- In 1997, the founders of Carsales.com created an alternative way to advertise vehicle sales – the internet.

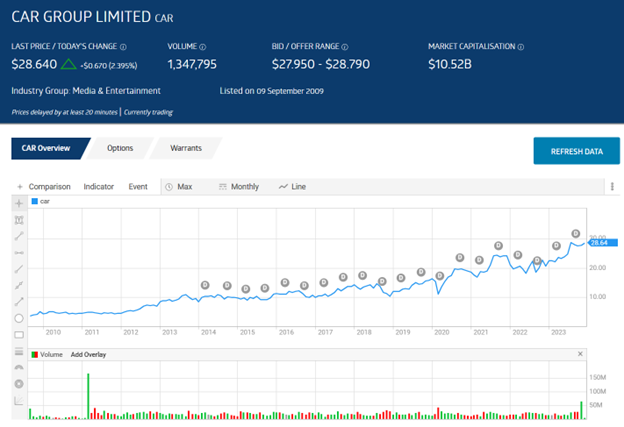

- By 2009, when the company was listed on the ASX, the digital revolution was in full swing.

- CAR Group has grown organically through technology applications in its business offerings and through acquisitions.

CAR Group’s primary revenue-generating markets are Australia, North America, South Korea, and Brazil, with well-known branded digital platforms in each country.

In the company’s FY 2023 financial results, one of the highlights was the completion of the acquisition of the Trader Interactive platform in the US and the Webmotors platform in Brazil.

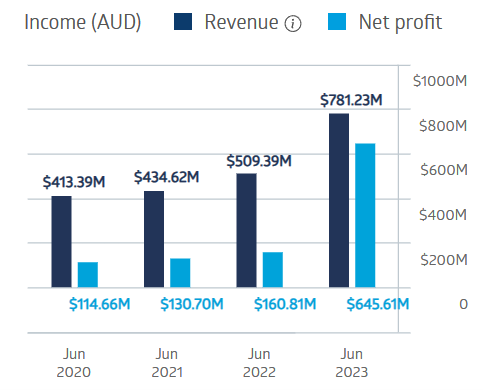

The financial results continued the company’s uninterrupted trend of increasing revenues and profit over the last four fiscal years.

CAR Group Financial Performance

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The share price has flirted with intraday 52-week highs in September, October, and November, up 39.06% year to date. Over five years, the share price is up 154.33%, and since listing on the ASX in 2009, the share price is up 705.05%.

The company began paying dividends in 2013 and has increased the amount paid per share every year, with a five-year average payment of $0.47 per share and a five-year average dividend yield of 2.55%. FY 2023 dividends paid came to S0.65 per share.

An analyst at Catapult Wealth has a HOLD recommendation on CAR Group shares, citing its strong presence in Australia and its international exposure in the US, South Korea, and Latin America. The analyst called the shares “fairly priced” and advised investors to watch for weaknesses.

The mean consensus of sixteen analysts rating the stock is OUTPERFORM, with seven at BUY, three at OUTPERFORM, five at HOLD, and one at UNDERPERFORM.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy