Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

Capitol Health (CAJ)

CAJ provides diagnostic imaging and related services to the healthcare market. Revenue of $184.2 million in fiscal year 2022 was up 3.5 per cent on the prior corresponding period. Operating EBITDA of $41.1 million was down 2.6 per cent, but we’re expecting it to climb in response to increasing demand for services. Technically, I expect the stock to attract new buyers.

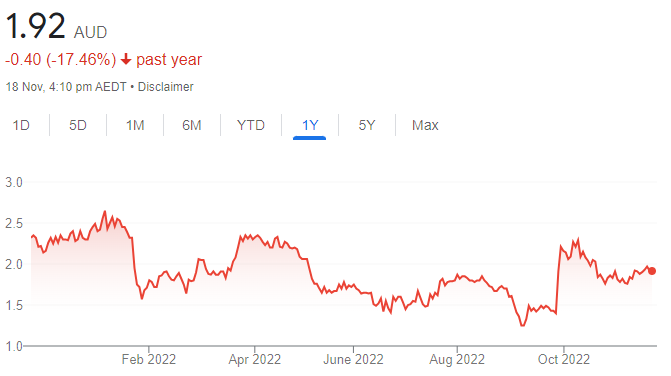

Cogstate (CGS)

This neuroscience technology company announced a 14 per cent increase in total contracted future revenue as at September 30, 2022 when compared to the prior corresponding period. Investors have recently supported the stock, with the price rising from $1.40 on September 27 to trade at $1.935 on November 17. From a technical perspective, I expect favourable momentum to continue and test $2.50 a share.

HOLD RECOMMENDATIONS

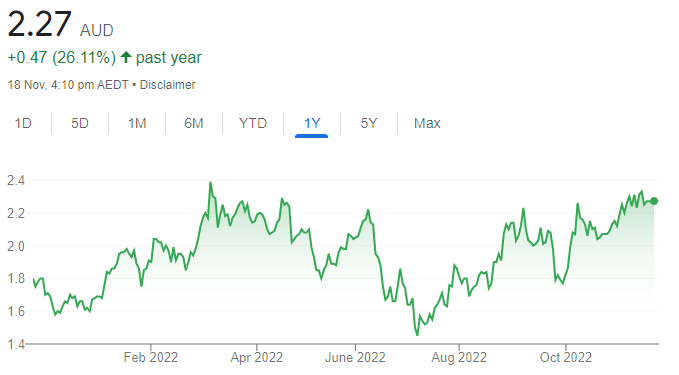

Karoon Energy (KAR)

This oil and gas producer and explorer has major assets in Brazil and Australia. Production volumes in the September quarter were 19 per cent higher than the prior quarter. The lower end of production guidance has been revised upwards in fiscal year 2023. The shares have risen from $1.82 on September 30 to trade at $2.26 on November 17. We expect the uptrend to continue.

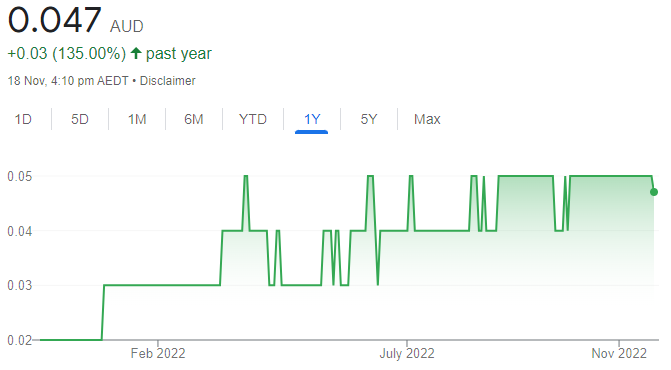

Norwest Energy NL (NWE)

This oil and gas explorer is focused on the Perth Basin. The shares have risen from 2.6 cents on January 4 to trade at 4.8 cents on November 17. The chart shows new buyers willing to enter at higher levels. Given strong institutional interest from a capital raising earlier this year, I believe the share price has more upside.

SELL RECOMMENDATIONS

JB Hi-Fi (JBH)

This consumer electronics giant continued to grow sales in the first quarter of fiscal 2023 when compared to the corresponding period. However, the share price has fallen from $55.21 on March 29 to trade at $42.81 on November 17. Higher interest rates and rising cost of living expenses may impact consumer spending moving forward. Investors may want to consider cashing in some gains.

Neuren Pharmaceuticals (NEU)

The company is developing new therapies for debilitating neurodevelopment disorders that emerge in early childhood. It has two drugs in clinical development. The share price has risen from $3.74 on July 1 to trade at $8.18 on November 17. I believe positive news has already been factored into the share price, so investors may want to consider locking in some profits.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

Silver Lake Resources (SLR)

Gold production of 59,935 ounces in the September quarter marginally missed market expectations due to lower grades and maintenance at its Deflector mine. However, SLR’s other assets performed well and, with higher grades anticipated moving forward, SLR retained full year guidance. We see attractive value as we expect an improving operational performance amid potential for a long-awaited rally in the gold price.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Macquarie Group (MQG)

The company’s diversified business model is appealing. The company’s latest half year net profit after tax of $2.305 billion to September 30, 2022 was up 13 per cent on the prior corresponding period, but down 13 per cent on the period ending March 31, 2022. The full year will be tough, but we believe the investment bank is positioned for an earnings recovery in 2024.

HOLD RECOMMENDATIONS

Sonic Healthcare (SHL)

The healthcare company provides pathology, radiology and medical services. The unwind from pandemic testing is widely anticipated and reflected in SHL’s share price, which has fallen from $46.14 on January 4 to trade at $32.34 on November 17. We’re encouraged by recent US peer reports, particularly from Quest Diagnostics, that suggests core business demand is recovering.

Avita Medical Inc. (AVH)

The maker of RECELL regenerative skin treatment for burns delivered a mixed third quarter update, in our view. Commercial revenue was up on the prior corresponding period, but so were operating expenses. Biopharmaceutical development carries risk, but potential markets are big. AVH is relatively well funded, and we see significant upside potential as it expands usage approvals and geographical marketing in coming years.

SELL RECOMMENDATIONS

Sims Group (SGM)

A recent update from this metals recycling company revealed margin pressure across its scrap operations, which, we believe, is unlikely to subside in the near term. The company is up against fierce competition and higher inflation. The share price has fallen from $22.33 on April 22 to trade at $12.31 on November 17.

Super Retail Group (SUL)

Company brands include Supercheap Auto, rebel, BCF and Macpac. A trading update in late October revealed strong sales growth in the first 16 weeks of fiscal year 2023. However, the retail sector faces the challenges of higher interest rates and rising cost of living expenses. SUL is trading significantly above our fundamental $9 valuation. The shares were trading at $10.51 on November 17.

Niv Dagan, Peak Asset Management

BUY RECOMMENDATIONS

ReNu Energy (RNE)

The company invests in renewable and clean energy technologies. Also, it identifies and develops hydrogen projects. RNE acquired Countrywide Hydrogen in February 2022. ReNu recently announced that Australian superannuation fund HESTA had agreed to a non-binding term sheet for an investment of up to $100 million in RNE group projects to produce green hydrogen. The company continues to progress its hydrogen projects.

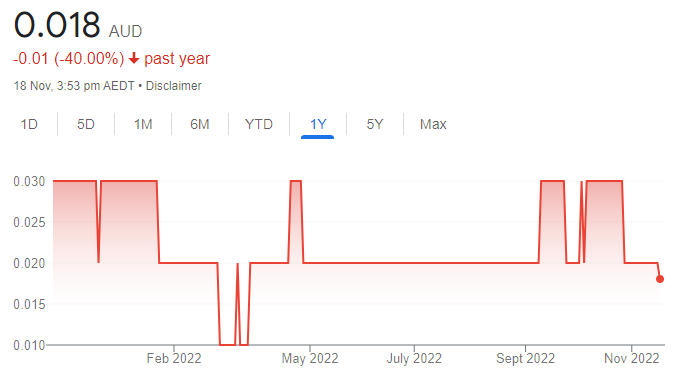

Volt Resources (VRC)

Volt is a graphite producer and battery materials developer. A recent oversubscribed placement raised $10 million. The company had been seeking $5 million. The funds will go towards advancing Volt’s integrated graphite battery materials business. We acted as lead manager and were encouraged by the response to the placement. We like the graphite outlook. Prospective buyers should take potential rewards and risks into account before investing. The shares were trading at 1.8 cents on November 17.

Hold RECOMMENDATIONS

QBE Insurance Group (QBE)

Earnings may be impacted following floods in New South Wales and Victoria. The shares have fallen from $12.92 on November 9 to trade at $11.97 on November 17. However, a rising interest rate environment is positive for the insurer as a significant amount of cash is waiting to be deployed.

Myer Holdings (MYR)

Total sales for the retail giant increased 12. 5 per cent in fiscal year 2022 compared to the prior corresponding period. Group online sales increased 34 per cent. Net cash of $186 million was up $74 million on fiscal year 2021. The company reported encouraging sales in the first 13 weeks of fiscal year 2023.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

Concerns about the travel market recovery given high inflation may pressure the travel agent’s shares, in our view. Higher crude oil prices, cost pressures and a dampening economic outlook should be taken into account. We prefer others until a clearer global economic outlook emerges.

Magellan Financial Group (MFG)

The company recently announced that an entity associated with co-founder Hamish Douglass has sold about 13 million MFG ordinary shares at $9.10 each. The partial sale was executed through an after market block trade. In October 2022, Magellan experienced net outflows of $2.4 billion. The shares have fallen from $21.40 on January 4 to trade at $10.12 on November 17.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.