Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – Treasury Wine Estates (TWE)

The premium wine maker has been sold off after announcing a $US900 million acquisition of DAOU Vineyards and subsequent equity raising on October 31. DAOU is a luxury wine brand based in California. The shares have fallen from $11.98 on October 30 to close at $10.54 on December 14. We believe the shares are attractive at recent levels, particularly if China reduces tariffs on imported Australian wine.

BUY – ASX Limited (ASX)

Following several years and an investment of hundreds of millions of dollars in unsuccessful blockchain settlement technology, the ASX has finally abandoned the costly strategy in favour of a revamped CHESS system. This decision, while still requiring increased capital expenditure, reduces near term uncertainty and should enable the stock to re-rate towards our current intrinsic valuation of $72.50. The shares finished at $61.58 on December 14.

HOLD RECOMMENDATIONS

HOLD – South32 (S32)

This globally diversified miner has materially underperformed its peers in recent months and the materials sector this year. But it has a strong balance sheet and an attractive development profile skewed to more structurally favoured commodities such as zinc and copper.

HOLD – Select Harvests (SHV)

The almond producer’s share price was punished following full year 2023 results. Unfavourable weather materially impacted the 2023 crop. Global almond pricing had been below historical levels in the second half. The company is carrying elevated debt levels, in our view. However, we see significant recovery potential in crop volumes, pricing and earnings moving forward. Almond production is boosted by warmer dry weather.

SELL RECOMMENDATIONS

SELL – City Chic Collective (CCX)

City Chic is a global omni-channel retailer, specialising in women’s apparel, footwear and accessories. Revenue and margins were impacted in the first eight weeks of the new financial year to August 27, 2023, as it continued to aggressively clear inventory in Australia, New Zealand and the US. Sales were down 33 per cent on the prior corresponding period. The company posted a net loss of $45 million from continuing operations in fiscal year 2023. The company is up against challenging macro-economic conditions, so other stocks appeal more at this stage of the cycle.

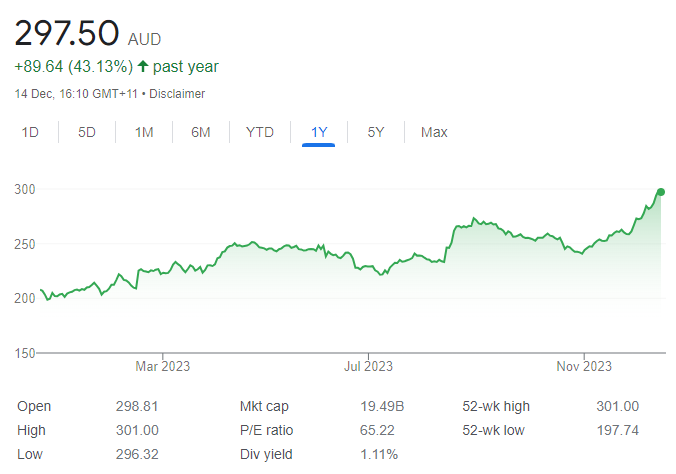

SELL – Cochlear (COH)

This hearing implants maker posted a strong fiscal year 2023 result. Record sales revenue of $1.956 billion was up 16 per cent in constant currency on the prior corresponding period. Statutory net profit of $301 million was up 7 per cent in constant currency. The share price has risen from $240.84 on October 31 to close at $297.50 on December 14. At current prices, we see superior opportunities in alternative sectors, so investors may want to consider taking a profit.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

John Edwards, Novus Capital

BUY RECOMMENDATIONS

BUY – Meteoric Resources NL (MEI)

Speculation exists that this rare earths junior is a potential takeover target. Earlier this year, MEI acquired the Caldeira project, a tier 1 ionic clay rare earth element project in Brazil. The tenements are among the biggest and richest in the world. The share price has risen from 1.6 cents on December 5, 2022 to trade at 21 cents on December 14, 2023. I have a 12-month price target of up to 50 cents a share. I own shares in MEI.

BUY – De Grey Mining (DEG)

The gold price recently exceeded $US2000 an ounce and may keep increasing. A higher gold price could spark merger and acquisition activity. In our view, De Grey is a possible takeover target as its Hemi gold project in the Pilbara region of Western Australia is most appealing. The project is relatively close to ports and other critical infrastructure. Hemi is the third largest undeveloped gold project in the world. Hemi’s mineral resource estimate of 10.5 million ounces is likely to increase, which could attract interest from major gold companies needing to replenish their resource bases. I have a conservative 12-month price target of $1.80 a share. The shares were trading at $1.305 on December 14.

HOLD RECOMMENDATIONS

HOLD – Pilbara Minerals (PLS)

This lithium producer posted a statutory profit after tax of $2.4 billion in fiscal year 2023, an increase of 326 per cent on the prior corresponding period. It produced 620,000 tonnes of spodumene concentrate, an increase of 64 per cent. Yet the share price has fallen from $5.37 on August 10 to trade at $3.84 on December 14. AustralianSuper has become a substantial shareholder in PLS, which was recently one of the most shorted stocks on the ASX. The PLS price could recover if lithium prices increase.

HOLD – Perpetual (PPT)

Perpetual recently rejected a $3 billion takeover bid from diversified investment house Washington H. Soul Pattinson (WHSP). The PPT board concluded the WHSP bid materially undervalued Perpetual and its corporate trust and wealth management businesses among other reasons. While the WHSP bid was rejected, it may flesh out other interested parties.

SELL RECOMMENDATIONS

SELL – Core Lithium (CXO)

CXO owns and operates the Finniss lithium mine in the Northern Territory. The share price has fallen from $1.21 on January 6 to trade at 27.7 cents on December 14. Lithium prices have been in a sustained decline during calendar year 2023. High lithium prices in the past have prompted a flood of supply from new mines.

SELL – Premier Investments (PMV)

Investors rewarded the company’s full year 2023 result. Premier Retail generated sales of $1.64 billion, up 9.7 per cent on the prior corresponding period. Premier Retail earnings before interest and tax, excluding significant items, were up 6.4 per cent to $356.5 million. The shares have risen from $22.45 on October 30 to trade at $27.25 on December 14. In my view, sustaining sales moving forward will be a challenge as careful shoppers watch their spending in Australia’s cost of living crisis. Investors may want to consider cashing in some gains.

Arthur Garipoli, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – Orora (ORA)

This multinational packaging company was recently trading below average price/earnings ratio levels. The shares have fallen from $3.45 on August 17 to trade at $2.62 on December 14. We believe Orora is trading at a discount and offers a good long term buying opportunity at these levels. A recent dividend yield above 6 per cent is also appealing. We expect Orora to deliver future earnings growth and solid cash flows. The recently completed acquisition of Saverglass provides Orora with market share in the premium wine and spirit categories.

BUY – Botanix Pharmaceuticals (BOT)

This clinical dermatology company is seeking US Food and Drug Administration (FDA) approval for its leading product Sofpironium Bromide gel (Sofdra) for treating axillary hyperhidrosis (excessive sweating). The initial application was denied by the FDA due to unclear instructions about using the product. The company is on target to submit its final component to the FDA in the first quarter of fiscal year 2024. BOT is targeting FDA approval by mid-2024. The company has advised the planned content of materials proposed to be re-submitted are acceptable to the FDA. No additional materials have been requested by the FDA. The company has recently raised $13.5 million in preparation for a product launch and marketing. This stock is more suited to investors with an appetite for risk.

HOLD RECOMMENDATIONS

HOLD – Collins Foods (CKF)

The KFC and Taco Bell operator delivered strong results for the half year ending October 15, 2023. Group revenue from continuing operations of $696.5 million was up 14.3 per cent on the prior corresponding period. Group underlying net profit after tax from continuing operations of $31.2 million was up 28.7 per cent. The results show the business is well managed in this inflationary environment.

HOLD – Endeavour Group (EDV)

Endeavour operates liquor outlets, hotels and gaming facilities. The company is focused on creating shareholder value of more than 10 per cent a year from mid-2026. The dividend payout ratio is between 70 per cent and 75 per cent. EDV plans to expand returns on funds employed year-on-year. The company has 54 freehold sites and 300 leaseholds across Australia. At recent prices, the stock is offering valuation support.

SELL RECOMMENDATIONS

SELL – Premier Investments (PMV)

Premier owns retail conglomerate Just Group. Brands include Smiggle, Just Jeans, Peter Alexander and Portmans, among others. Premier Retail generated sales of $1.64 billion in fiscal year 2023, an increase of 9.7 per cent on the prior corresponding period. The final, fully franked ordinary dividend of 60 cents a share was up 11.1 per cent. PMV is doing a good job at managing costs and inventory. The shares have performed strongly since the result, so investors may want to consider locking in a profit. We remain cautious about the consumer spending outlook.

SELL – Adairs (ADH)

This home furnishings company experienced weaker sales in the first 21 weeks of fiscal year 2024 when compared to the prior corresponding period. Higher interest rates and cost of living pressures also contributed to a significant decline in traffic. The outlook remains challenging as household budgets are stretched. The shares have fallen from $2.92 on February 1 to trade at $1.747 on December 14.

Related Articles:

- CFD Trading in Australia

- Commodities Trading – A Beginners Guide

- The Best ASX Stocks for Day Trading

- The Best Australian Apps for Investing

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.