Investors addicted to high growth potential are constantly on the hunt for whatever researchers and market analysts are dubbing as “the next big thing.”

Next Big Thing candidates are generally disruptive, as their business models have the capability to disrupt normally accepted business operations. Financial technology, or FinTech, stocks offered a variety of Next Big Thing prospects that fulfilled their promise, with the Buy Now Pay Later and Peer to Peer Lending sectors key among them.

Yet not all survive the gauntlet of running from conception to commercialisation. As far back as 2014 and earlier, a derivative of common graphite was being hailed as a potential “next big thing” – the once dubbed miracle material – graphene.

In 2014 IBM announced a major research project – funded by $3 billion dollars – to replace silicon chips in digital devices, with graphene said to be the leading candidate at that time. Research on employing graphene in a coating technology for multiple industrial applications from paint to concrete to solar panels was underway.

Today graphene use in batteries and energy storage systems is in development, and some companies have begun to commercialise graphene additives in coating materials, but the breathless pronouncements from the start of the last decade have failed to come to pass in large part.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

However, there are impressive developments in the pipeline that could bring graphene into the production of existing lithium ion technologies and graphene stand alone batteries.

As far back as 2015 researchers at Northwestern University in the US built a battery made of silicon and graphite and remain in the hunt for a better battery to this day. The US Department of Energy formed the CEES (Center for Electrochemical Energy Science) to advance the technology used to create the cathode in lithium-ion batteries. Collaborators in the effort include another major engineering school – the University of Illinois at Urbana-Champaign and renowned multidisciplinary science and engineering research center, the Argonne National Laboratory.

Graphene is ideally suited to “coat” other battery metals/minerals resulting in improved performance. Researchers are also working on “hybrid” metals/mineral compositions using graphene and other metals like vanadium.

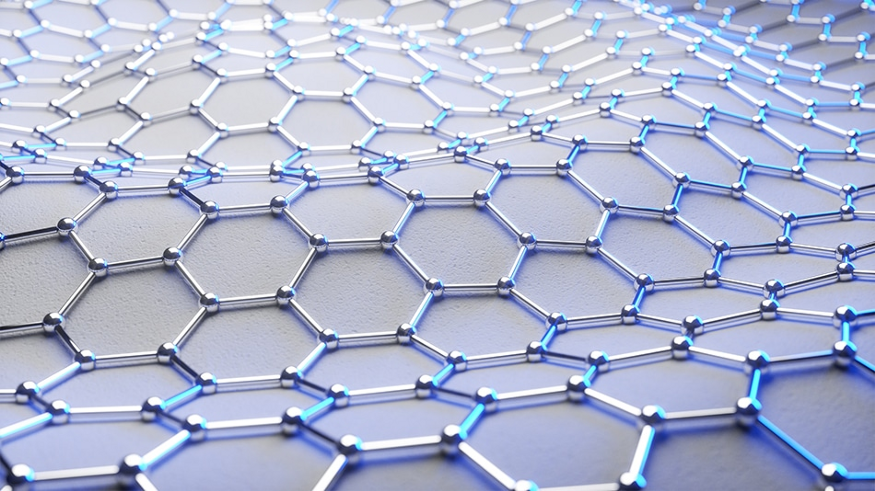

Think of graphene as an ultra-thin “honeycomb” sheet of carbon atoms that is stronger than steel, a better conductor of electricity than copper, and is lightweight, and flexible. A graphene enhanced battery has higher capacity for longer range, faster charging times, and higher temperature range reducing fire risk.

From the website azonano.com, here is an image of the structure of a sheet of graphene:

Given the hype investors have been reading about graphene for more than a decade, why has graphene not lived up to its promise?

The short answer is cost to produce graphene related products on a commercial scale. In addition, researchers are pursuing multiple production paths, making identifying the most promising developments difficult. Perhaps of greater importance is the history of graphene, first discovered in 2004, with researchers experimenting with applications for graphene ramping up at start of the second decade of the 21st century.

In marked contrast, lithium was first discovered in 1814 with the first lithium-ion battery hitting the market in 1990. Researchers have been working on improving li-ion batteries for more than three decades.

The ASX does not include many graphene producers and only one is pursuing battery and energy storage applications, with others considering the possibility. Two are approaching commercialisation of graphene additives for coating applications. The flexibility of graphene and its conductivity make it an ideal material for sensors, and one company is working on bio-medical sensors.

Graphite miner Talga Group has produced and distributed samples of a graphene additive for coating applications, Talphene. However, the company is in the short term focused on bringing its enhanced graphite anodes for batteries to the market.

The company has multiple operating graphite mines in Sweden, with processing plants and necessary infrastructure in place. Talga is the sole owner of its mines and production facilities, enabling “mine to market” operations. The company has 11 automotive and 37 battery manufacturers participating in Talga’s “qualification” stage for product testing and development. The company has financing partners targeted for supplemental project funding.

Talga has two graphene based product lines using the Talphene graphene additive -;Talcrete® graphene for concrete applications, and Talcoat® for marine coatings. Talcoat® is in the trial shipping stage. Talnode®-Si is a silicon based anode for battery use. Talnode®-Si is a byproduct of graphene.

First Graphene (FGR) claims to be the “leading graphene supplier in the world,” transporting graphite from the company’s mining operations in Sri Lanka to its processing facilities in Australia where its flagship offering – PureGRAPH® Graphene – is extracted. This graphene additive is suitable for enhancing a range of products using plastics, composites, rubbers, cement and concrete, and inks and coatings.

Production capacity is commercial scale, with a graphite supply sufficient to produce 100 tonnes of graphene per year. The company’s latest Quarterly Activities Report released in mid-July highlighted First Graphene’s 111% revenue increase in the fourth quarter of FY 2022.

The report also announced a JDA (joint development agreement) with Australian photovoltaic producer Greatcell for the development of graphene enhanced solar cells.

First Graphene has an R&D (research and development) in the UK, associated with the Graphene Engineering and Innovation Centre at the University of Manchester, working on graphene use in supercapacitors, a potential replacement for batteries. Capacitors are devices to store electrical energy, superior to batteries with higher capacity and lower charging time.

Sparc Technologies (SPN) has a dual focus – green hydrogen and graphene additives. The company is a three-way partner in the Sparc Hydrogen Joint Venture, comprised of Sparc, the University of Adelaide, and Fortescue Future Industries to develop green hydrogen using solar power and water via thermo-photocatalysis, a process developed by the University of Adelaide and Flinders University. The solar power is direct sunlight. .

Sparc is now ready to begin the manufacture of graphene based additives on a commercial scale. The company’s ecosparc graphene based coatings additives have been tested successfully, showing 40% improvement in corrosion resistance over traditional epoxy coatings. Commercial scale processing equipment has been ordered and a manufacturing site identified. Trial samples of the ecosparc coating have been distributed.

The company also has graphene enhancing additives for use in concrete construction and with composite materials. Finally, in late December of 2020, Sparc announced the company was launching a biomedical project in conjunction with the University of Adelaide to detect diseases in both humans and animals using graphene-based breath sensors. No project updates have been announced since the initial release.

Sparc is new to the ASX, listing in November of 2020 to promote the graphene technology platform from the University of Adelaide.

Finally, the Sparc website states the company “is evaluating opportunities to produce sustainably sourced graphene and hard carbon materials for high performance battery applications.”

Finally, the once Archer Exploration and now Archer Materials (AXE) jumped from metals mining into quantum computing. Although the extensive work the company has done on a world-first qubit processor chip for powering mobile quantum computers suggests Archer’s primary focus is on quantum computing, the company also is developing health solutions with its A1 Biochip based on chip technology that incorporates graphene. Archer has patent applications for the intellectual property filed to maintain 100% ownership. The chip is under development with the ARC (Australian Research Council) Hub for Graphene Enabled Industry Transformation.

This is a long term project at best, as are the battery and energy storage potential of the other three stocks in the table. The first products out of the box will be the graphene additive enhanced coating, concrete, and composite material products.

The following table included key metrics for the four ASX listed graphene stocks.

|

Company (Code) Market Cap |

Current Share Price |

Share Price 52 Week High 52 Week Low |

Year over Year % Change Year to Date % Change |

Total Shareholder Return 3 Year 5 Year 10 Year |

|

Talga Group (TLG) $409m |

$1.34 |

$2.23 $1.00 |

+3.88% -17.79% |

+47.2% +14.2% +20.5% |

|

Archer Materials (AXE) $221m |

$0.88 |

$2.61 $0.55 |

-56.8% -21.78% |

+94.3% N/A N/A |

|

First Graphene (FGR) $80m |

$0.14 |

$0.26 $0.11 |

-31.7% -33.33% |

-12% +16.5% +0.7% |

|

Sparc Technologies (SPN) $69m |

$1.02 |

$2.18 $0.43 |

+131.8% -37.04% |

N/A N/A N/A |