In 2011 the International Energy Agency (IEA) posed an intriguing question in a special report on the world energy outlook.

At the time oil and gas producers in North America were in the midst of a booming market for shale gas drilling; nuclear power was facing a troubling future, and facilities for liquefying natural gas (LNG) were sprouting here in Australia and Qatar, among other areas.

While the increased supply of natural gas from shale did drive down the price of natural gas in the US to eclipse coal as the most cost efficient source for generating electricity for a time, the LNG promise dimmed quickly.

Experts badly underestimated both the completion time and the cost required to build operational liquefication facilities and supporting infrastructure. Over time the situation improved, with Australia now vaulting into the top spot among the world’s exporters of LNG, supplanting Qatar.

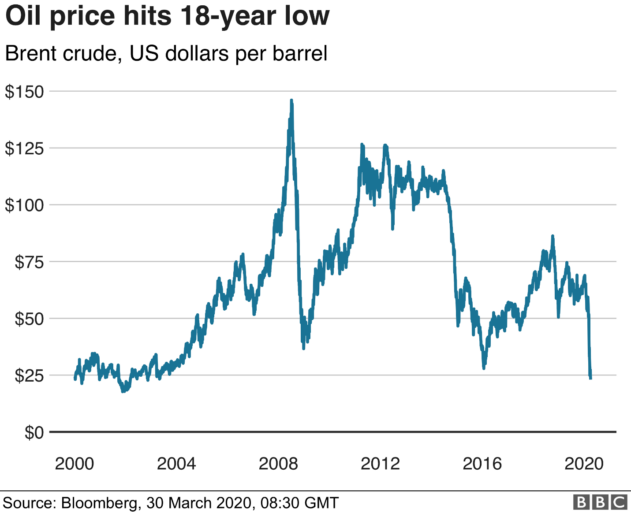

Early enthusiasm and limited supply along with rising oil prices pushed LNG pricing higher. LNG was sold on long term contracts based on the price of oil, which was on the rise until excess supply conditions led to a decline beginning in 2014 before rebounding in 2016. In March of 2020, the price of oil hit an 18 year low with losses accelerating in the continued presence of the COVID 19 Pandemic. From Bloomberg.com:

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

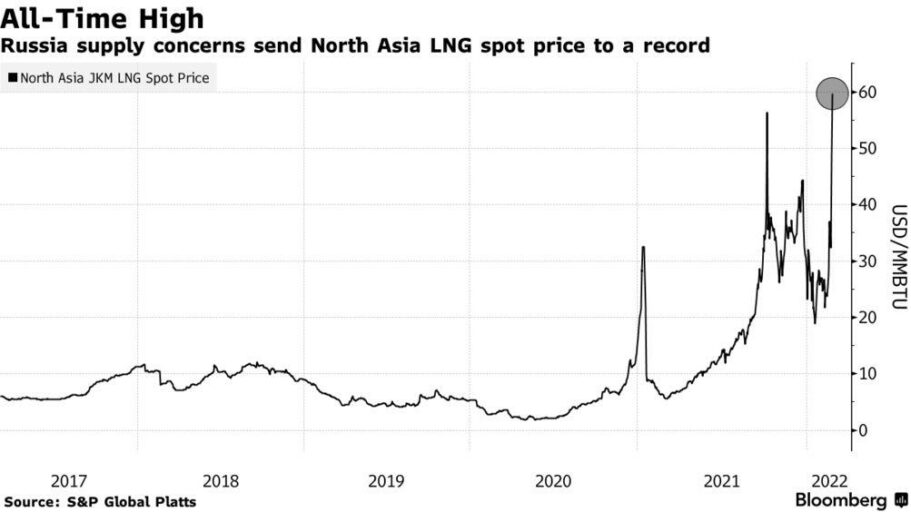

The war between Russia and Ukraine dramatically altered the global energy equation as in Europe and elsewhere the problem of replacing Russian supply became paramount, and the price of LNG skyrocketed. Again, from Bloomberg.com

In the near term, some experts expect the global demand for LNG to rise by 18% between 2021 through 2026, largely due to new supply coming on line.

Others see high prices and continued expansion of market share from a variety of renewable sources as dampening the LNG growth prospects in the longer term.

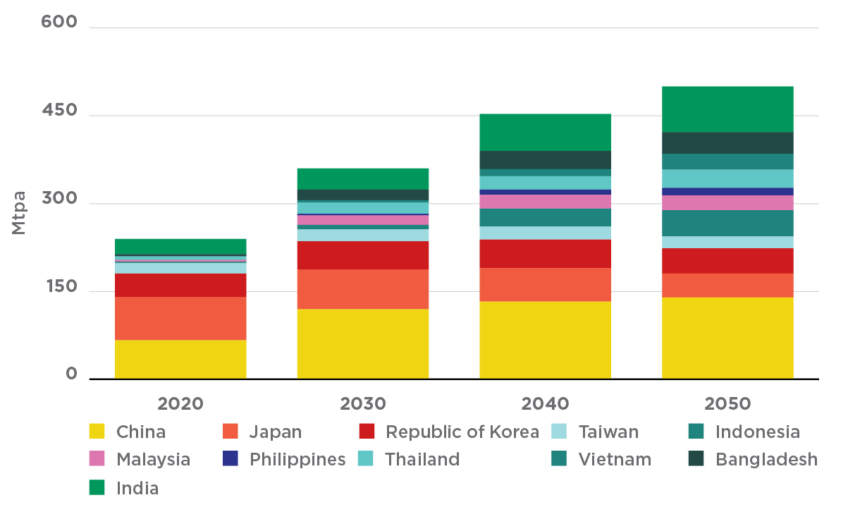

Global Energy Research and Consultancy firm Wood Mackenzie is not one of them. That firm sees global LNG demand increasing 50% by the end of this decade. From the Australian Government Department of Industry, Science, and Resources website:

LNG demand growth in Australia’s high potential markets. Source: Wood Mackenzie (December 2021)

Another global consulting firm – McKinsey & Company – sees LNG’s share of the global energy market increasing from the current 13% share to 23% by 2050.

Risk averse investors frightened by the negative long term projections could learn a lesson from investors with high tolerance for risk who took a chance on ASX coal stocks when that commodity was the subject of multiple pronouncements of coming death warrants. From the ASX website here is the five year share price performance of the two biggest coal mining stocks on the AX – Whitehaven Coal (WHC) and the New Hope Corporation (NHC).

The largest “pure play” LNG producers on the ASX – Woodside Energy Group (WDS) and Santos Limited (STO) – are about to be joined by a third company – Beech Energy (BPT). Integrated energy company Origin Energy (ORG) also has a major LNG producing asset, reporting separately from the company’s other operations. The following table includes relevant share price and historical and future growth metrics for the three companies.

|

Company (CODE) Market Cap |

Share Price 52 Week % Change |

2 Year Growth Forecast Earnings Dividends |

Average Earnings Growth 5 Year 10 Year |

Average Dividend Growth 5 Year 10 Year |

Total Shareholder Return 3 Year 5 Year 10 Year |

|

Woodside Energy Group (WDS) $63.8b |

$33.65 +70.4% |

+33.1% |

+14.4% +1.6% |

+10.2% +4.5% |

+7.2% +8.5% +5.7% |

|

Santos Limited (STO) $25.9b |

$7.73 +25.9% |

+58.2% 34.2% |

+20.8% +1.3% |

N/A -3.3% |

+2.3% +16.2% -0.4% |

|

Beach Energy (BPT) $3.7b |

$1.64 +51.8% |

+56.7% +45.8% |

+5.3% +8.4% |

+0.3% -3.3% |

-12.3% +16.5% +4.5% |

The former Woodside Petroleum is in the process of reinventing itself as the newly monikered Woodside Energy Group, adding new energy to oil and gas as operational entities. Prior to the change, Woodside was strictly in the oil and gas business and one of the earliest ASX entries into the push for LNG.

In 1985 Woodside and its joint partners signed an LNG sales agreement with eight Japanese power companies for supply from the JV’s North West Shelf LNG project. The partnership structure includes Woodside as operator along with BHP, BP, Chevron, Shell, and a 50/50 spilt between Mitsubishi and Mitsui as the sixth partner.

In 1989 the first production and LNG shipments left the North West Shelf, bound for Japan. The project has been expanded twice since its birth. In 2002 China signed a 25 year agreement for LNG supply from the North West Shelf Project.

In 2007 Woodside began construction on another LNG project – Pluto – with production and shipment beginning in 2012.

In 2021 the company began the development of its next project – the Scarborough/Pluto Train 2. Train 2 is an additional liquefication unit added to the Pluto operation.

On 1 June of 2022, the oil and gas assets of BHP were merged with Woodside, creating a top ten global independent energy company and the biggest energy producer on the ASX.

Woodside’s planned “new energy” endeavors include a $5 billion dollar investment to 2030 in three distinct hydrogen and ammonia projects, one in Western Australia, a second in Tasmania, and a third in the US state of Oklahoma.

Finally, Woodside is working in collaboration with US based renewable energy technology company Heliogen Inc to develop solar farms, one in California and another here in Australia to power the operations at the Pluto LNG site.

All three of this companies saw their share price crushed and revenues and profits shrink as the COVID 19 Pandemic decimated energy demand. On 30 August Woodside reported its Half Year 2022 Financial Results, with net profit increasing 414% and revenues up 132%. Shareholders were reward with a tripling of the company’s interim dividend.

Santos has a 30% in the Gladstone LNG project (GLNG) in Queensland as well as a 43.4% interest in the Darwin LNG project (DLNG). In December of 2021, the company merged with Papua New Guinea’s Oil Search Limited, giving Santos claim to the oil assets of Oil Search as well as a 43.2% stake in the Papua New Guinea LNG Project (PNG LNG), operated by Exxon Mobil.

The Oil Search merger puts Santos into position to achieve its stated goal of becoming a leading provider of LNG to the Asia-Pacific Region. Santos already holds the title of Australia’s largest gas supplier to the domestic market.

The company boasts five core assets.

On the border between Queensland and South Australia, Santos produces natural gas, ethane, crude oil, and gas liquids in the Cooper and Eromanga Basins.

Santos has multiple gas assets in the Northern Territory, both operational and in development, with the crown jewel being its stake in the Darwin LNG project.

The company saw its existing stake in the PNG LNG project increased with the merger with Oil Search.

In addition to the company’s stake in the Gladstone LNG project in Queensland, Santos has coal seam gas (CSG) assets in the Bowen and Surat Basins.

Santos is the biggest supplier of gas in Western Australia, with both oil and gas assets and two major oil projects under construction – the Van Gogh Project and the Pyrenees Project.

The company is exploring becoming a “carbon solutions business” through initiating Carbon Capture and Storage projects at its own natural gas operations and extending expertise and assistance to customers and third parties.

Beach Energy has been in business for more than 60 years and on the ASX since 1961. The company’s early growth was organic, with significant exploration and discoveries leading to producing oil and gas assets. In 2016 Beach made its first major acquisition, with Drillsearch Energy followed by Lattice Energy in 2018.

The company has five producing oil and gas operations here in Australia and one in New Zealand.

The company’s Waitsia Gas Project in the Perth Basin is in Stage 2 expansion, with a construction completion target and first LNG sales in the second half of calendar year 2023 followed by Beach’s entrance into the global LNG export market in the first half of FY2024 via the North West Shelf facilities.

Waitsia is a 50/50 JV with Mitsui E&p Australia. BP Singapore has already signed a deal to purchase Beech’s entire LNG output from Waitsia.

The Moomba Carbon Capture and Storage (CCS) project is among Australia’s largest efforts to reduce carbon emissions, and Beach is one of the partnering companies..

Beech’s Full Year 2022 Financial Results had positive news on underlying net profit – up 39% – and sales revenue up 15% – but the mood was soured for Beech investors with the 15% decline in production and a 14% decline in sales volumes. Sales revenues increased due to higher pricing, with average realised oil price up 79%.