to date, suggesting each is worthy of consideration as a bargain stock. Investors who place a lot of credence in analyst recommendations will steer clear of Fortescue, as the Wall Street Journal has an analyst consensus rating of UNDERWEIGHT on FMG shares, with not a single rating of BUY or OVERWEIGHT and seven of twelve analysts reporting recommending investors SELL their FMG holdings.

The journal does not stand alone. Yahoo Finance Australia has an UNDERPERFORM rating on FMG and moderate BUY ratings on both RIO and BHP. Marketscreener.com also has an UNDERPERFORM rating on FMG with OUTPERFORM ratings on both RIO and BHP.

Year to date the three are all in the “red” with Fortescue the worst performer, dropping more than 16%. Year over year the picture shifts, with FMG leading the pack with the only share price appreciating in double digits – up 17.2%.

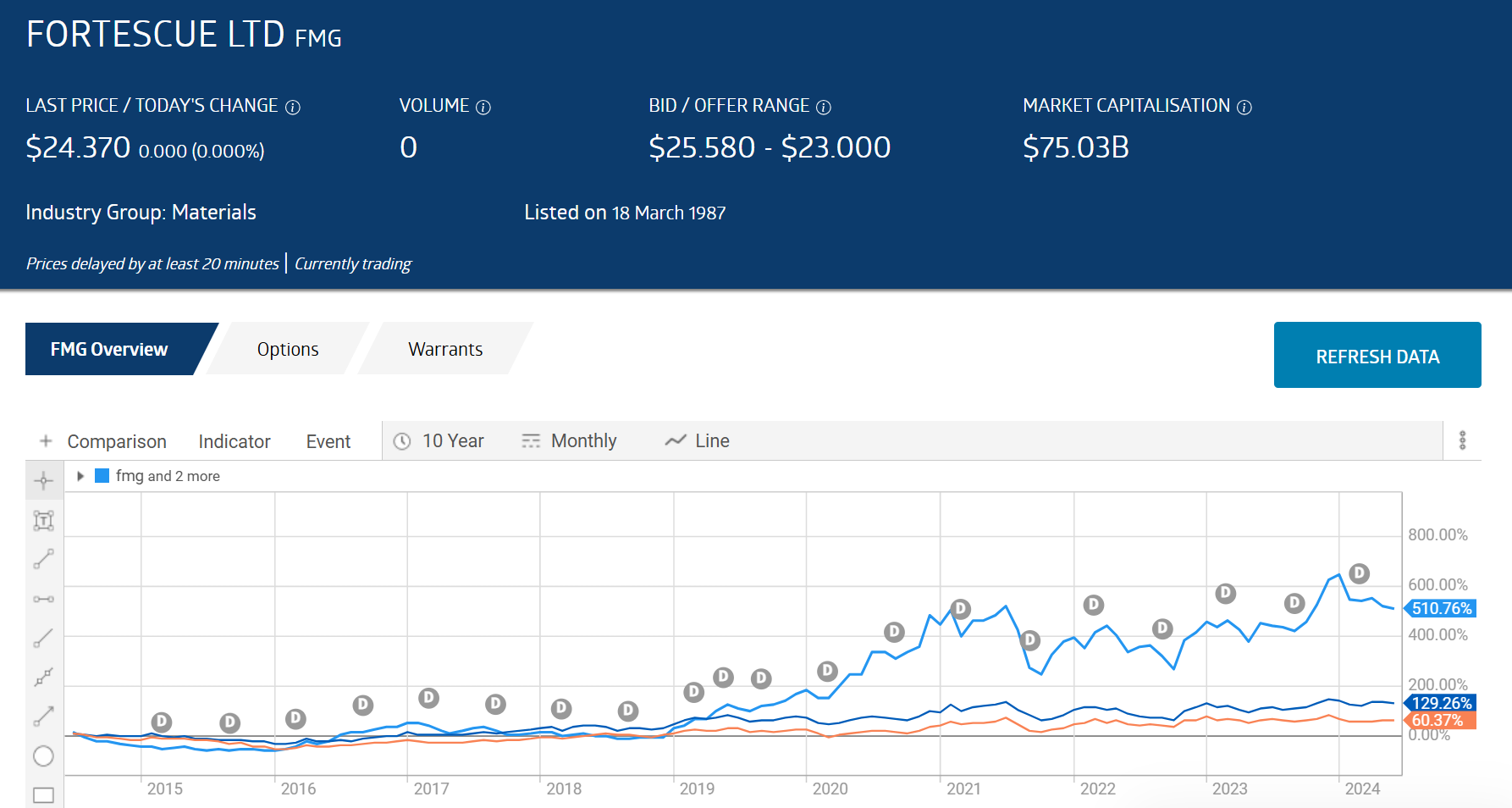

Over ten years the comparison is dramatic, with FMG crushing its larger rivals despite burgeoning debt and lower grades of iron ore mined.

Source: ASX June 2024

Over five years BHP and RIO shares appreciated about 24% while FMG’s shares were up 176%.

Source: ASX June 2024

Of the three Fortescue has set its sights on a single entry into the minerals needed for entry into the new economy – green hydrogen. The company has established a subsidiary – Fortescue Futures – to spearhead its transition to green hydrogen for use in its own mining operations as well as to commercialise the commodity.

Rio is arguably the most diverse, with operations in alumina, bauxite, copper, uranium, borates, titanium dioxide, and lithium supplementing the company’s status as the second largest iron ore operator in the world today – trailing only Brazil’s Vale.

BHP Group mines copper, nickel, and metallurgical coal. The company’s Jansen Potash Project in Canada is expected to begin producing fertiliser in 2026.

All three companies are consistent dividend payers, with Fortescue again leading the way with a five-year average dividend yield of 8.19, while BHP’s five-year average dividend yield is 6.19% and RIO’s is 6,03%.

All three also have Price to Earnings ratios (P/E) below the index average of 19.42, with Fortescue at 6.4, RIO at 9.7, and BHP at 12.4. The P/EG ratio (price to earnings growth ) takes forecasted earnings into account with ratios under 1.0 signaling the stock is undervalued. RIO’s P/EG is 0.12; Fortescue’s is 0.18; and BHP’s is 0.47.

All three saw revenues and profits decline in FY 2023. For the Half Year 2024, Fortescue’s revenues were up 21% while net profit rose 41%. BHP’s Half Year 2024 results were abysmal, with a 6% revenue increase but an 86% decline in net profit.

While Australia’s top iron ore miners share prices are in decline, there are two high-risk small cap iron ore miners worthy of a look for risk-tolerant investors.

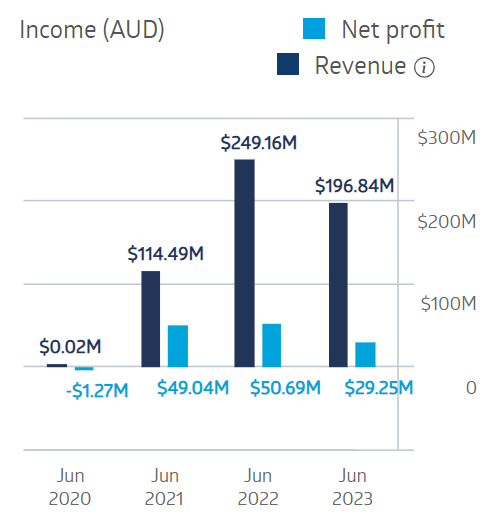

Fenix Resources (ASX: FEX) has been on the ASX since 2008 with its Iron Ridge Mine going into production in December of 202o, showing a loss in FY 2020 before going profitable in FY 2021 and 2022 before slipping back in 2023.

Fenix Resources Financial Performance

Source: ASX

Half Year 2024 results were outstanding with revenues up 46% and net profit after tax up 102%.

Fenix acquired two shuttered mining operations and infrastructure from Mt Gibson Iron (ASX: MGX). The company plans to carve a niche as a low cost, high grade, high margin, high profit producer. As of 7 March the company announced its first iron ore shipment from the Twin Peaks Direct Shipment Iron Ore Project slated to become the company’s second producing iron ore mine following an agreement with locally owned iron ore explorer 10M Pty. Ltd.

On 13 March Fenix announced a $70 million dollar logistics contract with regional iron ore producer Gold Valley.

Tiny Equinox Resources(ASX: EQN) listed on the ASX in October of 2021, with the share price appreciating 72.7% since the company began trading and 204% year over year.

Source: ASX 11 June 2024

The company’s flagship asset is the Hammersley Iron Ore Project in the Pilbara region of Western Australia. The company also has Rare Earth Elements (REEs) assets in Brazil and lithium assets in Canada, all wholly owned.

The company has recently completed a successful capital raise Metallurgical testwork at Hammersley has already identified direct shipping ore mineralisation within Hammersley. Drilling is expected to begin in the second half of calendar year 2024. The company claims the initial direct shipping ore mineral resource estimate is “one of the largest hematite detrital resources in the Pilbara.” The company also announced the expansion of its REE asset in Brazil, increasing the total project land holding.

Iron ore is the second most valuable commodity in the world. Steel needs iron ore and the world, both now and in the “clean energy” future, needs steel.

The safest and potentially most profitable way to invest in iron ore is by buying shares in an ASX listed iron ore miner, bypassing riskier CFD’s and futures options and less rewarding ETFs.

The ASX features three of the world’s top iron ore miners – Rio, BHP, and Fortescue – along with a host of mid and small cap producers and explorers.