Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

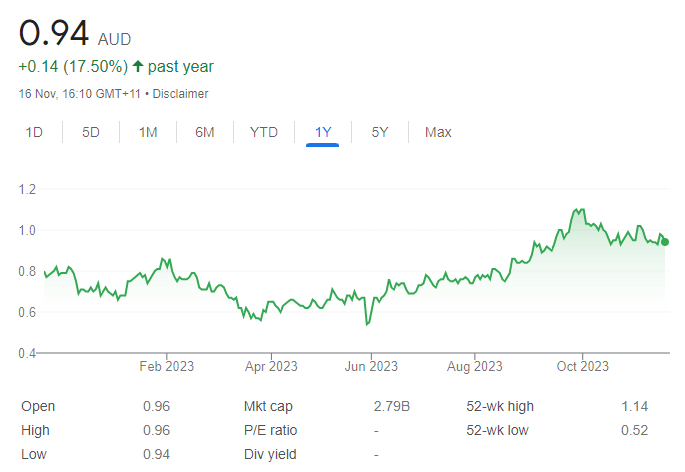

BUY – Paladin Energy (PDN)

In a resurgent uranium market, PDN is poised for an upswing as its Langer Heinrich mine approaches a return to production. First volumes are targeted for the first quarter in calendar year 2024. The company is in a sound financial position. Uranium prices have hit decade highs and the outlook is brighter. Favourable industry demand and supply dynamics contribute potential upside to a company we regard as a speculative buy.

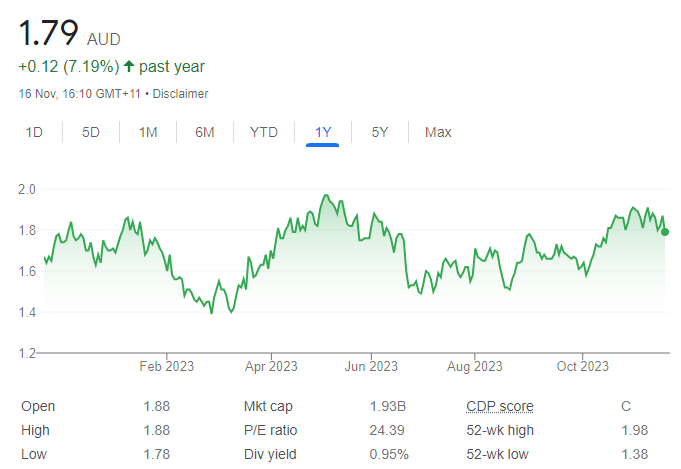

BUY – Gold Road Resources (GOR)

This unhedged gold producer should continue to benefit if Australian dollar spot gold prices keep rising. GOR recently delivered an impressive September quarter report. It posted record production, with all-in-sustaining costs below the spot price. The shares have been trending up since the start of October. We rate GOR as a speculative buy.

HOLD RECOMMENDATIONS

HOLD – Domino’s Pizza Enterprises (DMP)

Rising network sales and strategic initiatives paint an encouraging outlook for this fast-food giant. The product value offering for consumers is attractive. A link-up with Uber bolsters an already solid delivery service. Current levels offer value for patient shareholders.

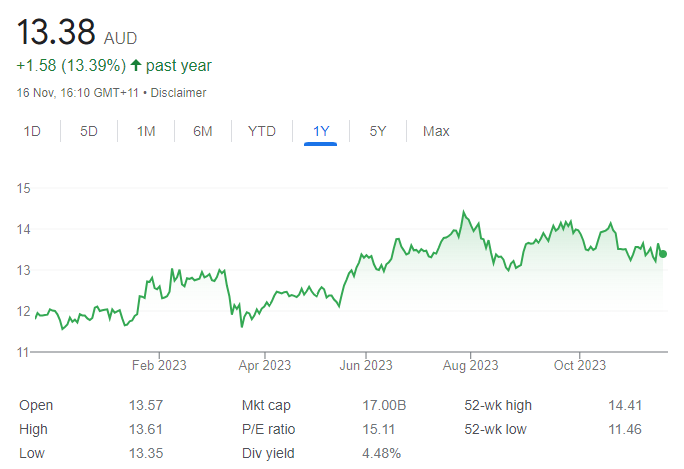

HOLD – Suncorp Group (SUN)

This financial services company posted a solid fiscal year 2023 performance. Group net profit after tax of $1.148 billion was up 68.6 per cent on the prior corresponding period. The gross written premium across Australia and New Zealand was up 10.8 per cent. SUN’s long-term outlook remains positive. We retain a hold rating pending a decision from the Australian Competition Tribunal on the planned sale of Suncorp Bank to ANZ.

SELL RECOMMENDATIONS

SELL – Bank of Queensland (BOQ)

Fiscal year 2023 statutory net profit after tax of $124 million was down 70 per cent on the prior corresponding period. Material one-off items after tax, such as an impairment of goodwill, restructuring costs and the group’s remedial action plans contributed to the profit fall. The net interest margin of 1.69 per cent was down 2 basis points. Fierce competition and slower credit growth may pressure revenue and margins moving forward. Other peers look more attractive from a risk-to-reward perspective.

SELL – Bubs Australia (BUB)

Shares in this infant formula company have fallen from 35 cents on January 25 to close at 16.5 cents on November 16. Group revenue of $60.1 million in fiscal year 2023 was down 32.7 per cent on the prior corresponding period. Revenue in China was down, but significantly up in the US. Expanding in the US is a company priority, but it isn’t an easy market to penetrate at scale. Better opportunities exist elsewhere, in our view.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Harrison Massey, Argonaut

BUY RECOMMENDATIONS

BUY – Global Lithium Resources (GL1)

The exploration company owns the Manna and Marble Bar lithium projects in Western Australia. GL1 has a combined mineral resource of 54 million tonnes at 1.09 per cent lithium oxide. The company is undertaking a 50,000-metre reverse circulation and diamond drilling program, which could further upgrade the mineral resource estimate in the first half of fiscal year 2024. Mineral Resources owns 9.6 per cent of the shares on issue.

BUY – Patriot Battery Metals Inc. (PMT)

Earlier this year, the company announced a significant maiden resource of 109.2 million tonnes at 1.42 per cent lithium oxide, which put the asset on a globally significant scale. In October, the company announced the discovery of a new mineralised high-grade zone called CV13, with sample sizes of between 3 per cent to 5 per cent lithium oxide near the surface. We expect Patriot to release an array of assay results in the next six-to-nine months, which could further increase its resource estimate.

HOLD RECOMMENDATIONS

HOLD – Mineral Resources (MIN)

In the Pilbara region, MIN lifted iron ore production by 16 per cent in the first quarter of fiscal year 2024 when compared to the previous quarter. The average realised iron ore price was US$99 per dry metric tonne, up 9 per cent on the prior quarter. Also, the company produced 64,000 dry metric tonnes of spodumene concentrate at Mt Marion, a 7 per cent increase on the prior quarter. Spodumene concentrate shipments rose 5 per cent. MIN remains a solid portfolio hold at current levels.

HOLD – Whitehaven Coal (WHC)

In October, Whitehaven announced it had acquired 100 per cent of the Blackwater and Daunia metallurgical coal mines from BMA for an aggregate cash consideration of $US3.2 billion. In our view, the deal should deliver diversification, scale benefits and strengthen WHC’s position in growth segments of the coal market. Despite headwinds faced by the sector, Whitehaven is worth holding in portfolios seeking energy exposure.

SELL RECOMMENDATIONS

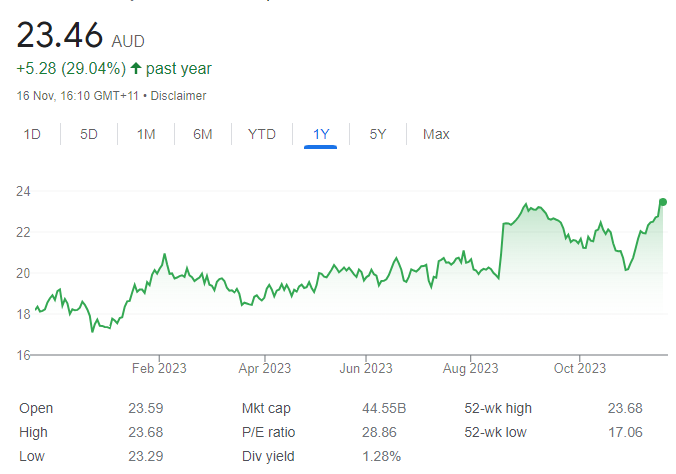

SELL – Fortescue Metals Group (FMG)

FMG’s share price has performed strongly in the past month due to better than anticipated iron ore spot prices. Total ore mined increased in the September quarter and the company met previously announced guidance. The share price was recently bordering on two-year highs, so investors may want to consider locking in a profit at these levels.

SELL – Bank of Queensland (BOQ)

Investors were disappointed with its full year 2023 result, with cash earnings after tax of $450 million representing an 8 per cent fall on the prior corresponding period. The lending market is highly saturated and the bank experienced slower levels of credit growth and higher funding costs, which increased its operating costs by 8 per cent. Other financial institutions appeal more at this time.

Oliver Matthew, Marcus Today

BUY RECOMMENDATIONS

BUY – Lynas Rare Earths (LYC)

The rare earths miner enjoyed a significant share price rise in October after its Malaysian operating licence was extended until March 2026. LYC has signed a follow-on contract with the US Department of Defence for the construction of a heavy rare earths component at the Lynas facility in Texas, as the US seeks more domestic rare earths processing. Rare earths prices have also risen since the lows in July. We believe the latest developments provide a catalyst for further gains.

BUY – Telstra Group (TLS)

This telecommunications giant is attracting new customers following the Optus network crash. The company has guided underlying EBITDA to range between $8.2 billion and $8.4 billion in fiscal year 2024. Underlying EBITDA was $8 billion in fiscal year 2023. The company’s T25 strategy remains on track. Despite recent gains following the Optus crash, the share price is still below its long-term trading range average and remains our choice in the telecommunications sector.

HOLD RECOMMENDATIONS

HOLD – Northern Star Resources (NST)

The gold miner reported a positive September quarter. It announced record production at its Thunderbox operations. NST generated underlying free cash flow of $28 million. The company retained fiscal year 2024 guidance. The stock has been rising since the start of the Middle East war. We expect the share price to gradually rise if the conflict continues and bond yields fall.

HOLD – Goodman Group (GMG)

GMG is an integrated property group with operations in Australia and abroad. It reported like-for-like net property income growth of 4.9 per cent in the first quarter of fiscal year 2024. Portfolio occupancy across its partnerships is 99 per cent. The company is forecasting operating earnings per share growth of 9 per cent in fiscal year 2024.

SELL RECOMMENDATIONS

SELL – Alumina (AWC)

Alumina holds a 40 per cent share in Alcoa World Alumina and Chemicals (AWAC). The company invests in bauxite mining and alumina refining through AWAC. The company reported a statutory net loss after tax of $US43 million for the half year ending June 30, 2023. No interim dividend was declared. Weaker market demand for aluminium has impacted alumina prices. The shares have fallen from $1.45 on August 1 to trade at 73.2 cents on November 16.

SELL – Domino’s Pizza Enterprises (DMP)

The shares have fallen from $75.81 on January 30 to trade at $51.92 on November 16. DMP is up against a growing number of struggling households dealing with soaring cost of living pressures and higher interest rates. In our view, the company is still trading on a lofty price/earnings ratio, so we expect the shares to remain under pressure in the short to medium term. Investors may want to consider cashing in some gains.

Related Articles:

- Australian Automated Trading Software

- The Best Australian Forex Brokers

- How to Start Forex Trading in Australia

- How to start CFD Trading

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.