The Australian Stock Exchange has managed to escape a plunge into official Bear Market Territory but there are some market experts of the opinion it is only a matter of time before we follow the lead of US markets into the abyss. All major US exchanges are in Bear Market territory and still falling.

In mid-week as September of 2022 began to fade away, US markets roared back with the DJIA (Dow Jones Industrial Average) gaining more than 600 points, only to lose it all by the end of the week, with both the Dow and the S&P 500 hitting fresh 52 Week Lows in the closing days of the week.

While some investors will gladly heed the advice to put the idea of adding stocks to your portfolio on hold, others are ready to look for worthy investments. Surely US markets are telling us there is blood in the streets and while the ASX remains out of Bear Territory, the situation for equities is hardly favorable.

30 September marked the end of the week, the month, and the second quarter of FY 2023. On that final trading day the ASX 200 fell 1.2%, following the lead from the prior day’s trading on the US markets. ASX Gold miners were spared the pain, taking nine of the ten spots on the ten best performers of the day list.

Over the month the index lost 7.5%. For the Fiscal Year 2022 the index fell 10.2%, only the third time over the last decade that the ASX 200 posted a yearly decline.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

In volatile times like these with no end in sight, even passive investors are stirred to action, if nothing more than reviewing their holdings. Retail investors do not lack for a range of opinions on what to do. Some experts claim retail investors should essentially freeze their portfolios, buying nothing new and avoiding panic selling of what they own.

Others adhere to the time-honored advice of buying low and selling high, but it appears retail investors are shunning that advice, questioning how low can we go? The US financial website CNBC is reporting that online search trends for equity investing related queries have fallen back to the safer time in the pre-pandemic days.

While stocks hitting 52 week lows seem a favorable place for prospecting for stocks that over time prove to be bargains as their price per share rises, what of stocks hitting 52 week highs?

In ordinary times, many investors follow the advice to “buy high and sell higher.” A potential hunting ground for these investors is a list of stocks hitting 52 week highs.

In both cases the journey toward that hallmark is a prolonged period of slow but steady movement, trending upward or downward. And in both cases the trend can end, sometimes violently. It takes a catalyst of some kind to accelerate or break a trend. Catalysts can be news accounts or market announcements.

While no one can predict a market bottom or top, the nature of the announcement can be helpful in assessing the likelihood the trend will continue.

Fiscal Year Financial Performance announcements can dramatically impact a share price. Announcements of upcoming capital raises or acquisitions can be even more impactful. Positive news about a company project is another, but in every case a question for an investor to ponder is how long will the news remain relevant?

A discovery of a new mine may cause the share price to shoot up in the short term, but it could take years before the discovery progresses to a profit-generating operation.

There were two ASX stocks that hit 52 week highs this week that bear watching. Only the bold or perhaps the foolhardy will plunge in during the first week of October as there are market-moving events on the calendar in the next few weeks.

On 4 October, the Reserve Bank of Australia (RBA) is expected to increase the cash rate by 0.5%. Of equal or perhaps greater importance is what the RBA has to say about the future economic situation here in Australia.

On 13 September global markets recoiled in shock and terror as the latest inflation reading from the US came in below expectations, with sub-readings like a 6.3% rise in core inflation deeply troubling. Market participants had lulled themselves into a complacent state, believing rising interest rates were about to begin to take a toll on inflation.

On 13 October, another reading out of the US has the potential to send markets spiraling deeper into the abyss or resuming an upward trend. Market analysts and expert who still believe a recession is unlikely may reverse their opinions should the report be negative.

On 25 October, the FY 2022-2023 Australian Federal Government Budget is due to be released, with the market community looking for a budget stimulatory if needed to spur the economy, but not enough to lead to a recession.

Although Lindian Resources (LIN) has been trading on the ASX since the beginning of this century, the company has not operated in its current form as a bauxite miner with projects in Africa until 2017. The company has a market cap of $271 million dollars. The share price is $0.33, with a 52 week high of $0.36 and a 52 week low of $0.03.

The company has yet to generate any revenue or profit from its four bauxite mining projects, but the stock price has been inching sideways since the shift to bauxite in 2017 before taking a steep upward turn beginning in May of this year.

Over five years shareholders have enjoyed an average annual rate of total shareholder return of 81% and 177% over three years.

The boosts began in late May when the share price was at $0.048 per share. Lindian announced a preliminary out of court settlement that would allow Lindian to acquire a 100 per cent interest in Rift Valley Resource Developments, and with it that company’s Kangankunde Rare Earth Project in Malawi. Rift Valley had been fighting for control of the project for fifteen years. Apparently what broke the stalemate was Rift Valley’s sale of a 75% interest in the project in 2018 to Lindian.

On 27 September, the company announced Lindian’s shareholders had approved the acquisition of a 100% interest in Rift Valley.

In January of 2020 Lindian generated some buzz with Aussie investors with a positive drilling announcement from the company’s flagship asset, the Gaoual bauxite project in West Africa.

The Gaoual Project is still under development with management raising capital for Gaoual and the newly acquired Kangankunde Rare Earth Project with two share placements, the first in November of 2021 and the second in May of 2022. Anxious investors frown on capital raises frequently since they dilute the value of existing holdings, but Lindian shareholders accepted the placements without selling off the shares.

Rare earth metals are among the “hot metals/minerals” vital for electric cars, smart phones, and industrial applications. The Kangankunde Project has the potential, size, grade, and quality to be considered a world class rare earths resource. Kangankunde has been on the mining radar since 2004 with licensing and legal issues keeping the project in limbo.

Although Lindian management claims its long term bauxite development strategy calls for developing a “northern corridor “ of producing assets in Guinea, with the Woula Project and the Lelouma Project joining the Gaoual Project. The latest investor presentation from late August in 2022 indicates the Kangankunde Project will be the company’s primary focus throughout the remainder of 2022 and into 2023.

Another company hitting its 52 week high might surprise investors with an early interest in what was to be the “next big thing” – marijuana stocks – only to see them stumble, fall, and in many cases disappear in a sea of missed expectations.

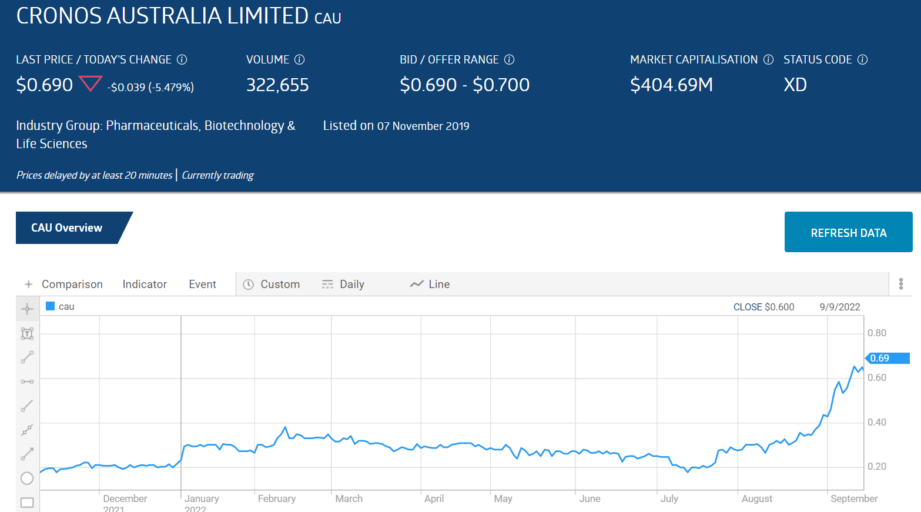

The company is Cronos Australia (CAU) with a market cap of $405 million dollars and a current share price of $0.69 with a 52 week high of $0.75 and a low of $0.014.

Like Lindian, the share price had been trading largely sideways with some upward movement before taking off in mid-July of this year.

Cronos originally came to Canada via one of that country’s cannabis giants – Cronos Group. Cronos Group, like many of the early entrants into the mad dash towards the massive profits many analysts forecasted once recreational marijuana sales were legalised, had recreational marijuana as its primary focus along with medicinal use products in the adjunct field of medical marijuana.

Cronos Australia abandoned the cumbersome business model calling for growing marijuana and producing and distributing brands, all the while coping with burdensome regulations. Cronos Australia moved quickly into medical marijuana, using technology to take the process a step further.

The company had planned to build its own marijuana manufacturing facility here in Australia while importing and selling Cronos Group brands imported from Canada, but that all changed dramatically in September of 2021. Cronos Australia announced its intention to merge with CDA Health Pty Ltd.. The Cannabis Doctors Australia’s (CDA) primary mode of operation was telehealth, but the company had some in-person clinics on the East coast of Australia.

The merged entity then developed an artificially intelligent platform called CanView linking patients, doctors, and pharmacists. Cronos is in the process of rolling out CanView 2.0 in a six step introduction of new features targeting each linked group in the platform. The 2.0 Features are in place for pharmacists.

The company’s Full Year 2022 Financial Results were beyond solid, with year over year revenue growth of 208% and net profit after tax growth of 324%. In addition, Cronos Australia became the first ASX marijuana stock to issue a dividend – one cent per share. Looking forward to 2023 the company highlighted its towering competitive advantages :

- 700 authorised physician prescribers

- 2,800 dispensing pharmacies

- 7,000 regular patients

- 160+ branded products from 25+ suppliers.