- Mineral Resources offers investors the chance to diversify their holdings with one stock.

- The company’s historical stock price movement is exemplary, but the stock is down this year.

- In the past five years, investors have had opportunities to buy Mineral Resources stock on the dip.

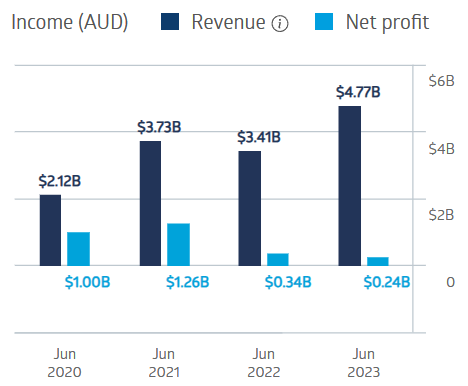

Mineral Resources (ASX: MIN) mines two commodities – iron ore and lithium – with both subject to volatile fluctuations in pricing. The company also offers ‘dirt to port’ mining services for the Australian mining community. The mining services operations offer the company some safety as in most cases not all commodities decline in sync. The company’s financial performance over the last four years reflects volatility from commodities.

Mineral Resources Financial Performance

Source: ASX

The company has a five-year average dividend payment of $1.37 per share, fully franked, with an average yield of 3.42%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Over five years, the share price is up 328.85%, but year over year the stock price is down 23.04%.

Source: ASX

The chart shows ample opportunities over the last five years to invest in this quality company on the dip.

An analyst at BW Equities has a BUY recommendation on Mineral Resources, lauding the company’s expansion into the lithium sector, and expressing the belief that the stock “offers good value”.

In general, analysts are bullish on Mineral Resources.

The Wall Street Journal is reporting an OVERWEIGHT rating on MIN shares, with 11 analysts at BUY, two at OVERWEIGHT, two at HOLD, and three at SELL.

MarketScreener is reporting a consensus OUTPERFORM rating on MIN, with nine of the 16 analysts reporting holding BUY ratings, two at OUTPERFORM, two at HOLD, one at UNDERPERFORM, and two at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy