See our brand new top 10 broker reviews. Find your perfect platform!

Julia Lee, Burman Invest

BUY RECOMMENDATIONS

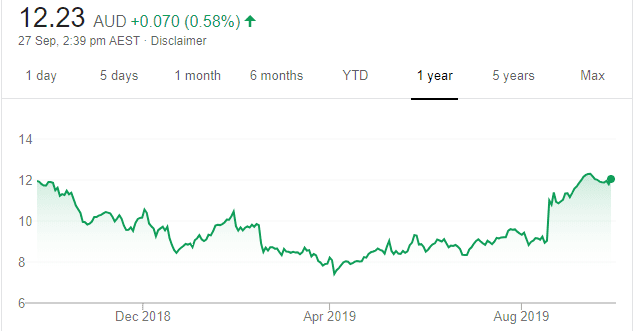

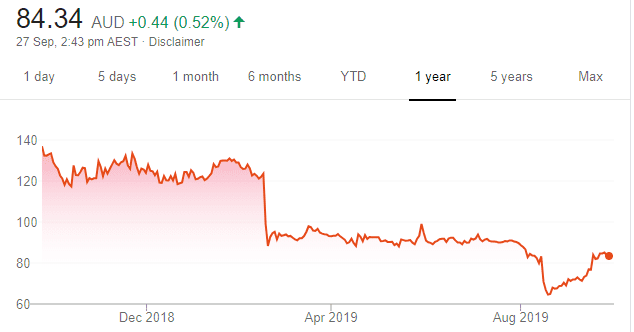

Smartgroup Corporation (SIQ)

Chart: Share price over the year

SIQ provides salary packaging and fleet management services. In its August result, SIQ showed strong earnings resilience despite weaker consumer trends. Given strong cash flow, there’s the possibility of acquisitions or capital management initiatives to help boost returns. This is a company that may experience upgrades during the next 18 months.

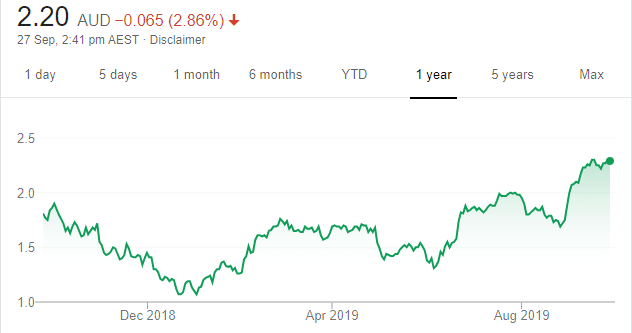

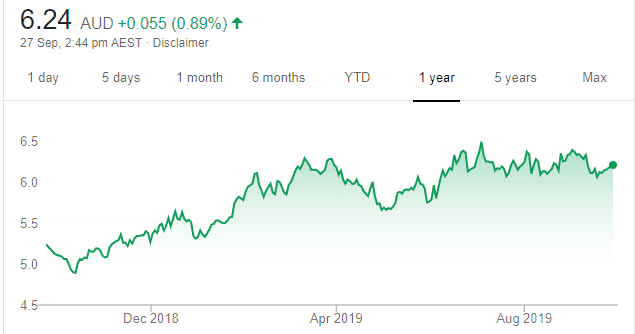

Perenti Group (ASL)

Chart: Share price over the year

A mining services company formerly known as Ausdrill. The gold price has been performing well in 2019 and even better in Australian dollar terms. This provides a tailwind for a drilling business, such as Perenti. The company has a strong pipeline of revenue opportunities, tendering for about $3 billion in near term projects. Australia accounts for about 45 per cent of revenue. In terms of commodities, gold accounts for about 70 per cent of Perenti’s revenue.

HOLD RECOMMENDATIONS

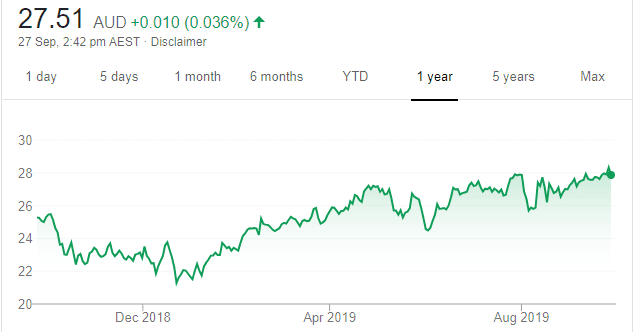

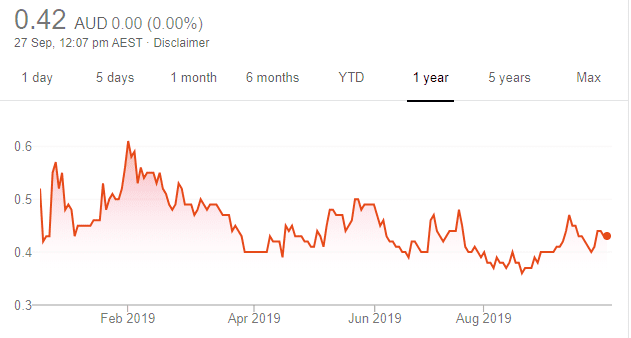

Ansell (ANN)

Chart: Share price over the year

In my view, organic sales growth is weaker than expected for this protective solutions company. To some extent, weaker growth will be offset by cost outs and the buy back. Ansell has a strong balance sheet, but weakening macro economic conditions means there’s no rush to buy this company. Keep an eye on macro economic conditions and input costs as they could move the share price.

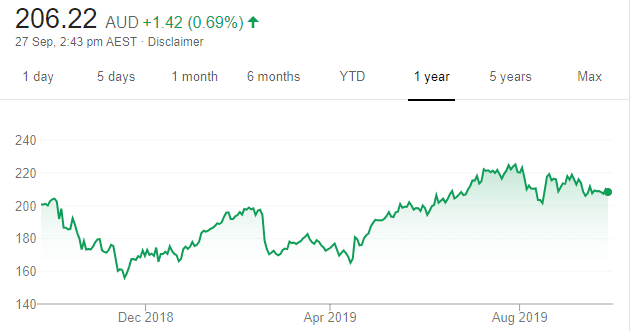

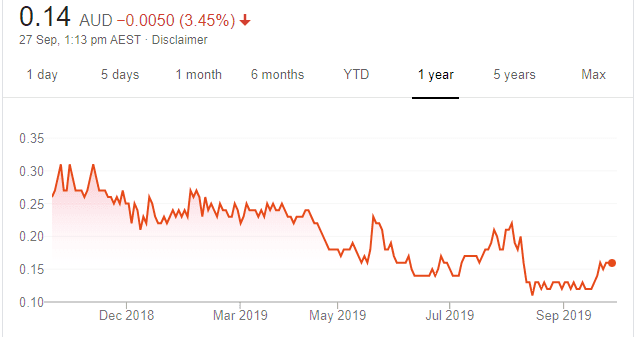

Cochlear (COH)

Chart: Share price over the year

The outlook for this hearing implants maker is improving, but, in my view, it’s far from compelling in the near term. In fiscal year 2020, I see COH chasing lost market share with its Nucleus Profile Plus implant in the US and Germany. There’s potential upside if the Australian dollar continues to weaken.

SELL RECOMMENDATIONS

Blackmores (BKL)

Chart: Share price over the year

SAMR (State Administration for Market Regulation) approval enables companies to sell product directly into China. BKL, at this point, doesn’t have SAMR approval, leaving it at a disadvantage to rival supplements and vitamin competitors, which have SAMR approval in the growing e-commerce market. BKL is operating in an increasingly competitive environment.

GPT Group (GPT)

Chart: Share price over the year

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Shopping centres around the world are under pressure from a structural shift to online shopping. In Australia, we’re seeing major retail brands reduce their bricks and mortar presence amid speciality sales continuing to slow. We could see further negative revisions to the valuation of shopping centre landlords. Interim net profit after tax was down 51.6 per cent on the prior corresponding period to $352.6 million. Shares in this diversified property group were trading at $6.235 on September 26.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Exopharm (EX1)

Chart: Share price over the year

This biopharmaceutical company is focusing on regenerative medicines. It’s seeking to develop and commercialise exosomes as therapeutic agents. According to EX1, an objective of testing exosome-based therapies is to develop new ways to tackle medical conditions afflicting people in old age. Senior management is highly experienced. EX1 offers potential, but as a biopharmaceutical company it carries risk. A speculative buy for those with a suitable risk appetite.

AdAlta (1AD)

Chart: Share price over the year

This drug development company recently secured a licensing deal for its i-body platform with global medical technology and diagnostics firm GE Healthcare. Under the deal, both companies will develop i-bodies for diagnostic imaging. AdAlta is also focusing on bringing forward value from its AD-214 therapeutic program to treat idiopathic pulmonary fibrosis. Clinical trials are expected to start in January 2020. A speculative buy for those willing to take on a high risk/high reward play.

HOLD RECOMMENDATIONS

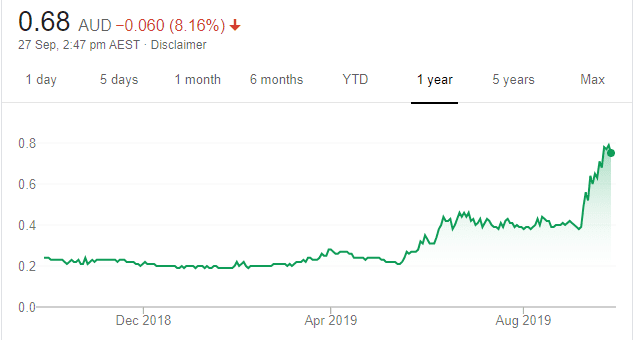

Alkane Resources (ALK)

Chart: Share price over the year

ALK has made a significant discovery of porphyry gold-copper mineralisation at its Boda project in New South Wales. One diamond drill hole intersected 0.48 grams a tonne gold at 502 metres. At 211 metres, it was 0.20 per cent copper. Further drilling is warranted based on a prolific area for large low grade gold-copper ore bodies. ALK could be on the cusp of a substantial mineral discovery.

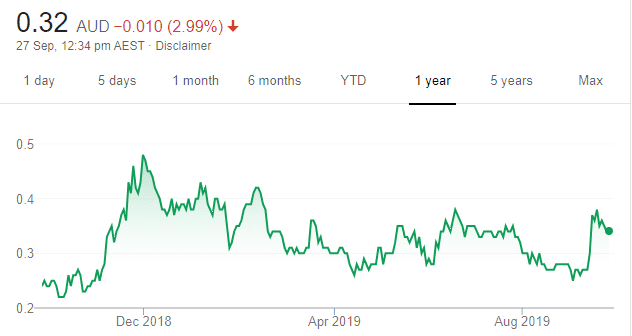

Proteomics International Laboratories (PIQ)

Chart: Share price over the year

The company’s PromarkerD is a predicative diagnostic test for diabetic kidney disease. The company recently announced successful performance validation results for a new advanced PromarkerD immunoassay In Vitro Diagnostic Test (IVD). The company says its PromarkerD test system will now be available using two technology platforms that can service the laboratory-developed test and the IVD markets. I believe this is a significant development. The company is in discussions with pharmaceutical companies to expand the global reach of PromarkerD.

SELL RECOMMENDATIONS

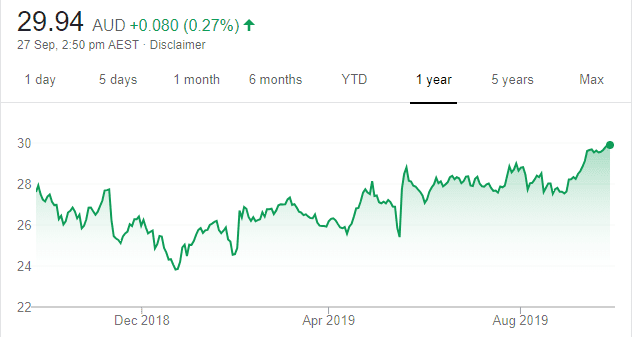

Westpac Bank (WBC)

Chart: Share price over the year

The property market is recovering in the eastern states after more interest rate cuts. However, in my view, the Australian economy is sluggish, consumer spending growth is negligible and the odds of a recession are shortening. I have long been concerned about WBC’s exposure to interest only loans. Based on my outlook for the Australian economy, investors can consider taking profits in WBC.

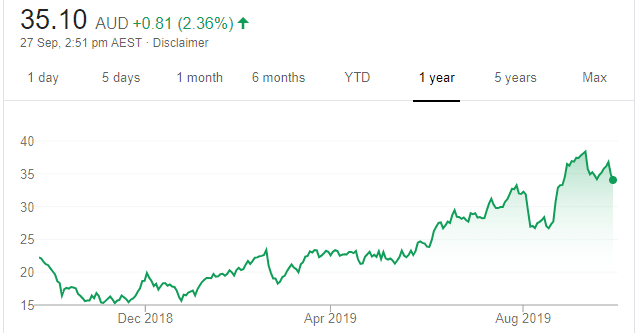

WiseTech Global (WTC)

Chart: Share price over the year

This software logistics provider posted a 57 per cent increase in total revenue to $348.3 million in fiscal year 2019. Net profit attributable to equity holders was up 33 per cent to $54.1 million. The shares have risen from $26.70 on August 16 to trade at $34.23 on September 26. In my view, growth potential has already been factored into the share price. Consider taking some profits.

Michael McCarthy, CMC Markets

BUY RECOMMENDATIONS

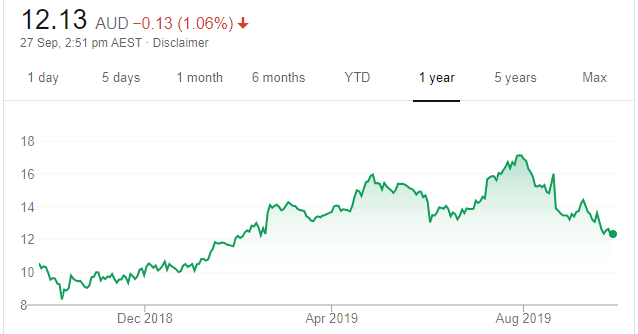

The A2 Milk Company (A2M)

Chart: Share price over the year

Management’s plan to invest for growth reduces margins, but it could set the company up for exceptional and extended gains. Long term growth above 15 per cent and a price/earnings ratio around 30 times provides a buying opportunity given the share price has substantially retreated from $17.12 on July 31. The shares were trading at $12.25 on September 26.

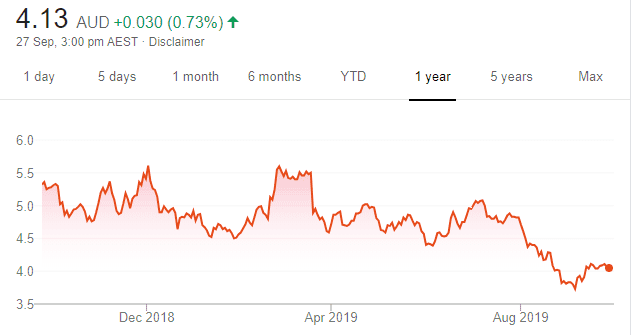

Platinum Asset Management (PTM)

Chart: Share price over the year

The shares were priced at $8.72 on February 2, 2018. However, concerns emerged after founder Kerr Neilson stepped down as chief executive. Also, underperforming active investment styles has left PTM trading at $4.10 on September 26, 2019. As the market cycle turns, PTM could offer value at recent prices. Also, a fully franked dividend yield above 6 per cent could be useful to longer term investors.

HOLD RECOMMENDATIONS

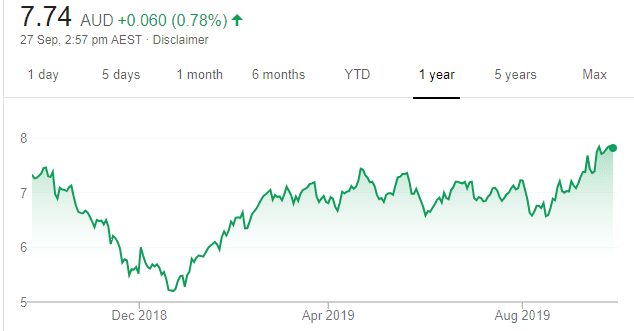

Santos (STO)

Chart: Share price over the year

The energy giant is trading at four year highs as it reaps the benefit of higher oil and gas prices. However, there is potential for significant regulatory change, particularly in east coast gas markets. While this represents risk, it may also deliver significant opportunities for STO.

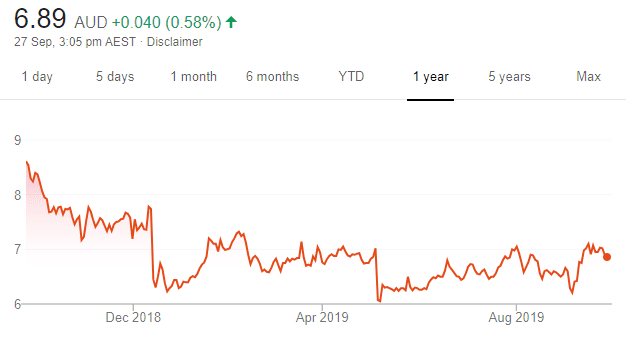

TPG Telecom (TPM)

Chart: Share price over the year

TPG and competitor Vodafone Hutchison were blocked from merging by the Australian Competition and Consumer Commission on the grounds it would reduce competition. However, the matter is before the Federal Court after TPG and Vodafone challenged the ACCC’s decision. Best to wait for an outcome.

SELL RECOMMENDATIONS

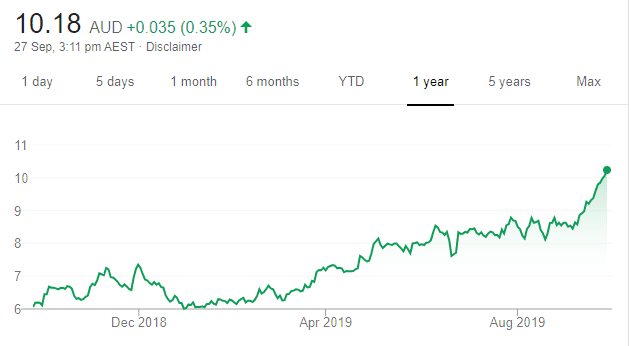

Collins Foods (CKF)

Chart: Share price over the year

The share price has been temporarily boosted by its addition to the S&P/ASX200 index. However, trading above $10 leaves the stock at all-time highs and on a lofty price/earnings ratio of around 30 times. The KFC and Taco Bell franchise holder would need spectacular growth to justify this sort of multiple. I’m happy to lock in gains at these levels. The shares were trading $10.14 on September 26.

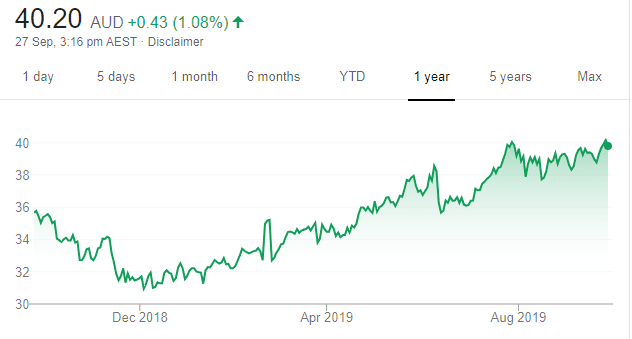

Wesfarmers (WES)

Chart: Share price over the year

The industrial conglomerate has a strong track record, and shareholder support recently pushed the share price above $40. However, we find it difficult to justify a price/earnings to growth ratio above 3 times, as meaningful growth options appear limited since divesting Coles Supermarkets a year ago. It may be prudent to consider locking in profits. The shares were trading at $39.74 on September 26.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.