Bevan Slattery – Australia’s Millionaire Tech Entrepreneur

In 2016 the Australian Financial Review posted an article entitled “Meet Megaport’s Bevan Slattery, Australia’s unknown tech success story”.

Today financial journalists Bevan Slattery has moved beyond “unknown,” with financial journalists calling Slattery a “serial tech entrepreneur.” His long list of involvement in breakthrough technology companies supports the claim.

A Queensland native with a documented love of the Great Barrier Reef, Slattery’s first company out of the box was a cloud connectivity and data centre company introduced in 1998 –iSeek.

He sold the company to a US firm in 2000 for USD$16 million dollars.

Next on his march into the tech limelight was a telecommunications infrastructure provider PIPE Networks cofounded in 2001 and sold to TPG Telecom (ASX: TPM) for AUD$373 million dollars in 2010.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Slattery’s deep seated affection for the Great Barrier Reef led him to found Biopixel in 2013, a “film production services provider for natural history and animal behavioural sequences, with a particular focus on aquatic life.” A dedicated diver, Slattery secured a library of stock footage of the Great Barrier Reef and its surrounding wildlife to share with the world.

In 2012 he launched a real estate investment trust (REIT) — Asia Pacific Data Centre – later selling his stake in the trust to fund expansion at his first crown jewel in what was to become a trio of successful ASX listed breakthrough tech companies – NEXTDC (ASX: NXT).

Founded in 2010, NEXTDC’s entry into the ASX would be followed by two more disruptive companies – Megaport (ASX: MP1) in 2013 and Superloop in 2014 (ASX: SLC).

Slattery Companies on the ASX

Slattery has been involved in numerous other companies not listed on the ASX, key among them was Cloudscene, an independent directory of colocation data centres, cloud service providers, and interconnected fabrics, the largest of its kind on the planet.

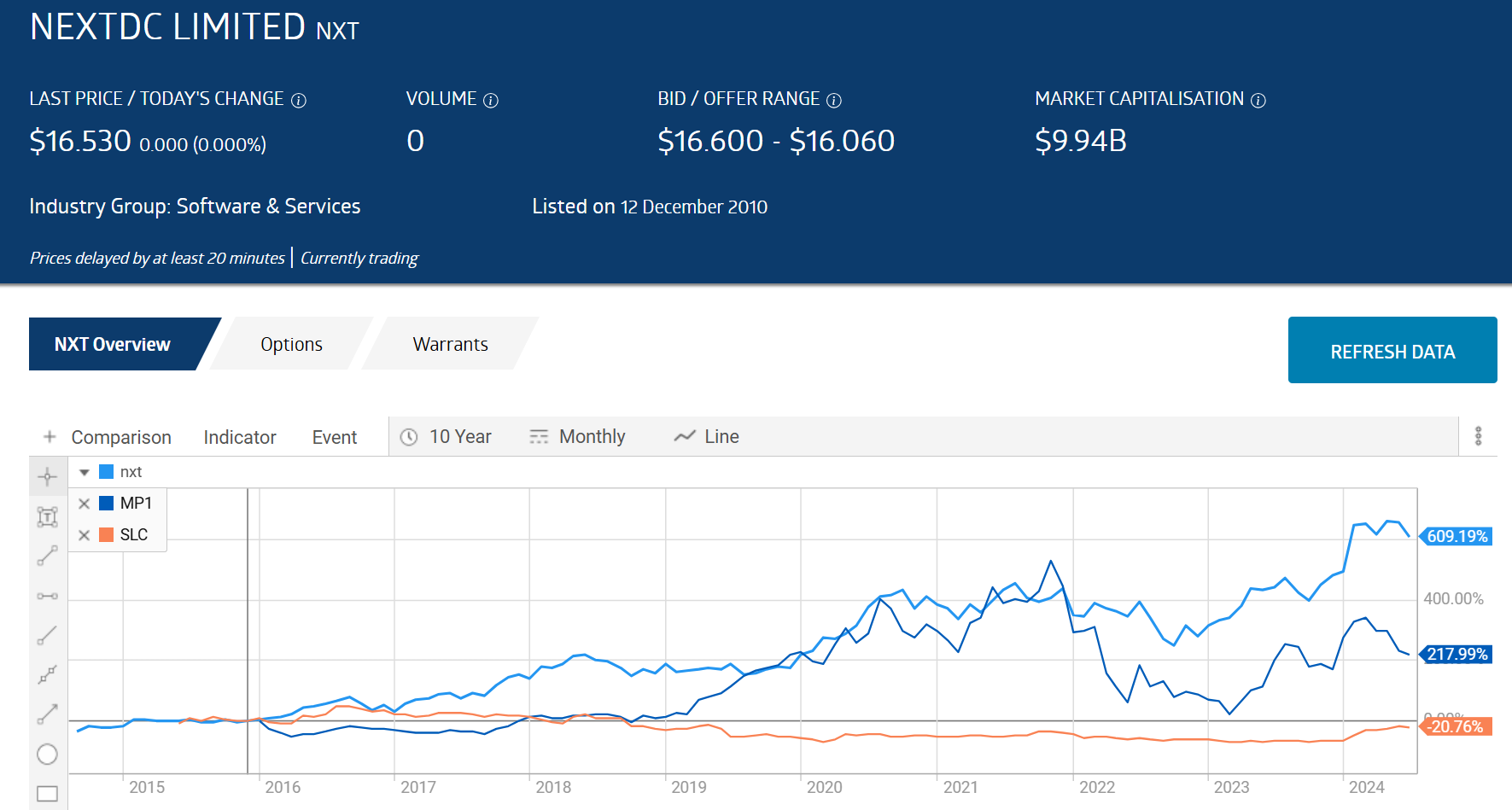

Of Slattery’s major moves on the ASX, only Superloop has struggled over the last decade.

Source: ASX

Slattery exited Superloop in 2022. The company is gaining traction, up 135.6% year over year.

NEXTDC Limited (ASX: NXT)

In late April and early May of 2024, NEXTDC raised AUD$1.3 billion dollars from both institutional and retail investors to go towards increasing the capacity of the company’s largest data centre facilities in Sydney and Melbourne.

A new industry report released by Moody’s Research suggests NEXTDC will need its planned expansion and more to meet the demands AI (artificial intelligence) will place on global data centre capacity.

The Moody’s Report states the demand for data centres around the world will double over the next five years. The report states Hyperscalers will increase information technology spending by $24 billion dollars in 2024 alone. Hyperscalers are massive data centres with massive computing resources. The four largest existing Hyperscale platforms are Amazon Web Services (AWS), Microsoft Azure, Meta, and Google Cloud.

Global investment behemoth Blackrock is out with a similar report, calling data centres “the engine of the AI revolution.” The report says demand for dedicated AI data centres will “grow between 60% and 80% annually in the coming years.”

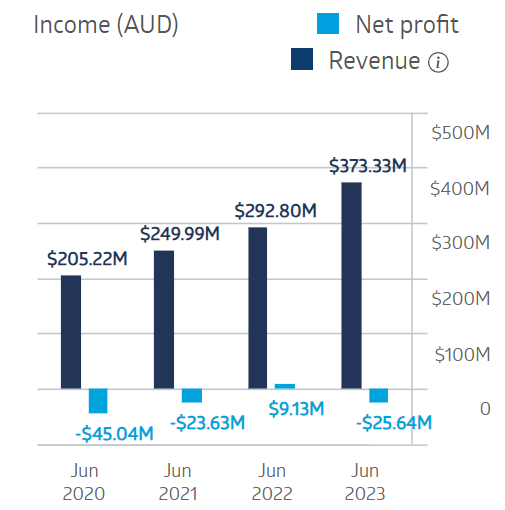

NEXTDC has grown revenue in each of the last four fiscal years but operating and expansion costs have eaten into profitability.

NEXTDC Financial Performance

Source: ASX

Half Year 2024 results continued the pattern of rising revenue and declining profit. Total revenues rose 31% while the net loss rose from AUD$2.8 million dollars in the first half of 2023 to AUD$22.5 million in the half year 2024. However, underlying EBITDA (earnings before interest taxes depreciation and amortisation) rose 5%.

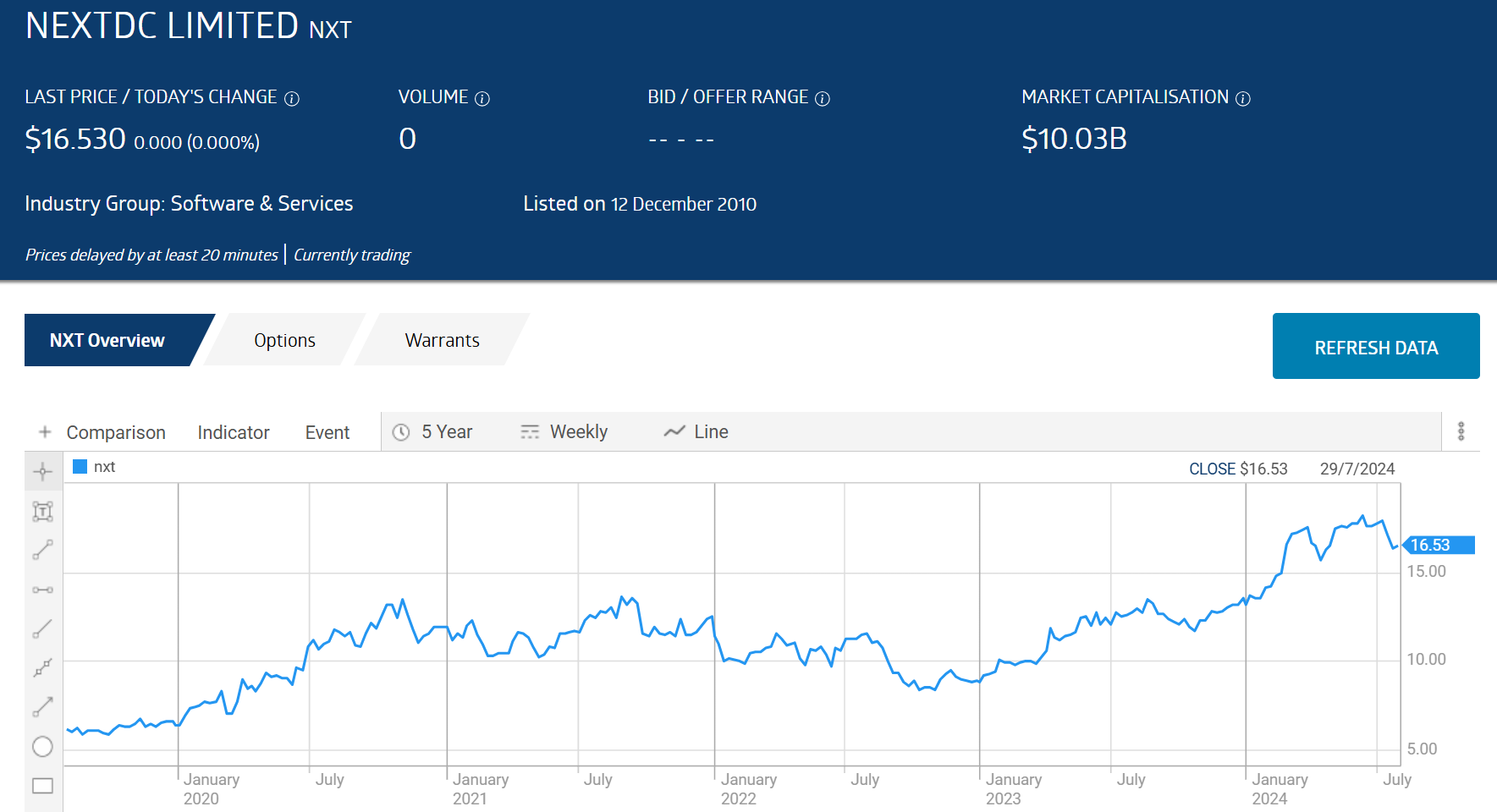

Over five years the NXT share price is up 159.9% and 30.7% year over year, as of 30 July.

Source: ASX

The Wall Street Journal is reporting a BUY recommendation on NXT shares, with 8 analysts at BUY and 3 at OVERWEIGHT.

NEXTDC has 13 operational data centres across the Asia Pacific Region, with nine more in development.

Megaport Limited (ASX: MP1)

Megaport is another tech stock set to benefit from the AI revolution. The company disrupted the traditional approach to network connectivity with SaaS (software as a service) software defined network connectivity services. Megaport services allow business enterprises to connect to cloud service providers like AWS (Amazon Web Services) and Microsoft Azure, in addition to connections to internet exchanges and multiple data centers.

The AI revolution will benefit Megaport in a variety of ways, from cost reduction to efficiency enhancements to better threat detection.

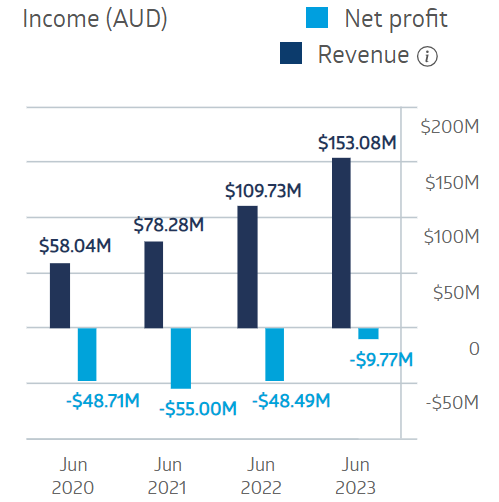

Megaport’s financial results show a frequent characteristic of big tech companies – growing revenues and little, if any, net profit, although the EBITDA measure is often positive.

Megaport Financial Performance

Source: ASX

Half year 2024 financial results were positive across the board, with revenues up 35%, EBITDA up 785%, and a net profit of AUD$4.4 million dollars, up from a loss of AUD$13.5 million in the first half of FY 2023. The reported profit was the company’s first in the last four fiscal years.

Over five years the Megaport share price is up 65.8% and 1.7% year over year.

Source: ASX

The Wall Street Journal is reporting an OVERWEIGHT recommendation on Megaport shares, with 9 analysts at BUY, 1 at OVERWEIGHT, and 5 at HOLD.

Superloop Limited (ASX: SLC)

Superloop’s stated mission is to “unleash the unlimited possibilities of the internet.” The company designs and builds operating networks for business and wholesale customers, and consumers. Superloop’s largest revenue source is residential plans for internet and mobile phone use.

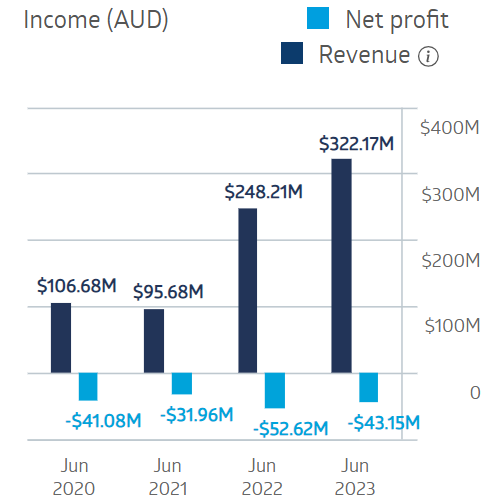

Superloop Limited Financial Performance

Source: ASX

Half Year financial results saw total revenues rose 32.7%, underlying EBITDA was up 83.3%, and adjusted net profit after tax (NPATA) rose 114.8%. Without the adjustments, the company posted a net loss, up 13.7% from the loss posted in the first half of FY 2023.

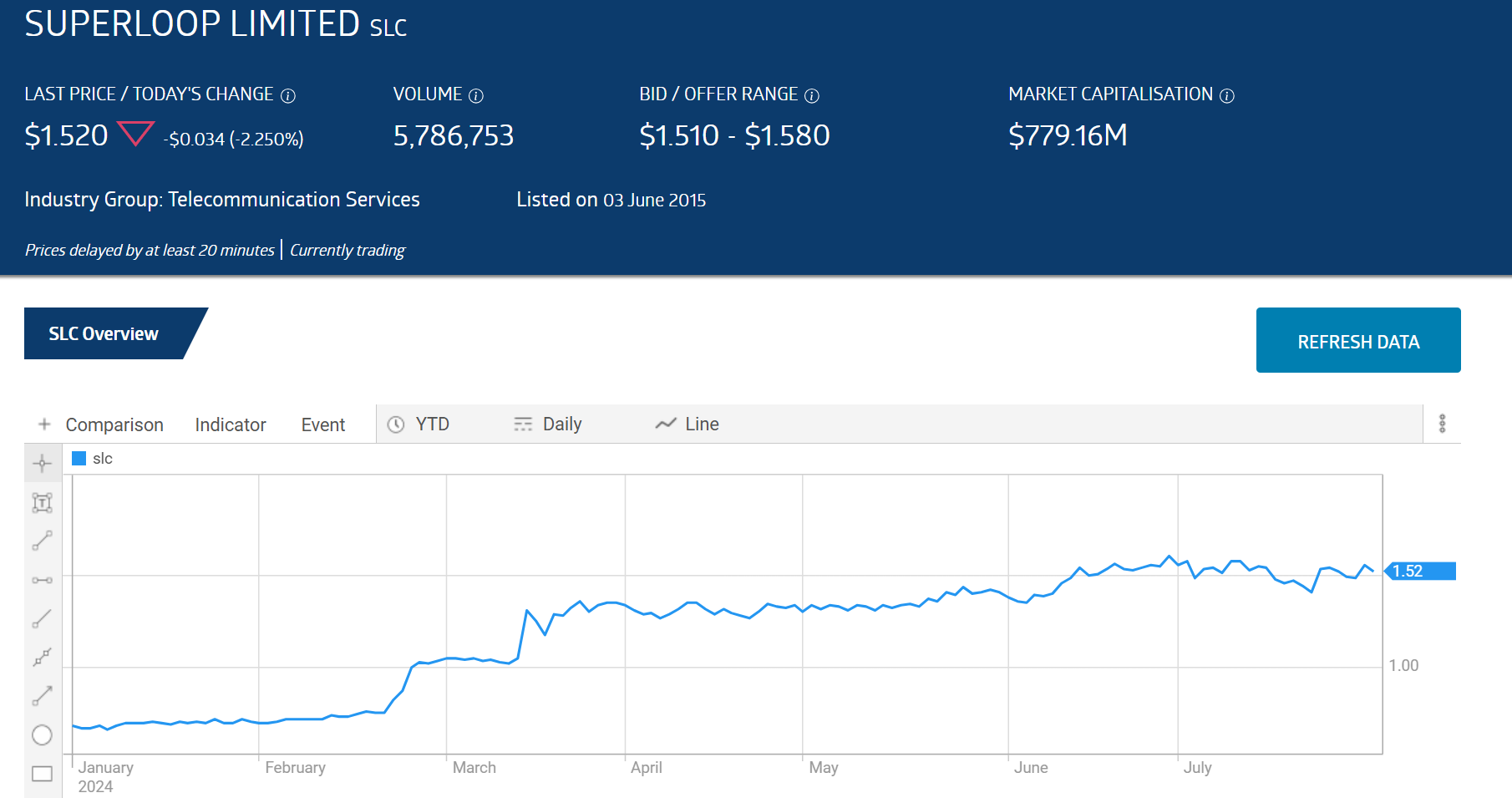

The Half Year 2024 results released on 22 February ignited an upward trend still in place.

Source: ASX

A trading update from Superloop released on 1 July showed the company set a record for new customer sign-ups in the second half of FY 2024.

Over five years, the Superloop share price rose 59.6%. Year over year SLC is up 135.6%, as of 30 July.

Source: ASX

Yahoo finance Australia is reporting a BUY recommendation on Superloop shares, with 1 analyst at STRONG BUY, and 3 at BUY.

As of 2024, Australia’s “serial tech entrepreneur” has amassed a fortune of AUD$46 million dollars, beginning with the sale of his first tech startup – iSeek – for USD$16 million dollars in 2020.

Next came the sale of a company he co-founded – PIPE Networks – for AUD$373 million dollars 2010.

Slattery is credited with launching two of the most successful ASX listed tech stocks over the last decade – NEXTDC and Megaport – with a third – Superloop – catching fire in 2023. Notable non-ASX listed companies in his illustrious career include submarine cable group SubPartners, Biopixel, and Cloudscene.