- Domino’s has franchise rights in the Asia Pacific region and in Germany, France, Belgium, and the Netherlands.

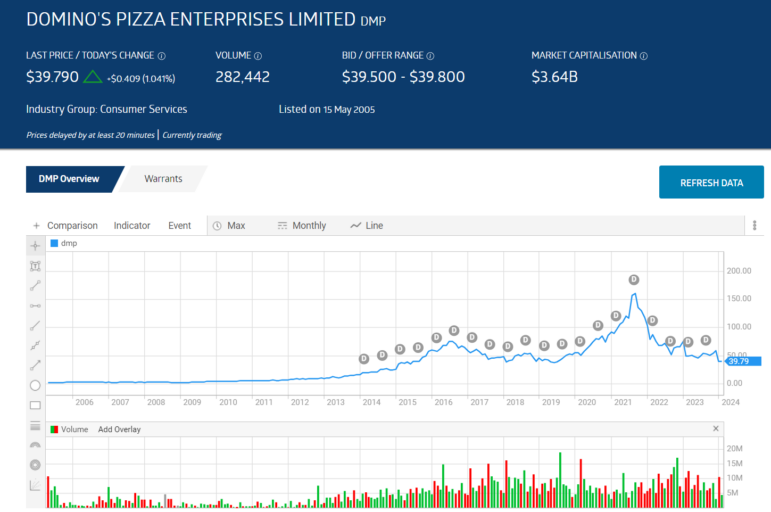

- The share price is down 75% since hitting an all-time high at the beginning of the 2021 trading year.

- Year over year the share price is now down double digits.

Domino’s Pizza Enterprises raised dividend payments from FY 2014 to FY 2021 before cutting the dividend in FY 2022 and again in FY 2023. The share price was trading at all-time highs – around $164 per share – in early January of 2021.

Source: ASX

The share price declines continue, with DMP down 44.3% year over year, with a significant sell-off coming at the end of January 2024 when a company trading update highlighted weak same store sales in the Asian market.

Despite the drop in share price the company maintained dividend payments over one dollar per share, dropping from $1.73 in FY 2021 to $1.57 in FY 2022 and $1.10 in FY 2023. The five year average dividend payment is $1.37 per share with a five year average dividend yield of 2.08%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The company’s track record of dividend payments in challenging times suggests Domino’s will continue to be a strong dividend payer.

An analyst at Bell Potter Securities has a BUY recommendation on, citing positive business results in Australia and New Zealand countering troubles in Japan as evidence the stock has been oversold, “as Domino’s remains a leader in the sector.”

Marketscreener.com has an analyst consensus rating of HOLD on DMP shares, with two of the fourteen analysts reporting at BUY, three at OUTPERFORM, six at HOLD, two at UNDERPERFORM and one at SELL.

The Wall Street Journal also has an analyst consensus rating at HOLD, with three analysts reporting a BUY recommendation, three at OVERWEIGHT, seven at HOLD, one at UNDERWEIGHT, and three at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy