Newcomers to share market investing are bombarded with bromides about “becoming owners” of a company of their choice, or at least a few pieces of it. They are also advised of the many things to consider before buying their own company, key among them are the differences between companies that pay dividends to their shareholders and those that choose to invest a percentage of their profits into making the company bigger and more profitable.

In the pre-1990’s dividend payments were common and investors expected them. Once the fast moving tech companies arrived on the scene, investors and corporate executives alike preferred growth from the kind of share price appreciation a company expanding rapidly can generate.

In short, dividends were a cash benefit many investors felt they could forgo, but dividends were not the only “benefit” companies offered their shareholders.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What Are Shareholder Benefits?

Stockholder loyalty is a major reason companies pay dividends. Investors attracted to a company’s long term dividend potential are more likely to remain long term shareholders.

In many walks of life, “perks” – or perquisites – are offered to customers for the same purpose –brand recognition and loyalty. Today, reward’s clubs are popular perks offered by many retailers. Take advantage of the perk, join the club, and become a loyal customer.

It is a stretch between retail shopping and investing thousands of dollars into a company, but the perks offered by the few companies that sill have them serve the same purpose – loyalty to the brand.

There is generally a minimum number of stocks purchased to qualify for the perk. Retailer perks come in the form of discounts on company merchandise. For diversified retailers, the perk can be used in any brand the company operates.

Property companies can offer purchase discounts or coupons for one month mortgage payment. Entertainment companies offer discounts at venues and events under their brand umbrella. Financial companies can offer discounts on mortgages.

Do Australian Companies Still Offer Shareholder Benefits?

Australian companies followed the trend set in the US — fewer and fewer companies offering shareholder perks, with cost being a major factor. Establishing the infrastructure needed to enroll shareholders and manage their distribution and payout has proven to be too much to bear for many companies in the modern era. In Australia, one of our most recognizable brand – Coles – no longer offers shareholder perks.

Will Shareholder Benefits Ever Come Back?

Given the dramatic changes the digital age has brought to the shareholder landscape, a return to shareholder benefits Is highly unlikely for several reasons.

Individual investors do not play the same role in the markets as they once did. Institutional and high net worth investors dominate, with little or no interest in discounts. More and more investors are abandoning the once dominant approach of stock-picking in favor of fund investing. Mutual funds started the trend and exchange traded funds (ETFs) allowed retail investors to build a diversified portfolio of holdings with an investment in a single ETF.

Australian Companies With Shareholder Benefits

Domino’s Pizza has offered 40% off discount cards for pizza purchases to shareholders for a limited time as far back as 2006. More recently in October of 2022 the company offered 30% discount vouchers to shareholders, valid until 1 December of 2023.

Here are six ASX listed companies currently offering some form of discount to shareholders.

Viva Leisure (ASX: VVA)

Viva Leisure was listed on the ASX in June of 2019 and posted its first profit in FY 2023, continuing into FY 2024, although dropping slightly. The company operates 476 corporately owned and franchise locations in five different countries with health club facilities catering to a variety of needs from big box general health clubs to women’s only clubs, to swim schools and boutique Pilates and yoga facilities.

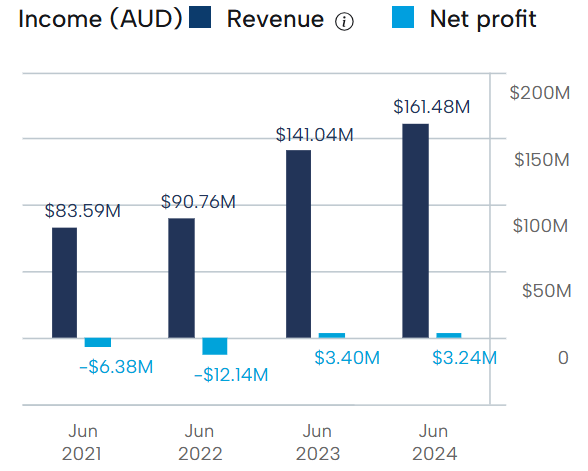

Viva Leisure Financial Performance

Source: ASX 24 February 2025

In FY 2023 revenues rose 55.4%, continuing the pattern of revenue growth since listing while profit shifted upward $15.5 million dollars – from an FY 2022 loss of $12.1 million to a statutory net profit of $3.4 million. Revenues rose again in FY 2024. Half Year 2025 results showed a 25.2% increase in revenue along with a 15.2% rise in net profit.

The company has a facility upgrade and refurbishment effort underway. A February of 2024 report from IBIS World Gym and Fitness Centres shows Viva Leisure with 50% share of the Australian fitness market.

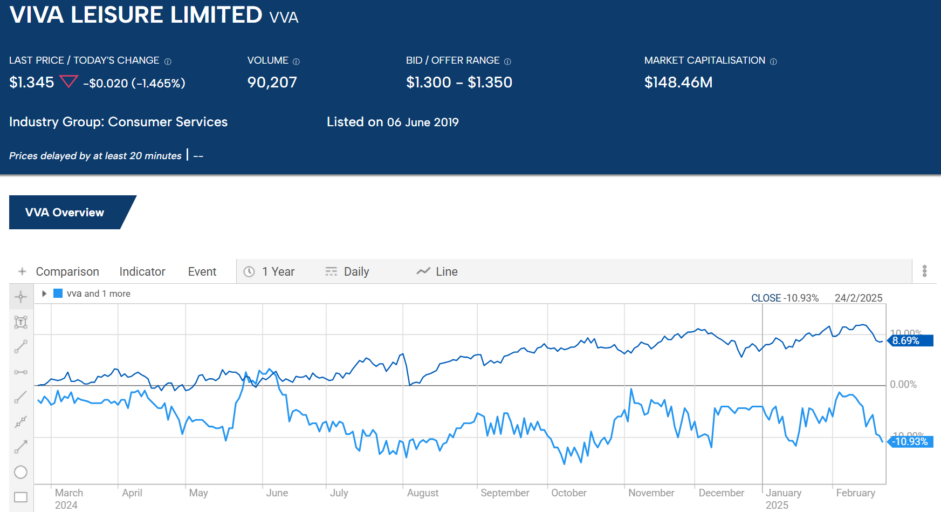

With a ninety day average trading volume of 119,850 shares per day this small-cap, under the radar stock has seen its stock price fall 10.9% year over year. Since listing the stock price is up 28.9%.

Source: ASX 24 February of 2025

A 3 August company announcement in 2023 of a Shareholder Discount Program boosted the stock price 6%. Shareholders with more than 1,000 shares became eligible for a 25% discount on their health club membership. The program was fully automated, run by a technology program created by Viva employees.

The company’s performance to date merits at least a place on an investor watchlist Perhaps the discount program was enough to bump some potential investors into taking action. In any case, Viva’s move shows there still may be some value to companies initiating cost effective discount programs.

EVT Limited (ASX: EVT)

EVT is a diversified provider of entertainment, leisure, and travel experiences. The company operates cinemas, restaurants and bars, hotels and resorts, and Australia’s Thredbo ski and biking resort. The company’s asset portfolio is valued at more than $2 billion dollars. EVT operates here in Australia, in New Zealand, and in Germany.

As expected for all travel and leisure companies EVT’s financial performance was impacted by COVID 19 border closures and lockdowns but has rebounded in both FY2022 and 2023 before profit slipped in FY 2024.

Half Year 2025 results showed a 1.5% drop in revenue and a 14.9% increase in net profit.

The company did not pay a dividend in FY 2021 or FY 2022 but resumed dividend payments with a payment of $0.34 per share in both FY 2023 and FY 2024.

EVT’s shareholder benefit varies by category, with a shareholder benefit card issued to all shareholders with more than 500 shares for use at cinemas, hotels, and the Thredbo resort. Hotel discounts include 15% off the best available room rate and 20% off hotel food and beverages.

Mosaic Brands (ASX: MOZ)

Mosaic Brands – once known as Noni B — entered the Australian women’s fashion scene in 1960, adding additional brand names and now changing its name to reflect the company’s nine brands with around 1,000 stores across Australia and online digital platforms. Mosaic brands are all company owned. The company operates in Australia and New Zealand with the lion’s share of revenues coming from Australia.

Like most retailers with a significant brick and mortar store distribution system, Mosaic was hit hard by the COVID 19 Pandemic but Mosaic never recovered, going into voluntary administration on 28 October of 2024. in FY 2023.

Prior to its collapse Mosaic shareholders with a minimum of 2,000 shares in their portfolio were issued a Shareholders Reward Card offering a 10% discount at any of the company’s brick and mortar outlets.

Beacon Lighting (ASX: BLX)

Beacon Lighting is global in scope, offering customers an array of lighting and energy products the company designs, manufactures, and distributes. Products range from lighting fixtures and fittings to ceiling fans to solar panels and a host of related electrical accessory products. Beacon sells through company owned and franchise stores as well as online.

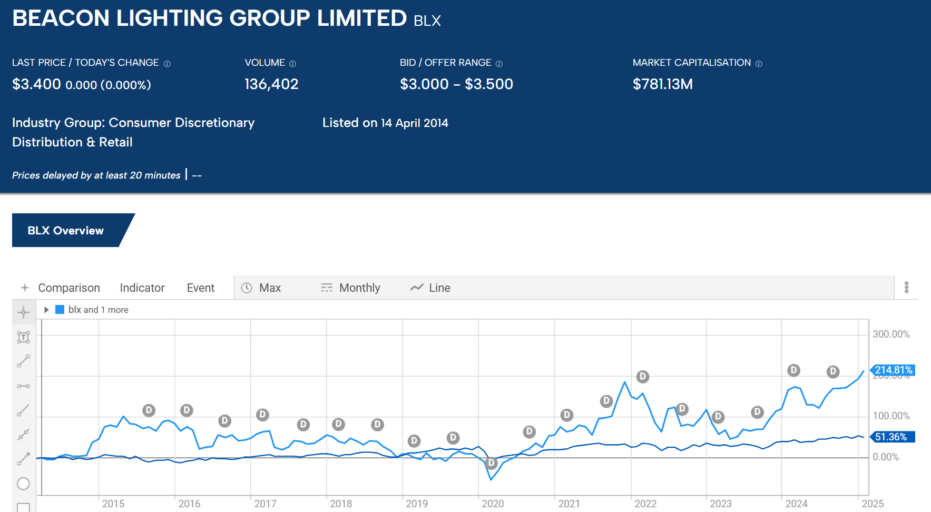

Since listing on the ASX in 2014, the share price is up 214.8%, with a brief dip at the onset of COVID 19 and a rapid recovery.

Source: ASX 24 February 2025

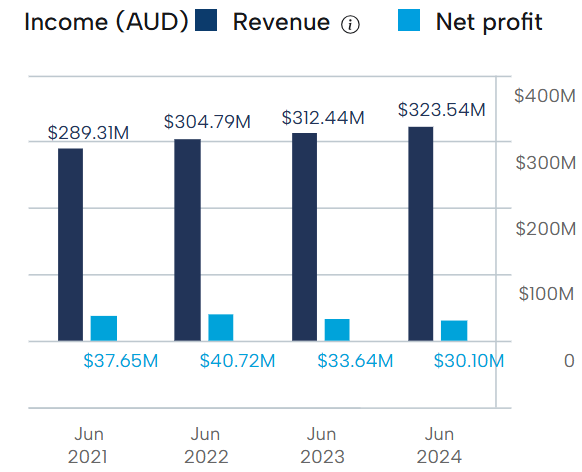

The company’s financial performance over the last four fiscal years defied the COVID 19 impact, maintaining revenue growth in all four fiscal years, with a slight dip in net profit in FY 2023,and in FY 2024.

Beacon Lighting Financial Performance

Source: ASX 24 February 2025

In FY 2023 the company added two new branded websites – GE Imagine Smart Living and Made by Mayfair – to complement its sixteen existing dedicated business websites. Half Year 2025 saw record sales of $170,568 dollars, up 3.5% coupled with a 3.5% decline in net profit. In-store sales rose 25.3% and online sales were up 34.2% at one platform and 9.2% on another.

The company has paid dividends every year over the past decade, increasing its dividend in the midst of the COVID Pandemic from $0.05 per share to $0.09 per share In FY 2022. The current dividend is $0.08 per share with a five year average yield of 3.71%.

Beacon Lighting invites all investors with a minimum of 500 shares to activate an Investor Pass application that allows shareholders to shop the Beacon Trade website and buy at trade member pricing with free shipping and same day delivery.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Cedar Woods Properties (ASX: CWP)

Cedar Woods develops residential communities and commercial developments in four mainland Australian states – Western Australia, Queensland, Victoria, and South Australia. The company has 37 existing projects with a pipeline of more than 19,700 lots for development.

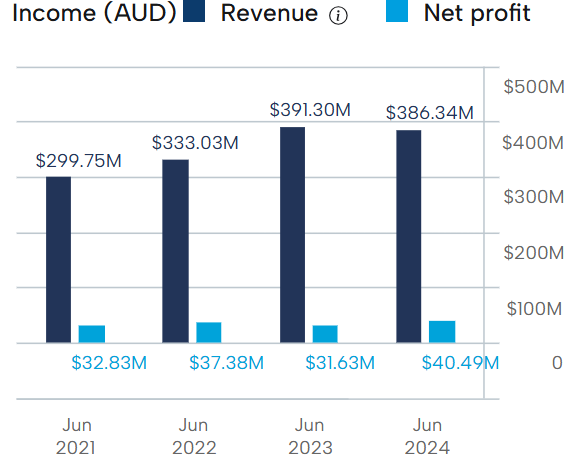

Although the company survived the COVID 19 pandemic, financial performance has been hurt by the current environment of rising interest rates. Revenues rose in three of the last four fiscal years, before dropping in FY 2024, with net profit increasing from FY 2023’s $31.6 million dollars to $40.4 million in FY 2024.

Cedar Woods Properties Financial Performance

Source: ASX 24 February 2025

Half Year 2025 showed revenues up 59% and net profit up 2.6.%

The total dividends of $0.20 per share paid to Cedar Woods shareholders in FY 2023 was fully franked, bumping up to $0.25 per share in FY 2024. Over five years the average dividend yield of 4.924%.

Cedar Woods Properties offers discounts on residential land lots (5%) and on houses, townhouses, apartments and strata commercial units (2.5%). (Residential or commercial strata units allow individual ownership of a unit within a larger building where common areas are shared.) To qualify, shareholders need to have held a minimum of 1,000 CWP shares for six months prior to purchase.

Year over year the share price is up 17.8%.

Source: ASX 24 February 2025

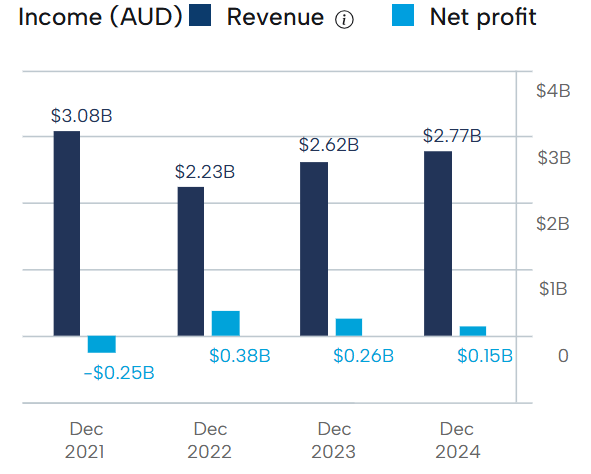

AMP Limited (ASX: AMP)

AMP Limited is primarily known for its wealth management business and network of financial advisors offering both AMP and non-AMP investment products. AMP also has a retail banking operation offering home mortgages.

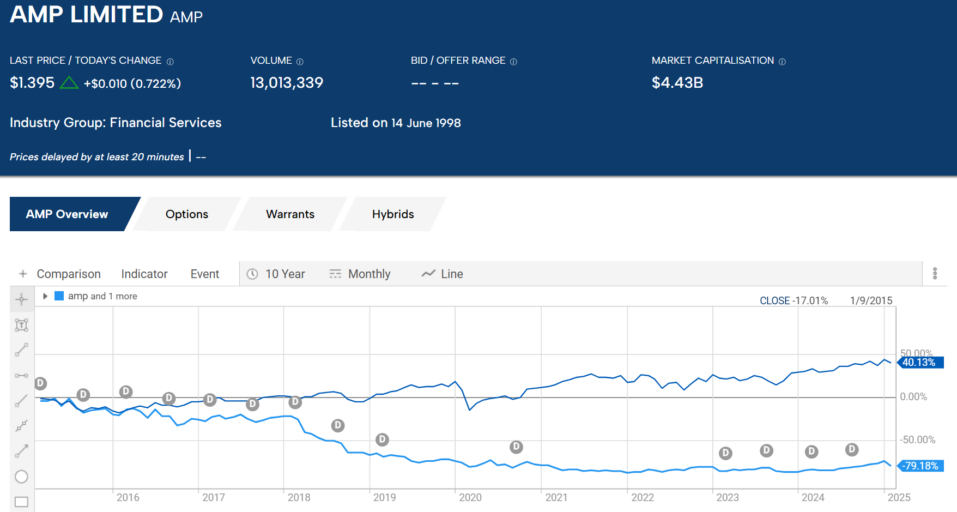

Unfortunately for its long time investors the company is also now known for its “fee for no services” scandal and the resultant fines it was forced to pay. As a result of an ASIC lawsuit against the company, AMP was forced to pay a fine of $14.6 million dollars in September of 2022. By August of 2022, the company had already paid out $627 million dollars in remuneration to over three hundred thousand clients.

In November of 2023, the AMP management announced a $100 million dollar settlement in a class action suit brought against the company. The shares were trading above $6 per share when the scandal broke in early 2018 and have remained in freefall since, now down 79% over ten years.

Source: ASX 24 February 2025

AMP’s dividend payment in the year preceding the scandal was $0.29 per share, now down to $0.04 per share.

Despite the scandal and the settlements the company is still profitable, although net profit has declined in the last three fiscal years following a posted loss in FY 2021.

AMP Limited Financial Performance

Source: ASX 24 February 2025

The company’s shareholder discount program is called AMP First, available to shareholders with a minimum of 500 shares. Home loan discounts are available when applying for a new loan via an AMP Bank. There are other perks as well, including eliminating multiple fees associated with traditional mortgage loans.

Publicly traded companies have a vested interest in developing and maintaining loyal customers. Many senior investors are loyal to the traditional ASX big dividend names like Tesla and the BIG Four Banks. Historically there have been and there remain ASX listed companies that hold to the belief providing their shareholders with a little something extra will build loyalty.

Shareholder perks take the form of discounts on products offered and have minimum ownership requirements.

Skeptics of the influence discounted merchandise may have should review what happened to the stock of Viva Leisure when the company announced the beginning of a Shareholder Discount Program – a rising stock price.