Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – ResMed Inc (RMD)

RMD makes medical devices to treat sleep apnoea. The company lifted revenue by 11 per cent on a constant currency basis in the second quarter of fiscal year 2024 when compared to the prior corresponding period. We also anticipate margin expansion as ResMed’s sales mix shifts to higher margin masks. The firm reduced its global workforce by 5 per cent in October 2023. The share price has recovered some of its substantial falls in the second half of fiscal year 2023, but has drifted recently to provide a cheaper entry point. The shares were trading at $26.77 on February 29.

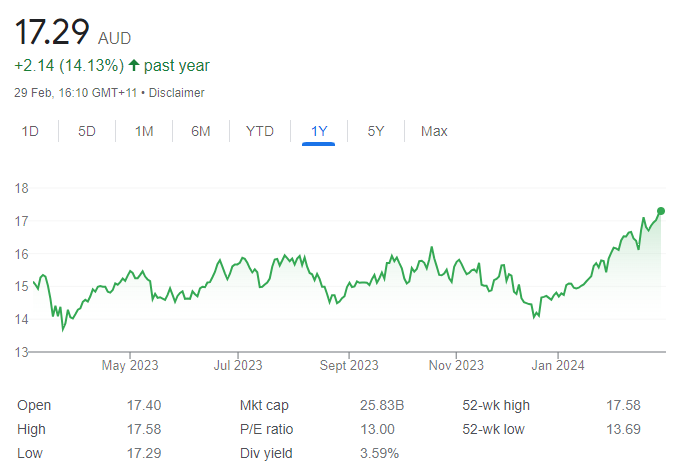

BUY – Telstra Group (TLS)

We view a 3 per cent increase in underlying EBITDA to $4 billion in the first half of fiscal year 2024 as a positive result for this telecommunications giant. Mobile EBITDA is on track to surpass $5 billion in fiscal year 2024, a remarkable turnaround from just above $3 billion less than four years ago. EBITDA margins are now approaching 48 per cent compared with just 31 per cent in fiscal year 2020. We believe there’s little management can do regarding structural pressures affecting fixed-line businesses. But it can recalibrate its costs.

HOLD RECOMMENDATIONS

HOLD – Macquarie Group (MQG)

This diversified financial services company’s third quarter trading update for fiscal year 2024 largely met our expectations. Commentary on the short-term outlook is marginally more downbeat given a reduction in transaction activity. Asset management base fees are expected to be broadly flat in the short term. MQG’s bank and financial services division is set to benefit from growing loan and platform balances, but incur higher expenses.

HOLD – CSL (CSL)

We remain optimistic about long term demand for immunoglobulin (IG), driven by improving diagnosis rates for existing and new indications. Despite the comparable prevalence of diseases, IG consumption per capita in the US, Canada and Australia is between two to three times more than CSL’s other markets, highlighting an unmet need. We still anticipate CSL Behring’s gross margin to recover to its pre-pandemic level of 57 per cent by fiscal year 2027, consistent with management’s time frame of between three to five years.

SELL RECOMMENDATIONS

SELL – Woolworths Group (WOW)

In our view, shares in this giant supermarket group are overvalued. We believe the market underestimates the risk of relatively low-growth, defensive yield stocks, such as WOW, de-rating given higher prevailing interest rates. A solid performance in the core Australian supermarkets business was largely offset by lower profits in the New Zealand food business and discount department store segments. Sales momentum continued to moderate across retailing businesses in the first seven weeks of the second half of fiscal year 2024. Against a backdrop of higher wages, we expect near term operating margins to be under pressure.

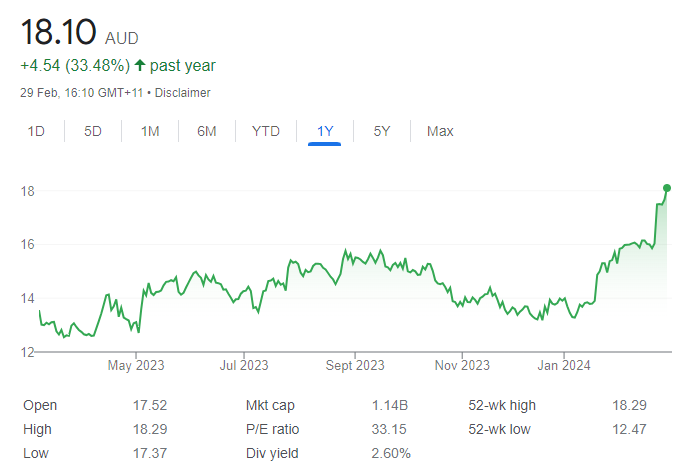

SELL – Jumbo Interactive (JIN)

Jumbo is a digital lottery retailer. It’s also a lottery software provider. The company generated revenue of $73.9 million in the first half of fiscal year 2024, an increase of 18.4 per cent on the prior corresponding period. Underlying EBITDA of $35.1 million was up 15.5 per cent. The shares have risen from $13.28 on January 8 to trade at $18.15 on February 29. Investors may want to consider cashing in some gains.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Mattew Lattin, Marcus Today

BUY RECOMMENDATIONS

BUY – QBE Insurance Group (QBE)

The insurance giant posted a significant increase in statutory net profit after tax to $US1.355 billion in fiscal year 2023 compared to $US587 million in the previous year. QBE’s gross written premiums grew by 10 per cent, supported by renewal rate increases and targeted new business growth, underscoring QBE’s resilience and competitiveness. Despite a slight increase in expenses, effective cost-management strategies have kept the expense ratio at a relatively low 11.8 per cent.

BUY – HUB24 (HUB)

HUB24 operates an investment and superannuation platform. HUB’s first half results in fiscal year 2024 saw notable increases in key metrics. Group underlying EBITDA of $55 million was up 10 per cent on the prior corresponding period and statutory net profit after tax of $21.5 million was up 39 per cent. Record half year net inflows of $7.2 billion – an increase of 26 per cent – demonstrates strong demand for its platform services. Moreover, HUB24’s strong pipeline of existing and potentially new advisers suggests promising growth prospects.

HOLD RECOMMENDATIONS

HOLD – The a2 Milk Company (A2M)

This infant milk formula company posted revenue of $NZ812.1 million in the first half of fiscal year 2024, an increase of 3.7 per cent. Revenue in the US and in the China and other Asia segment were up, but revenue fell in Australia and New Zealand due to a change in distribution strategy. A2M boasts a strong balance sheet with significant net cash. But, in our view, its conservative approach of prioritising investment in growth opportunities over returning capital to shareholders may limit immediate returns.

HOLD – Deterra Royalties (DRR)

The company manages a portfolio of royalty assets across a range of commodities. DRR’s latest financial results showed a notable 23 per cent increase in royalty revenue to $119 million in the first half of fiscal year 2024 when compared to the prior corresponding period. Net profit after tax of $78.7 million was up 24.2 per cent, leading to a fully franked interim dividend of 14.89 cents a share. Driving the performance was attributed to strong iron ore prices amid evaluating growth opportunities. In our view, China’s ongoing property woes and lack of meaningful stimulus may weigh on commodity prices in the medium to long term.

SELL RECOMMENDATIONS

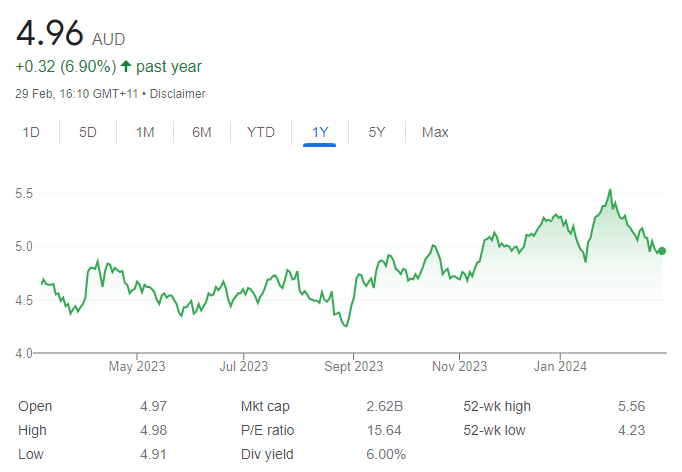

SELL – Bendigo and Adelaide Bank (BEN)

Residential lending of $58.5 billion in the first half of fiscal year 2024 was down 0.1 per cent on the second half of fiscal year 2023. The net interest margin of 1.83 per cent was down 15 basis points. Total operating expenses rose by 1.4 per cent. The cost-to-income ratio increased by 230 basis points. Competition in the banking sector is fierce, so other stocks appeal more in a challenging economic environment of high interest rates and soaring cost of living expenses.

SELL – Inghams Group (ING)

First half revenue of $1.642 billion in fiscal year 2024 was up 8.7 per cent on the prior corresponding period for this poultry company. However, underlying costs also increased by 6.9 per cent, reflecting inflationary pressures. Furthermore, net debt increased by $83.4 million to $345.9 million, but within a manageable leverage ratio of 1.5 times. Looking ahead, we expect market conditions to remain challenging, as the shift towards in-home dining is expected to persist. Ongoing inflationary pressures across various costs may also have a negative impact.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – Sandfire Resources (SFR)

We remain positive about the prospects for copper as we expect lower supplies and sustained global demand to result in higher prices during the next few years. SFR is the largest pure-play copper producer on the ASX. The stock is now starting to break above a three-year resistance level on the chart, so we believe it’s likely to start a new uptrend.

BUY – Macquarie Group (MQG)

The share price of this diversified financial services company rebounded strongly despite an update in February revealing a weaker net profit after tax to date for fiscal 2024 when compared to the prior period. This is a bullish sign as it showed the share price was factoring in a lower result. The stock has managed to remain in an uptrend. We expect MQG and the broader market to do well in calendar year 2024. MQG shares have risen from $178.37 on January 8 to trade at $193.42 on February 29.

HOLD RECOMMENDATIONS

HOLD – ResMed Inc (RMD)

Since the lows in 2023, this medical device maker has been in a sustainable uptrend, and we don’t see any warning signs yet from a charting perspective. Share price weakness in 2023 was driven by investor concerns that the company’s sleep apnoea business would be negatively impacted by diabetes and weight loss medicines. The stock still appears undervalued following a recent decline in the share price.

HOLD – Beach Energy (BPT)

Beach Energy (BPT) generated sales revenue of $941 million in the first half of fiscal year 2024, up 16 per cent on the prior corresponding period. However, underlying net profit after tax of $173 million was down 10 per cent. Moving forward, we expect energy prices to increase as robust demand outweighs supply. We expect a share price recovery from here.

SELL RECOMMENDATIONS

SELL – Woolworths Group (WOW)

Earnings growth is too low to support the company’s valuation, in our view. Recent first half 2024 results posted by this supermarket giant showed profits and margins were under pressure. Valuations held up during the past two years as investors flocked to defensive stocks, but that premium is starting to unwind, so we expect the shares to underperform the broader market.

SELL – Lendlease Group (LLC)

This property developer and investment manager posted a statutory loss after tax of $136 million in the first half of fiscal year 2024. The group’s core operating profit after tax of $61 million was down 42 per cent on the prior corresponding period. The result missed investor expectations. The share price was punished following the result. The share price may remain under pressure as a recovery could take time. Other stocks appeal more at this stage of the cycle.

Related Articles:

- How to start CFD Trading

- The Best Australian Apps for Investing

- Auto Trading Platforms in Australia

- The Best Crypto Trading Platforms in Australia

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.