Escrow in Share Market Investing

What is Escrow

A legal definition of escrow is “a financial instrument whereby two or more parties in a financial transaction deposit assets – documents and/or money – with an independent agent to be held until all specific conditions of the transaction have been met.”

The word “escrow” comes from the French “escroue” – a paper or parchment scroll traces its contemporary origins to the middle ages. In middle English, the term comes from escrowl.

Historically, banks were the early independent escrow agents, holding and later disbursing assets held in escrow once all conditions outlined in the transaction have been met.

Real estate ownership transfers are the most common transactions employing escrow agents. The most common condition specified in the transaction is completion of a home inspection along with owner disclosures regarding the condition of the property in question.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

In the US during the depression many homeowners were unable to pay property taxes. In 1934 the federal government mandated a system of “forced savings” whereby all FHA (federal housing authority) mortgages added prorated charges in monthly mortgage payments placed in escrow for disbursement at the time property taxes came due.

The system has evolved. Here in Australia lenders – typically banks – set up escrow accounts for property buyers setting aside some of the monthly mortgage payment to cover both taxes and property insurance.

Contemporary escrow accounts are a part of M&A (merger and acquisition) agreements, legal disputes, regulatory compliance, bankruptcies and auctions. The common element to all is the use of the trusted third party to function as escrow agent. Today there are even online escrow services for low-cost transactions.

Escrow accounts are not a 20th century occurrence. History tells us the use of trusted third parties to hold payments and documents such as title deeds goes back hundreds of years.

As a protection for new shareholders, escrow accounts have found there way into share market investing. The purpose is the same as every instance where escrow is applied – to ensure a fair and safe transaction for all of the parties involved.

What Are Escrowed Shares

Privately held companies have shareholders, beginning with the company founders and members of the families and in many cases extending to early investors in the company. Startup companies need cash to grow and as an alternative to incurring debt through loans from banks and other financial institutions, owners turn to high net worth individuals and private equity investment funds for working capital.

Privately held companies elect to go public through offering ownership shares in the company via an Initial Public Offering (IPO) to raise money for a variety of reasons, typically taking profit from their ownership stake or using the money to grow the company.

The new crowd of investors ready to buy into the IPO have a vested interest in what those existing shareholders will do with their shares. Large dumps of shares for sale drive down the price of a stock, lowering the value of the investment of these newcomers.

What new investors would like to see are company founders committed to staying with the company and helping it grow in the future. What new investors do not like to see is company founders and other original investors ready to profit from their work and move on to something else.

To protect incoming investors the ASX has set time requirements for different categories of pre-IPO owners setting out the time shares are to be held in escrow before those original owners can sell them.

The following table appeared on the ASX website in a 06 May of 2021 article entitled Navigating ASX escrow (or lock-up) for beginners: the basics.

Note the rules go beyond pre-IPO investors to include company employees receiving stock options. The time frames are intended to allow a sufficient operating period for investors to gauge the company’s status without the burden of large selloffs from pre-IPO investors looking to cash in on early investments. This is especially true when it comes to private equity investors with no interest in the future of the company.

The ASX applies two tests to potential IPOs – the Profits Test and the Asset Test. Companies passing the Profit Test are not required to place shares of existing owners in escrow, although they may do so voluntarily.

It appears that although many companies do list shares in escrow in their IPO investment prospectus, this is not required by the ASX.

Yet investors need to know if and when original shareholders can sell out. Incoming investors always like to see existing shareholders willing to stay with the company and help it grow.

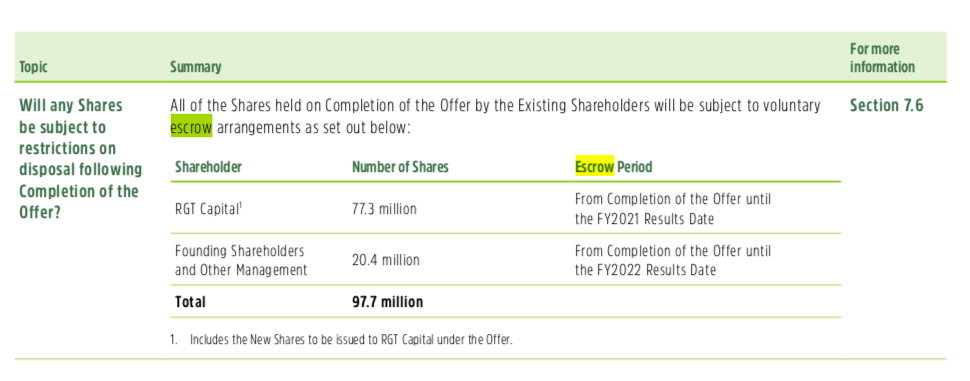

From stockhead.com, here is an example of a line item in an IPO prospectus incoming investors should see:

Source: (Pic: Youfoodz prospectus)

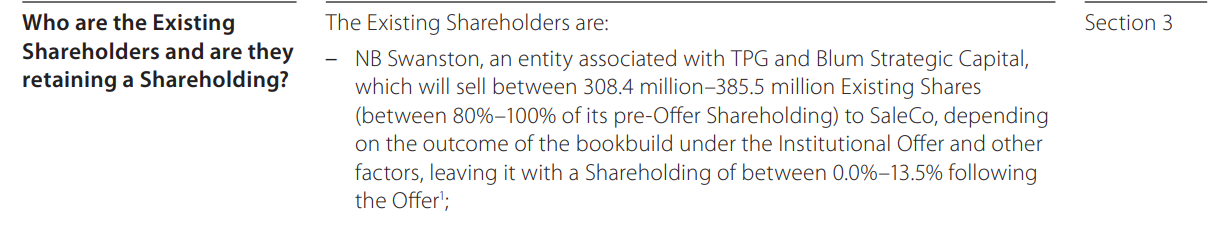

Retail investors familiar with what happened to the ill-fated 2009 debut of Myer Holdings (MYR) who took the time to read the prospectus should have seen a red flag here. The prospectus said nothing about escrowed shares. Here is the line item appearing in the Myer Holdings IPO Prospectus”

Source: MY Prospectus

Myer’s private equity owners, TPG Capital and Blum Capital, sold out their entire stake in the IPO by November of 2009, according to Reuters, the New York Times, and others. The stock began trading on 1 November of 2009.

Regardless of whether or not a company discloses the status of shares of pre-IPO investors in its prospectus, the ASX does require companies to disclose the release date of escrowed shares held by original investors and current company employees to existing investors prior to the release date.

In some cases, this gives investors concerned about the potential for a dip in share price due to dumping escrowed shares on the market the opportunity to exit their investment.

For centuries parties in a transaction have turned to trusted third parties who set up escrow accounts. These accounts hold funds or documents in the account, not to be released until all items spelled out in the transaction agreement are met.

Escrow accounts are most commonly employed in real estate transactions. Escrow now safeguards the interests of new investors following an initial public offering by holding shares of pre-IPO investors in escrow until a release date when they can be sold.