Top Down and Bottom Up Investing Strategies

Newcomers to stock market investing surged during the COVID 19 Pandemic, but the trend preceded COVID and remains in place. Some jumped into markets without much investment analysis, relying on tips from friends and relatives or business news highlighting the hot stock of the day.

Others approach investing in the same manner they approach most of life’s challenges – with a strategy. Derived from the Greek word for generalship – strategos – a strategy is a plan of action for achieving a goal.

With investing goals in place, newcomers set ought to learn investing strategies, quickly encountering growth, value, and growth at a reasonable price, among others. Where to start is an unanswered question within the descriptive approach of each strategy.

There is a broader concept of investing strategy that directly addresses that question – Top Down and Bottom Up investing.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What is Top Down Investing?

Stocks do not exist in isolation, with much of their success stemming from factors outside their direct control. The most successful business operating in the face of a global or domestic depression, recession, or slowdown is likely to see its share price suffer. Similarly, a business operating in a strong global or domestic economy in a business sector in demand is likely to see its share price rise.

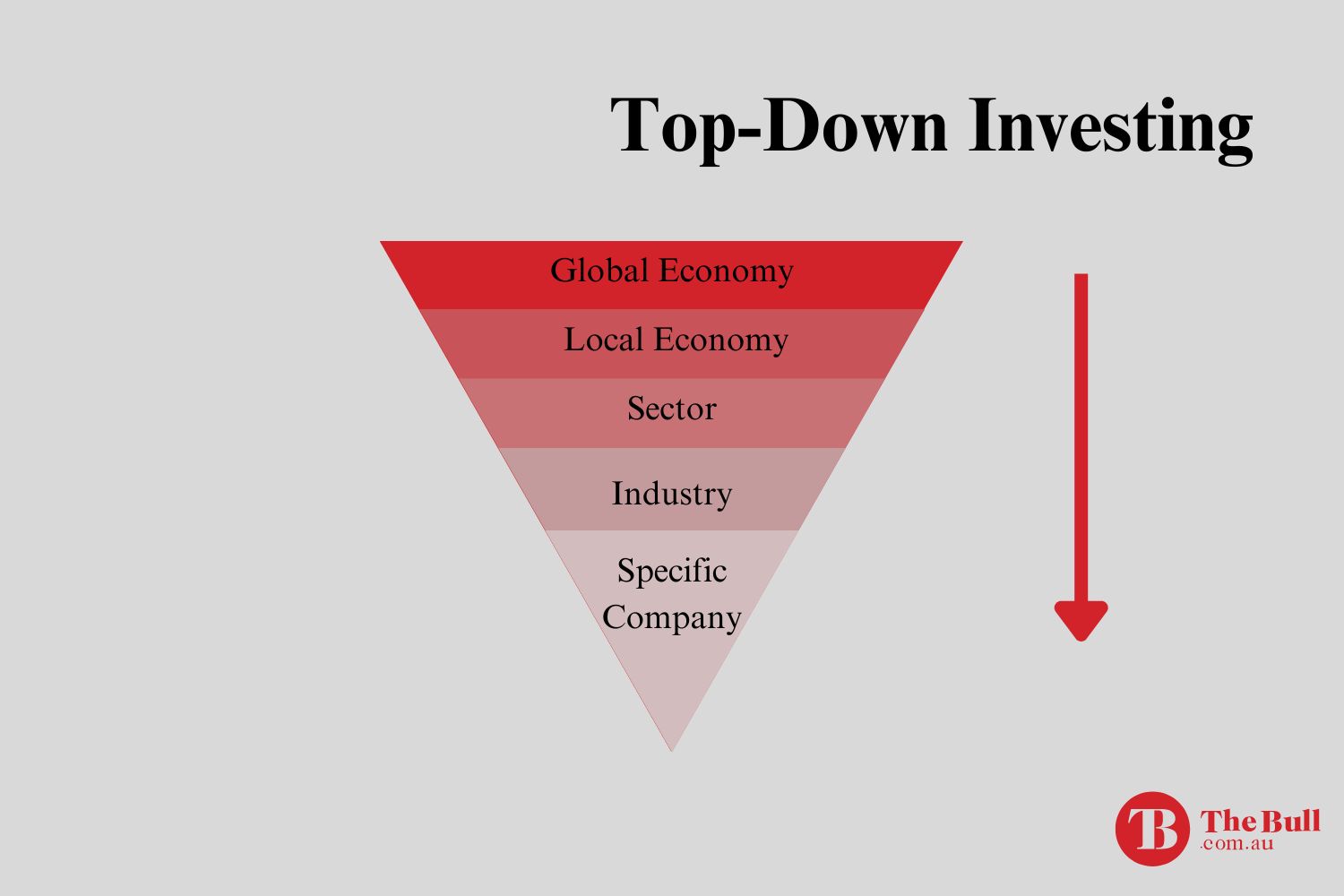

Since individual stock operates in an economic context, top down investing begins with “big picture” economic issues that impact the business climate – macroeconomics.

Macroeconomic theory is relatively new, with its origins going back to the 1940’s. Here are some of the macroeconomic factors that go into short and long-term analysis and forecasting:

- Gross Domestic Product (GDP)

- Interest Rates

- Inflation

- Unemployment

- Commodity Pricing

- Economic Growth Rates

- Monetary Policy

- Bond Prices and Yields

These factors extend downward from the global economy to local economies, with the final steps coming in analysis of sector, industry, and specific businesses.

Beginning with a strong gross domestic numbers around the world, rising interest rates and bond yields , low inflation and unemployment might filter down to financials as a sector likely to flourish, and banks within the sector down to a specific “best of breed” bank.

What is Bottom Up Investing?

Bottom up investing is the inverse of top down investing and what appears to be the logical choice for most newcomers to share market investing. While top down investing begins with economic considerations and ends with specific companies, bottom up investing begins with specific companies and ends with economic considerations.

Bottom up investing is the strategy favored by value investors like US-based Warren Buffet, in the belief a well-managed company will weather economic calamities over time.

Fundamental analysis provides both the starting and the potential ending point for bottom up investors. Bewildered newcomers may wonder where they find these well-managed companies with which to begin their investment analysis.

The answer lies within the analytical tools themselves. These tools assist both value and growth investors in their search. There are valuation, operational , and financial metrics characteristic of growth and value stocks. A search could begin with a stock screener to find stocks with low price to earnings ratios – characteristic of value stocks – and high price to earnings ratios,– characteristic of growth stocks.

The bottom up investment analysis then moves to the initially targeted company’s position within its business sector, examining its market share, competition, and projected growth for the sector.

Qualitative factors like management stability and quality, brand strength, customer satisfaction, and new product pipelines are also a part of the fundamental analysis required of the bottom up investor.

Finally, economic issues may come into play but are often of minor consideration in the belief that solid companies can be safe havens over time. Bottom up investors lean heavily towards long-term investing.

What is the Difference Between Top-Down and Bottom-Up Investing?

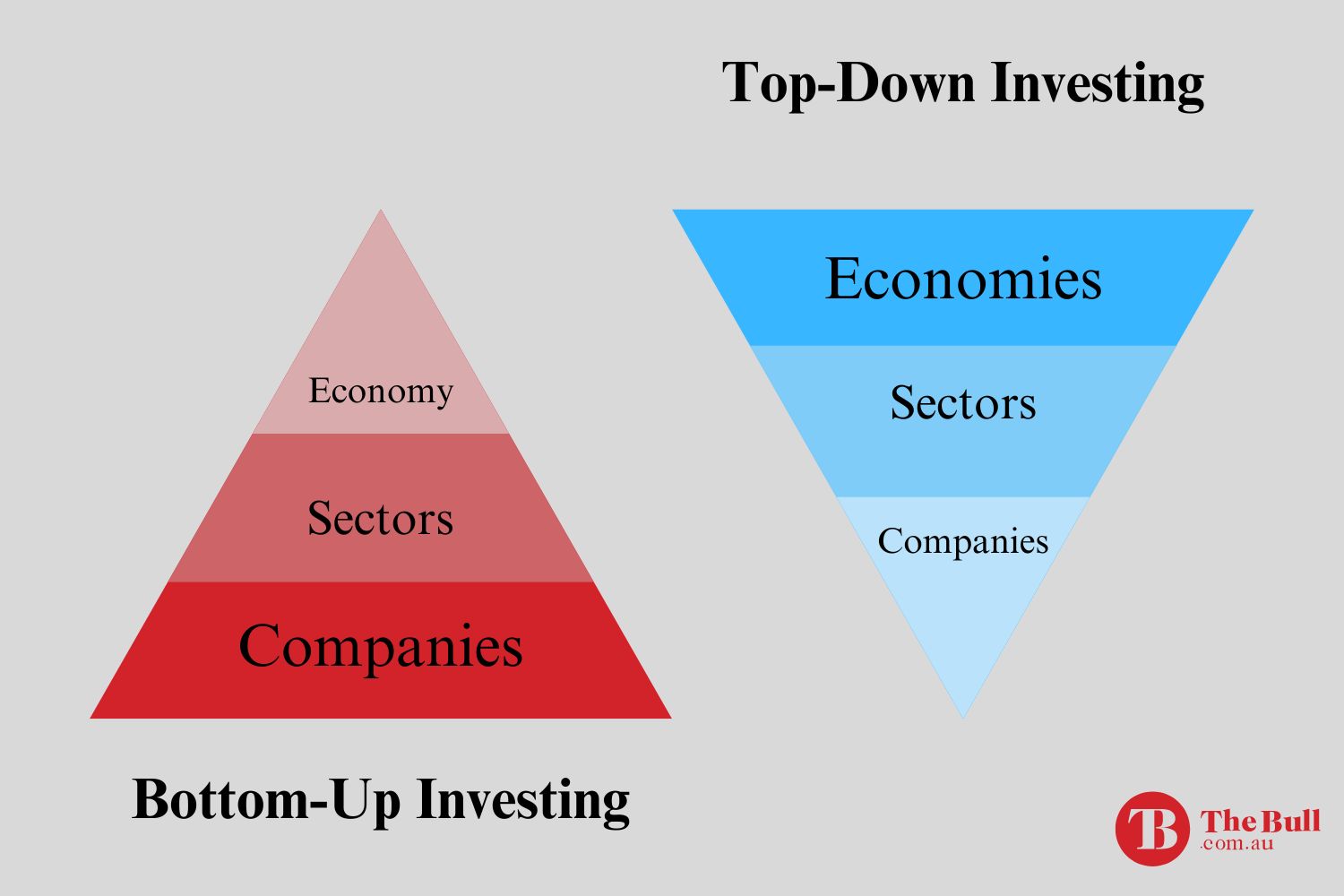

Broadly speaking, the most obvious difference between Top Down and Bottom Up investing is the top down approach begins with the general and cascades downward to the specific while the bottom up approach begins with the specific and works its way up to the general.

An investor employing a top-down approach would first research macroeconomic factors in the broader economy – global and/or domestic — followed by an analysis of specific business sectors and industries and ending with the stocks of specific companies within the industries of business sectors.

An investor using the bottom-up approach would begin with a fundamental and qualitative analysis of one or more stocks of specific companies, narrowing the investment choice to the stock with the best potential future prospects.

Some market experts are of the opinion that the top down approach is easier for newcomers to use as it frees the investor from the rigors of a full-blown fundamental and qualitative analysis of the financial and operational capabilities and prospects of the stocks in question.

However, the digital world has made it much easier for any retail investor to research individual stocks. Online trading platforms and numerous financial websites provide a wealth of financial and operational ratios for fundamental analysis drawn directly from a company’s three financial statements – the income statement, the balance sheet, and the cash flow statement.

Top down investors need multiple searches on their favorite search engine to find macroeconomic factors impacting global and domestic economies. In addition, the general nature of top down investing has the disadvantage of missing solid stocks that fall into the cracks between the general nature of the top down investment analysis.

While some sources detail some factors like GDP (gross domestic product) and growth rates, few include the full range of factors to consider like inflation, unemployment, interest rates, bond yield, and commodity pricing.

While there are differences between Top Down and Bottom Up investing, both approaches share the same end goal – finding attractive, potentially profitable investment opportunities.

The Top Down and Bottom Up are mirror images of each other, one beginning at the “top” and proceeding downward while the other begins at the bottom and works upward.

Both end in the same place – with targeted individual stocks for investments. The Top Down approach gets there by starting with an analysis of the broader economy – both global and domestic, and then into business sectors, specific industries within the sectors, and finally specific stocks within the industries.

The Bottom Up approach begins with specific high performance stocks and then evaluates their position in the industries, business sectors, and economies in which they operate.